2022 Global Fund Performance Report

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts!

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news.

2022 Global Fund Performance Report

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join over 6,000 readers for a summary our favorite SaaS insights, articles, podcasts, tweets, and news headlines, subscribe below:

2022 Global Fund Performance Report

The 2022 Global Fund Performance Report by Pitchbook was recently released, and it's packed with valuable insights and trends on both private equity fund performance as it relates to other private markets asset classes. We dove deep into the report and found some interesting data points and findings we'd love to share with you.

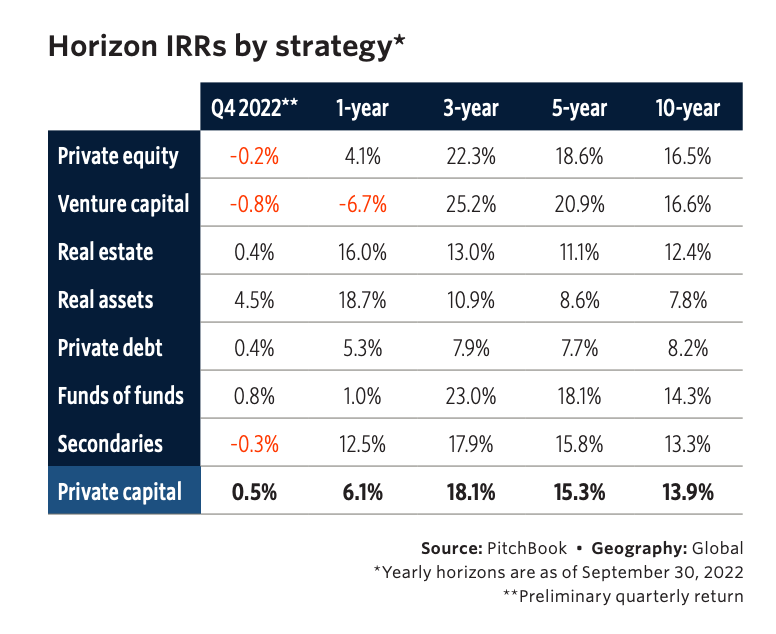

Global PE fund performance (preliminary estimates) for Q4 2022 came in at -0.2% following a -3.7% return in Q2 and a low 1.2% in Q1.

2022 PE fund returns were substantially better than the -18.1% return of the MSCI World Index, which gives a sense of overall public market performance.

The report noted that when dissecting PE fund returns by size bucket, in the past few quarters the largest size grouping, funds of more than $1 billion returned the best performance (measured by average quarterly rolling one-year IRR). This is a change from some periods of historical performance as seen below:

The average quarterly rolling one-year IRR since 2009 for funds under $250 million was 11.7%

For funds between $250 million and $500 million it was 13.3%

For funds between $500 million and $1 billion it was 14.5%

For funds above $1 billion, it was 15.3%.

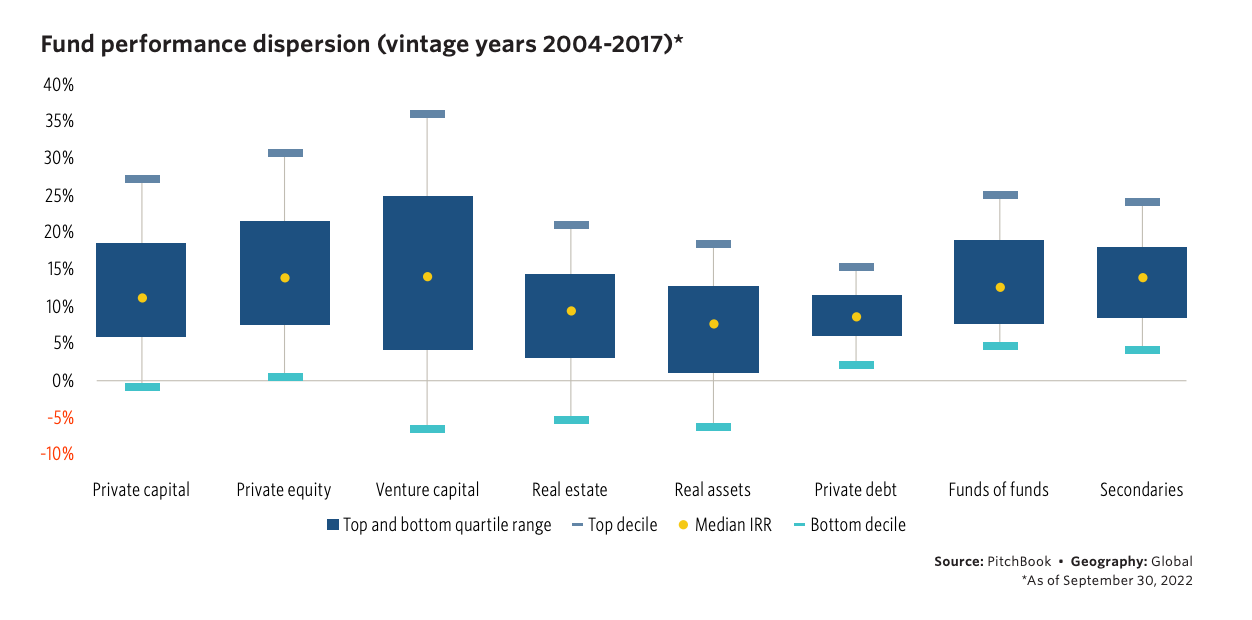

When it comes to the dispersion of fund returns, there was approximately a 15% difference between the top quartile and bottom quartile boundaries.

VC dispersion continues to lead the pack with a 20.8% difference between the top quartile and bottom quartile boundaries.

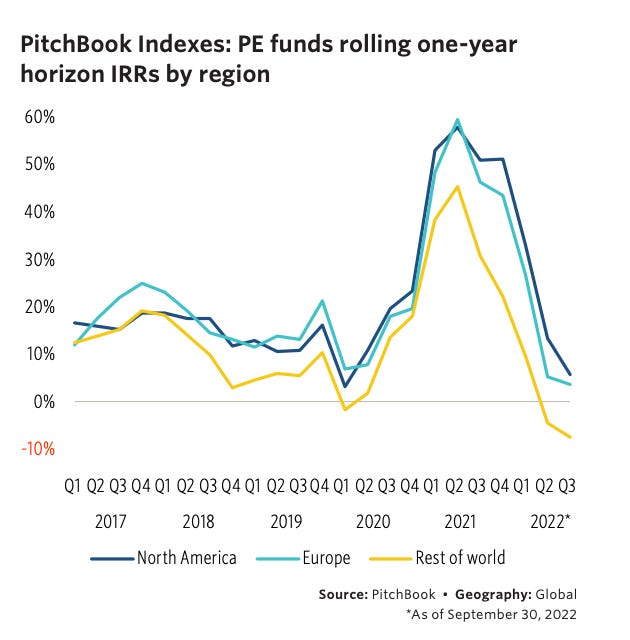

PE funds in North America have been the most resilient, returning 5.9% in the year through Q3 2022, while Europe returned 3.7% and the rest of the world returned -7.3%.

The report noted that this figure was in line with the drops in buyout multiples across the industry, as European multiples have fallen faster.

You can check out the full report👇

Global Fund Performance Report

About Bloom Equity Partners

We're big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment in their business, we would love to learn more! We just launched our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

PE firms stick with enterprise software bets

Fidelity IPO update: Can dealmaking rebound?

Favorites from the Ecosystem

Investors…

Operators….

If you're enjoying The Bi-Weekly Bloom, we'd appreciate it if you shared it with your network.