1Q25 SaaS M&A Report: Reaccelerating into the New Year

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition, we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join nearly 10,000 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

1Q25 SaaS M&A Report: Reaccelerating into the New Year

Software Equity Group’s Q1 2025 report points to an encouraging start to the year for SaaS M&A. Despite continued macro complexity, deal volume is up, valuations are holding, and buyer appetite remains strong—particularly for high-quality, vertical-specific solutions. Below, we’ve highlighted key takeaways from the report and shared our perspective on what’s driving momentum across the private SaaS market.

SaaS M&A Sees a Strong Start to 2025

SaaS M&A recorded 636 transactions in Q1, up 19% quarter-over-quarter and 31% year-over-year. This marks the strongest quarter for SaaS deal volume since 1Q22, signaling renewed buyer confidence after a relatively subdued 2023. SaaS accounted for 58% of total software M&A activity, consistent with recent quarters and a meaningful increase from the pre-COVID baseline (43% in 2020).

Private equity continued to lead the market, accounting for 61% of SaaS transactions. Notably, add-on acquisitions made up over half of PE deal activity, as sponsors continue to scale existing platforms with accretive bolt-ons and consolidation opportunities in fragmented areas of the industry. Public and private strategics remained active but selective, comprising 39% of total deals.

Valuations Hold Steady as Buyers Focus on Quality

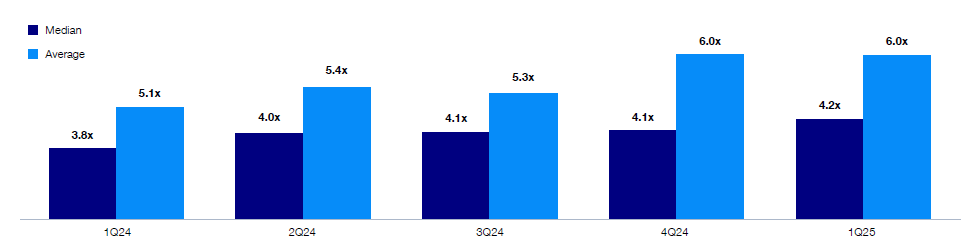

SaaS M&A valuations remained stable. The median EV/TTM revenue multiple held at 4.2x, up slightly from 4.1x in Q4. The average multiple reached 6.0x, reflecting continued demand for premium assets, particularly in sectors where vertical depth and product expansion result in strong retention rates.

The spread between average and median valuations continues to widen, underscoring a bifurcated market. Top-performing assets—those with strong retention, efficient growth, and are deeply embedded into mission critical workflows—are commanding clear pricing premiums. Meanwhile, lower-growth or less differentiated businesses are trading closer to the median or below. Buyers remain disciplined but are increasingly willing to pay up for defensible market positions with clear visibility into profitability and long-term durability.

Vertical SaaS Continues to Lead

Vertical SaaS remains a focal point for acquirers, making up a significant portion of overall activity. Healthcare was once again the most active vertical in Q1, accounting for 21% of vertical SaaS transactions, as providers continue investing in digital infrastructure to modernize care delivery. Financial services and real estate followed at 15% and 10%, respectively, both sectors where regulatory complexity and operational workflows create high switching costs and attractive M&A profiles.

Retail, energy, and education also saw steady activity, particularly where software plays a critical role in compliance and business continuity. On the horizontal side, content and workflow management (96 deals), sales and marketing (86), and analytics and data management (72) were among the most active categories. ERP and financial applications continue to perform well, supported by their mission-critical role and customer entrenchment.

Macroeconomic Backdrop: Stabilizing, but Still Uncertain

The macro environment remains complex but more stable than it was six months ago. U.S. GDP grew 1.6% in Q1, missing expectations, while inflation moderated to 2.4% year-over-year—cooler than anticipated and a potential signal of future rate movement. While the timing of interest rate cuts remains uncertain, the broader outlook is more constructive than it was heading into 2024.

At the same time, global enterprise software spend remains a bright spot. The category surpassed $1 trillion in 2024 and is expected to grow by over 14% in 2025, driven by AI adoption, digital transformation mandates, and increasing reliance on cloud-native applications across nearly every industry.

What We’re Watching

As we look ahead, we’re focused on a few key dynamics:

Interest rate cuts, which could further unlock deal flow and financing flexibility

AI-driven deal activity, especially in analytics, data infrastructure, and enablement tools

Strategic acquirer re-engagement, as public companies revisit M&A as a growth lever

Continued consolidation in vertical SaaS, where buyer conviction remains strongest

With Q1 setting a high watermark for recent SaaS M&A activity, 2025 is off to a promising start. While macro headwinds haven’t fully cleared, the sustained demand for mission-critical, high-retention software platforms continues to drive meaningful outcomes across the private market.

Join Our Portfolio Company: We're Hiring Account Executives

Bloom Equity Partners is rapidly scaling the Go to Market team for one of our portfolio investments in the Enterprise Data Management vertical. We're seeking our next two Account Executives to join this exciting company that sells into the Fortune 5000 with an incredible team, solution, and established customer list already in place. Remote positions available across the US. If you're a motivated sales professional looking to make an impact in a dynamic, high-growth environment, we want to hear from you.

See full job posting and apply here.

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: B2B Software and Technology-Enabled Companies

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M

Growth: No requirement

Profitability: Negative - $10M EBITDA

Investment Type: Operational control required

Business Development Team:

Abe Borden – Principal – abe@bloomequitypartners.com

Adam Kaseff – Senior Associate – adam.kaseff@bloomequitypartners.com

If you or someone you know is considering selling or investing in their business, we would love to learn more! Check out our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

PE Weekly: Sector-Focused Services Drive M&A

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.