2023 SaaS Benchmark Report: What Sets Top-Performers Apart

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news.

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

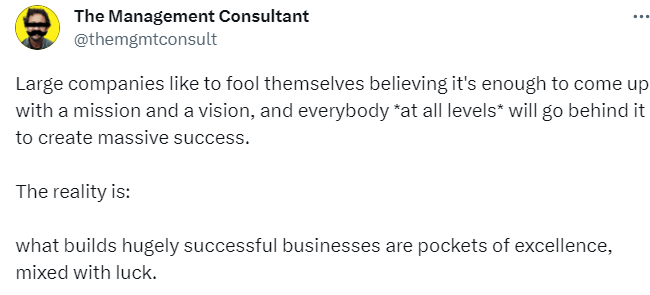

Insightful tweets from fellow investors and operators

Join over 7,000 readers for a summary our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

2023 SaaS Benchmark Report: What Sets Top-Performers Apart

To help SaaS companies grow faster and reach profitability sooner, Capchase recently released the results from its 2023 SaaS Benchmark Report, which compiles the performance data of more than 900 early-stage B2B SaaS companies with an ARR between $1m and $15m, sustainable growth and profitability. The data in the report reflects actual financial performance from companies' anonymized records.

We reviewed the report and extracted crucial insights to help you understand how your business compares to its peers and what it takes for the strongest companies to stand apart from the competition.

Top Takeaways

The healthiest businesses are growing three times as fast as the average, despite maintaining higher Net Margins.

Companies with the strongest Rule of 40 (ARR Growth + Net Margin) will likely achieve profitability sooner.

Top performers focus on efficiently acquiring new logos rather than customer retention.

These businesses keep Customer Acquisition Costs (CAC) low and recoup costs in half the time of their peers.

Key Performance Indicators

Annual Recurring Revenue (ARR) Growth Year-over-Year: Businesses in the top quartile for Rule of 40, a measure of growth versus burn for SaaS businesses, are growing around three times as fast as their peers, experiencing higher growth early on as they start from a low base.

Net Margin: Businesses emphasizing balancing growth with burn will likely reach profitability much sooner than their peers. Additionally, businesses focused on sustainable growth, rather than growth at all costs, can better respond to market shocks or funding crunches.

Gross Margin: For SaaS businesses, gross margins are typically very high to reflect the cost of goods sold (COGS) which are limited to hosting costs, and sometimes customer service costs. Gross margins are similar for average and top performers, likely because SaaS COGS are kept to a minimum by nature.

Customer Acquisition Costs (CAC): In the early stages, top performers are more conservative in CAC spending as they focus on product/market fit. CAS increases as the businesses mature, move upmarket, and target higher contract values.

Logo Churn/Net Dollar Retention: Top performers’ growth comes from new logo acquisitions and could indicate missed opportunities to increase revenue from existing customers.

You can view the full report here.

About Bloom Equity Partners

We're big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment in their business, we would love to learn more! We just launched our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

Accelerate Success by Assuming the Transformative Power of SaaS Products

Dealmakers Signal Optimism for Consumer-Focused Investments

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you're enjoying The Bi-Weekly Bloom, we'd appreciate it if you shared it with your network.

Thanks for including our Demand Index data.

For anyone interested in the report - including drill downs by category like Sales, Marketing, HR/HCM, etc - click here:

https://cloudratings.com/saas-demand-index-july-2023/