Q3 SaaS Trends Report: Prices Rising

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news.

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join over 8,500 readers for a summary our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

Q3 SaaS Trend Report: Prices Rising

Despite the challenging economy, businesses still buy and renew SaaS software — it’s just taking longer, costing more and under more buyer scrutiny, according to Vendr’s recently released “The SaaS Trends Report” for Q3 2023.

The report offers a detailed breakdown of the most critical trends in the software market to help SaaS buyers and sellers navigate the year ahead. It is based on over 3,000 transactions processed on the Vendr platform for Q3, totaling over $240 million in SaaS spend.

We reviewed the report and uncovered some valuable insights for you.

You can view the full report here.

Pricing Trends

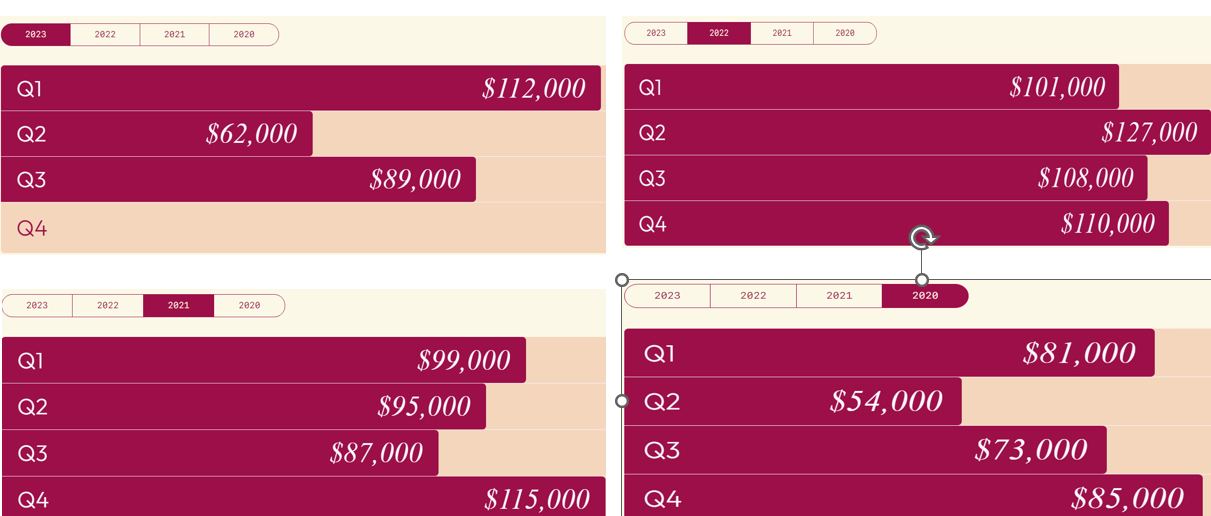

ACV climbs 43% quarter-over-quarter but remains lower than the three-year average.

ACV hit a three-year low in Q2 2023 at $62k before rising to $89k this quarter.

ACV is down 17% year-over-year.

Many sellers raise prices to maintain ACV levels as buyers prioritize efficiency by scrutinizing line items and cutting seats.

Predicted Price Hikes Appear

As shown in the chart below, the number of contracts with price increases dropped over the past four quarters while the number of contracts with price decreases rose.

The trend reversed in Q2 2023 — more contracts contain increased prices than reduced pricing.

Acquiring Customers Costs More

Customer Acquisition Cost (CAC) reaches a three-year high, more than doubling since 2020.

Companies take, on average, 48 months to pay back customer acquisition costs.

Many companies limit or freeze net-new purchases, incentivizing buyers to renew existing contracts.

Tech Stack Consolidation

Net new purchases down 37% YoY

SaaS buyers focus more on ensuring they receive the best possible renewal deals than on buying new software.

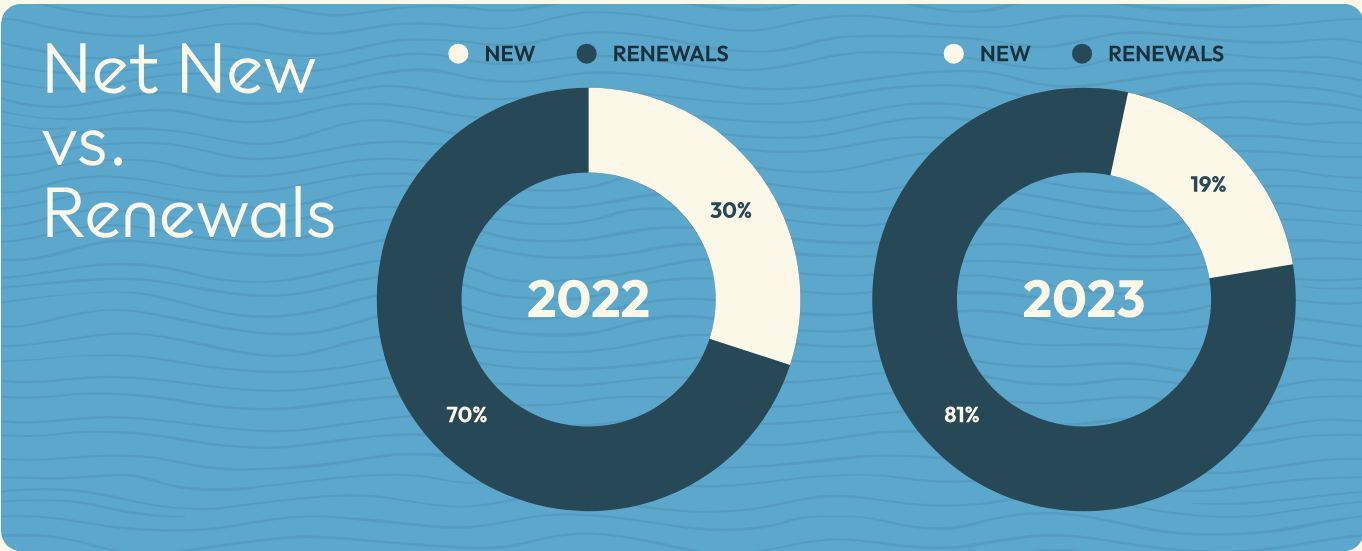

In 2022, 30% of the spending was for net new software, with 70% for renewals.

Through three quarters in 2023, net new software purchases are down 37% with only 19% of net new purchases

In Q3, only 17% of transactions on Vendr’s platform are net new.

Buying cycles increase by 37% for net new purchases

Companies invest more in sales and marketing to close deals, impacting CAC and company revenue.

As companies scrutinize spend, more stakeholders are involved in purchases, lengthening buying cycles.

Negotiations make up 54% of the buying cycle

Negotiation represents the most extended phase of the buying cycle.

In general, the larger the contract, the longer the negotiation cycle is — as ACV rises, negotiation cycles take longer.

Top Purchased Categories

The chart below shows the top 25 categories purchased net new and renewed in Q3 2023, broken down by quantity of transactions per category.

The three subcategories with the fastest growth within Data Analytics are Data Integration, Data Science and Analytics, and Business Intelligence. For each, average ACV and savings decrease while buying cycles extend QoQ.

Q4 Predictions

Q4 purchases to decline YoY

Q4 is typically a high-purchase quarter. However, with most companies re-forecasting this year, buyers have less leftover money to spend in Q4. Instead, many decision-makers will already be focused on 2024 spending next quarter.

Teams face continued pressure to consolidate internally

Throughout this process, finance teams will get closer to understanding how teams use tools and which tools are essential.

The build vs. buy debate continues

With many companies focusing on reducing new spend, teams may build new tools instead of buying.

Mission critical is the name of the game

Sellers of non-mission-critical software will be more likely to negotiate prices.

Ask, and you (maybe) shall receive

Buyers and sellers continue to find creative ways to ensure contracts work for both sides. Multi-year contracts, particular language on uplifts, and terms, will be more common. While some suppliers are holding firm on pricing, others are thrilled to negotiate a deal.

About Bloom Equity Partners

We're big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment in their business, we would love to learn more! Bloom has a referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

18 Factors to Track When Valuing Your SaaS Company

Cash Efficient Burn Beats Profitability

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you're enjoying The Bi-Weekly Bloom, we'd appreciate it if you shared it with your network.

Thanks for flagging Dave + Ray's Historic SaaS Metrics podcast episode.

The research + slides they discuss are available (no email required) here:

https://cloudratings.com/saas-benchmarks-historical/