Happy Friday!

We are back with another week of SaaS insights, news, and updates from the team at Bloom Equity Partners.

If you are a new reader, welcome 👋 to The Weekly Bloom. Every Friday, we share our favorite SaaS articles, podcasts, tweets, and news headlines from across the industry to now ~4,000 readers. We also share some insights from our team or other successful professionals in the industry.

SaaS Benchmarks Report

Earlier this week, the team at OpenView released their 6th annual SaaS benchmarks report. The survey includes data from over 3,000 private software companies (~50% were $1 and $10 million ARR SaaS, 19% >$1M ARR, and 33% <$10M ARR). Our team took a deep dive into the report and wanted to share some key data points and findings:

Financial & Operating metrics by ARR

Growth Rates are a lot lower than expected. $1 to 2.5M ARR, SaaS co’s only grew 79% year-over-year on average, which may seem relatively low for that size. Why is this the case?

The surveyed companies were both bootstrapped and venture-backed which skews the data lower.

A lot of SaaS companies have cut their cash burn significantly relative to 2022 projections.

The value of growth is down significantly

Investors have begun to place more of an emphasis on “the rule of 40” rather than “NTM growth” as seen below. As of June 2022, the Rule of 40 explained 39% of valuation differences while growth rates alone only explained 27%.

In order to improve “Rule of 40”, companies must look to NDR and CAC payback

The top two indicators for predicting efficient growth in today’s market environment are customer acquisition cost (CAC) payback and net dollar retention (NDR).

The companies with top-quartile CAC payback and NDR had an average Rule of 40 of 63%.

There were many more interesting data points highlighted in the report, so make sure to check it out: Here. It’s not often that you get a behind-the-scenes look into the playbooks of private software companies.

What We’re Reading and Listening To…

📚 OpenCloud 2022: How to Navigate Stormy Markets and Other Tips for Cloud Founders

📚 Don't let the Rule of 40 rule your company

📚 Cutting R&D to Grow GTM Spend : Is it Happening Across Software Companies?

Favorites from the Ecosystem

Investors👇…..

Founders👇…..

Operators👇….

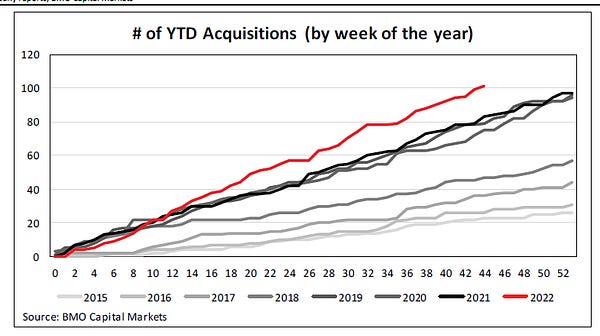

News from the Industry: deals, deals, and more deals 💰

Ontra Acquires Alternative Investment Software Provider Captain

Invictus Growth Partners Raises $322 Million for Deals

Cinven acquires tax preparation software provider TaxAct for $720M

HG amasses $11bn in Europe’s largest buyout fund to close this year

End Note 🔚

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.

About Bloom Equity Partners

Bloom Equity Partners is a lower mid-market software-focused private equity firm, leveraging deep operational and commercial experience to create enduring market value for the benefit of our investors, founders, and their companies.

If you or someone you know is considering selling or taking investment, we might be able to help out. Just reply to this thread and we can get acquainted!

Thanks for sharing your takeaways from the benchmarks report! 📈