Trends in SaaS Sales Performance

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news.

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join over 8,500 readers for a summary our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

Trends in SaaS Sales Performance

The SaaS landscape has changed significantly in the past several years. Growth has slowed across all SaaS sectors after a high-growth period in 2020 and 2021. Sales performance is one area most affected by the economic tailwinds as buyers tighten their purse strings. Sales cycles are lengthening, causing a significant impact on the revenue and long-term profitability of SaaS businesses.

Capchase’s recently released report, B2B SaaS Sales Cycles in 2023: New Insights and Data, tracks the B2B SaaS industry’s sales performance in today’s economic environment.

The report combines data from a survey of 500 U.S. SaaS leaders commissioned by Capchase with data from more than 1,200 SaaS companies from the company's underwriting process. The findings indicate the industry has shifted to longer sales cycles, more scrutiny in the buyer process, and a decline in average contract value.

The poll, conducted between April 11 and April 19, 2023, surveyed 500 decision-makers and leaders in finance, sales, or marketing for B2B SaaS companies of various sizes, growth stages and verticals across the United States. Questions focused on the sales process, sales performance, revenue generation, and payments regarding annual contracts since H1 2022.

We reviewed the report and extracted some top takeaways to help SaaS companies understand the current sales climate.

Top Sales Trends

Sales Cycles are Longer

66% of respondents said sales cycles lengthened compared to January to June 2022. The average sales cycle is 27 days longer.

42% of respondents reported cycles are 2-3 weeks longer.

35% of respondents reported cycles are 4-5 weeks longer.

The average CAC payback period increased by 150%, which means recouping the losses generated by acquiring them takes longer after deals close.

Median CAC increased by 180%, indicating companies must spend significantly more money to close the same number of deals—a sign of a struggling sales environment.

Median LTV/CAC has declined by 47%, resulting in companies getting less revenue from customers despite increased acquisition costs.

Average Contract Value (ACV) Growth Cooling

While ACV continues to grow across most B2B SaaS businesses (69% reported an increase in ACV since H1 2022), growth cooled considerably compared to the typical hyper-growth environment SaaS has enjoyed for the past several years.

23% reported their ACV stagnated.

8% reported a decline in ACV. Of those seeing a decrease in ACV, 44% reported a decline of 10%-30%, 24% a decline of 30%-50%, and 7% reported a decline of over 50%.

82% currently offer discounts to encourage prospects to sign up for annual contracts, with the average discount being 18%.

42% of companies saw a decline in ARPU (average revenue per user).

Between pre- and post-downturn, Capchase saw a much higher number than the small 8% of companies reporting a decline in ACV, indicating overall revenue growth may have slowed down more than what revenue leaders are self-reporting.

Of companies experiencing a decline in ARPU, the average decline was 52%, showing a much more drastic decline in revenue performance than the reported average ACV decline of 21%—again indicating revenue is even harder to generate than expected.

Whether their ACVs were decreasing, stagnating, or increasing, most B2B SaaS leaders said increasing ACV was “important” or “very important” at their organizations.

Rigid Payments are Creating a Bottleneck

Out of all the factors preventing B2B SaaS companies from closing deals quickly, payments and pricing concerns stood out as a powerful sticking point —which is expected during a time when everyone has less money to spend.

85% believe offering existing customers more flexible payment options could reduce churn.

82% said an inability to offer flexible payment options hindered deals from closing with 47% of respondents strongly believing not being able to offer customers more flexible payment options prevents deals from closing.

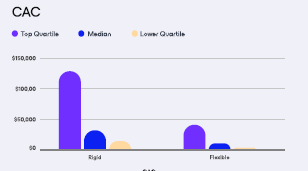

Companies with flexible payment options can generate up to $100,000 in MRR per $1M in CAC spend compared to companies with rigid payment options.

A 75% higher LTV/CAC means companies with flexible payments also enjoy a long-term boost in customer value—and potentially customer retention.

A $100,000 lower overall CAC means that aside from any other factors, companies with flexible payment options spend less on acquiring customers due to increased flexibility and less friction in closing a deal.

Why are These Trends Occurring?

Negotiations have increased, adding, on average, more than two weeks (16 days) to payment terms.

More stakeholders are involved in the buying process. 64% of respondents reported that the number of stakeholders involved in each deal has increased since H1 2022, with the average number of stakeholders at over two.

In addition, 44% of respondents reported as many as three to four stakeholders involved in each deal. Most of these stakeholders are high-positioned decision-makers, with around 59% of reported stakeholders as founders or CEOs. Key leaders are paying more attention to how money is being spent. The chart below shows the number of stakeholders needed to approve a sale.

How to Improve Sales Performance

Streamline Sales Process:

Leveraging automation and streamlining workflows to minimize unnecessary or repetitive tasks allows sales teams to focus on more productive tasks.

Offer Flexible Terms:

Empower your sales team to discuss payment preferences with clients and tailor contracts to match their requirements to reduce churn and close deals delayed due to budgetary constraints.

Make Renewals Painless:

Simplify renewal processes by offering hassle-free options such as automatic renewals or personalized incentives.

Be Careful with Discounts:

While discounts effectively entice prospects during tough economic times, use them strategically. Before implementing discounts, consider the impact to ACV, LTV, and cash flow.

Optimize Your Billing Process:

Use technology that automates repetitive tasks like collections, payment reminders, and reconciliation to save your finance team time, enhance accuracy, reduce delays, and create a smoother customer experience.

You can view the full report here.

About Bloom Equity Partners

We're big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment in their business, we would love to learn more! We just launched our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

The Rise of Private Equity in Tech M&A

Why Favorable Conditions Abound for the US PE Middle Market

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you're enjoying The Bi-Weekly Bloom, we'd appreciate it if you shared it with your network.