Happy Friday Founders & Friends!

Thanks for joining us for another edition of the weekly bloom.

If you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and we hope you're enjoying it.

2022 SaaS Trends

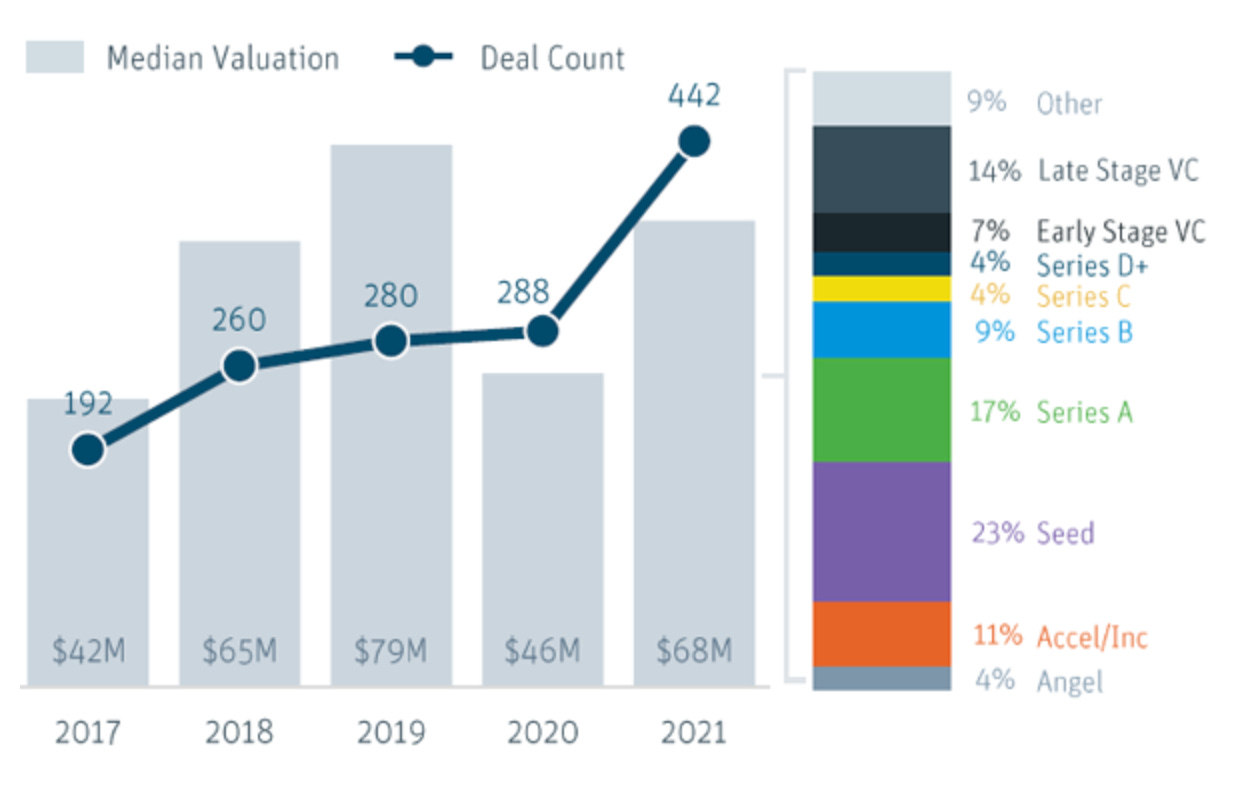

As always, our goal is to share the best insights and quick takes from across the SaaS landscape. Last month, SVB released a “SaaS investment, valuation, VC activity” trends report for 2022.

Here’s what you need to know:

Repricing underway for late-stage startups

If public markets continue to slide, there will be pressure on late-stage valuations to rebase.

To keep up the strong multiples, late-stage privates will need to demonstrate strong fundamental growth.

We can expect a return to fundamentals in 2022.

SaaS seed-stage companies are still VC targets

Given the changing market dynamics, VC’s are beginning to reassess at what stage to deploy capital. Many beginning to put the breaks on large late-stage deals.

This has led to a highly competitive seed to series B environment as these companies are fairly isolated from macroeconomic variables impacting late-stage privates.

Additionally, early-stage startups are heavily valued on potential value v.s demonstrated value for late-stage companies.

Early-stage M&A spike

Early-stage M&A spiked in 2021 which can be seen by the chart below. This trend seems to be continuing as acquirers are looking to take advantage of these “more pragmatically” priced opportunities.

What We’re Reading and Listening To…

🎥 The Ultimate Guide to Vertical B2B/SaaS Advertising

📚 The Importance of CAC Payback in Today’s Market Environment

News from the Industry: deals, deals, and more deals 💰

Vista Equity Partners has invested in BetterCloud

Clearlake Capital-backed Cornerstone to acquire Skillsoft's SumTotal

Access Group secures investment from Hg and TA Associates at £9.2bn valuation

Favorites from the Ecosystem

Investors👇…..

Founders👇…..

Operators👇….

About Bloom Equity Partners

Bloom Equity Partners is a lower mid-market software-focused private equity firm, leveraging deep operational and commercial experience to create enduring market value for the benefit of our investors, founders, and their companies.