Technology Continues to Be Strong for Private Equity

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news.

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join over 6,000 readers for a summary our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

Bloom Announces Several New Appointments Across Its Value Creation Group

Bloom Equity Partners (“Bloom Equity”) is pleased to announce several new appointments across its Value Creation Group, supporting portfolio companies to drive meaningful and durable step-change growth and operational improvements.

For more information: https://www.bloomequitypartners.com/post/bloom-equity-is-pleased-to-announce-several-new-appointments-across-its-value-creation-group

Private Equity’s Interest in Technology Continues to be Strong

The private equity industry has benefitted from over a decade of low-interest rates, however, as interest rates rise, and economic uncertainty becomes apparent, new tailwinds and headwinds arise.

The Opportunity in Technology: With record dry powder and the adaptation of complex portfolio strategies that leverage relationships and expertise, private equity is starting to gain an edge against corporate buyers. With lower stock prices and increased regulatory scrutiny, M&A is becoming more difficult for corporate buyers, but makes a perfect opening for private equity firms. Private equity buyers led seven of the 10 biggest IT M&A deals in the US and Canada last year.

Fighting Against The Storm:

With uncertainty in the air, longer investment cycles are triggering more value-creation strategies for portfolio companies. From optimizing and fortifying supply chains to emphasizing the importance of corporate culture, managers believe there are links between investment performance and employee turnover rates. Another opportunity arises in downturns, as they are expected to force larger corporations to produce spinoffs or divestitures. These occurrences can be buying opportunities for GPs as they focus on looking beyond the typical three to five-year investment cycle.

The Threat:

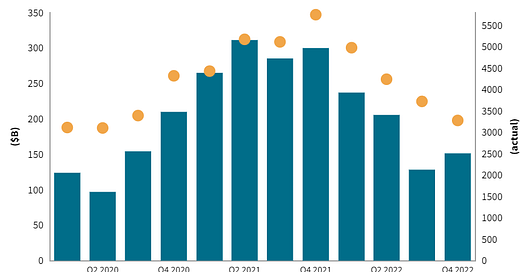

In the latter half of 2022, private equity posted almost 20% fewer technology deals compared to the same period in 2021. Acquisition types have also changed with smaller, bolt-on deals accounting for 71% of all buyouts in the space for 2022. With debt becoming more expensive and declining valuations combined with an uncertain economic outlook, private equity entries and exits have fallen significantly – almost near 2020 levels. Portfolio companies are also affected – those carrying more debt become less flexible with their business operations and may have to right-size their teams to achieve profitability faster than anticipated.

The Upside:

Firms that are in robust financial positions are now able to act more opportunistically as these valuations fall and the market starts to open up

About Bloom Equity Partners

We're big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment in their business, we would love to learn more! We just launched our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

US Inflation Report Suggests Fed Rate Pause Will Become a Full Stop

E.U. Approves Landmark AI Act, Challenging Tech Giants' Power

If you're enjoying The Bi-Weekly Bloom, we'd appreciate it if you shared it with your network.