2023 SaaS M&A Year in Review

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition, we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join nearly 9,000 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

2023 SaaS M&A Year in Review

SaaS M&A activity continued to build momentum in 2023, with the transaction count rising 9% over 2020 (pre-COVID) and surging to follow 2022 as the second-highest year on record, according to the recently released SEG 2024 Annual SaaS Report.

In addition to recapping 2023 SaaS M&A activity, the report provides a global IT & enterprise spending outlook for 2024, revenue multiples and top product categories from the previous year.

We reviewed the report and identified essential insights to help you make decisions in the year ahead.

2023 M&A Summary

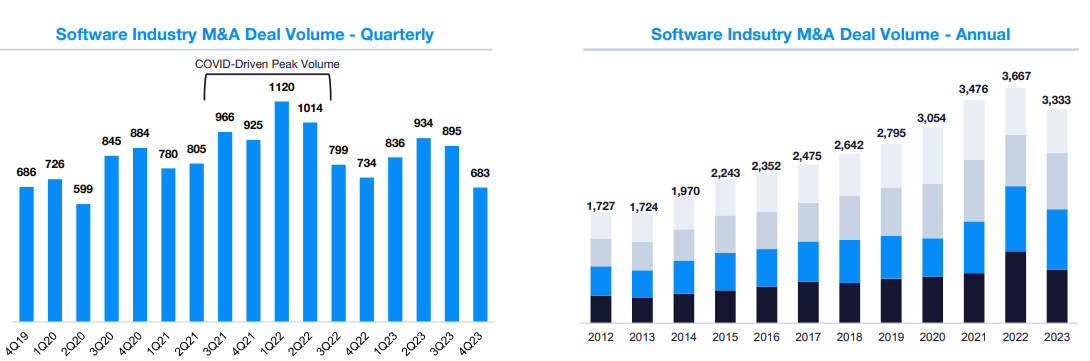

Overall Software Industry Deal Volume

The aggregate software industry M&A volume declined in 2023, decreasing ~9% YOY from 2022.

Driven by COVID tailwinds, 2021 and 2022 were unprecedented years for software M&A. From a volume perspective, 2023 was a strong year compared to pre-COVID levels (up 9% over 2020).

Q423 did decline 7% YOY as it lacked some of the transaction catalysts seen in previous Q4s, such as changes to the tax code and potential legislation.

Macroeconomic uncertainty and high cost of capital applied downward pressure on overall M&A volume.

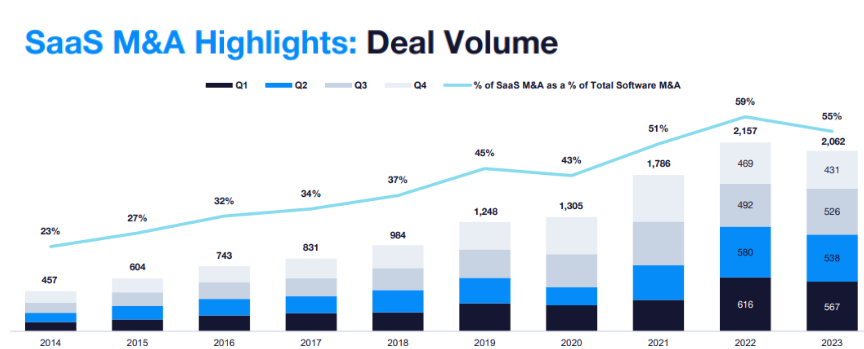

SaaS M&A Deal Activity

SaaS M&A deal activity recorded the second-highest transaction count on record, trailing only 2022.

While aggregate software M&A settled into pre-COVID levels, SaaS M&A volume in 2023 was up 15% against 2021 and 58% against 2020

4Q23 was down YOY (8%) and QOQ (18%) due to a lack of deal catalysts putting pressure on year-end closes and the uncertain macroeconomic outlook throughout most of 2023, pushing some liquidity events into 2024.

SaaS deals comprised 56% of all aggregate software deals, marking the third consecutive year that SaaS comprised more than 50% of aggregate software transactions.

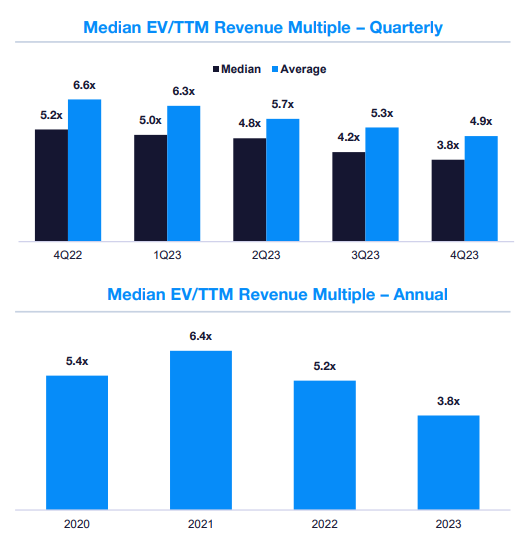

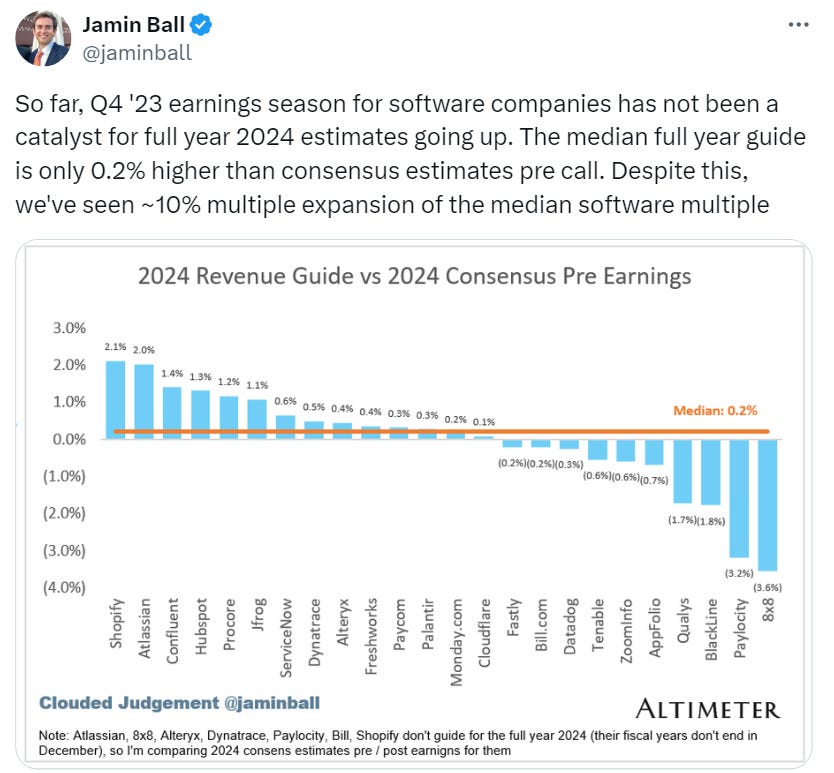

EV/TTM Revenue Multiples

The median EV/TTM Revenue multiple for 4Q23 was 3.8x, down 10% from 3Q23.

In 2023, a high volume of low-multiple deals created a gap between the average and median (average of 4.9x).

Although multiples are broadly down, high-performing businesses receive solid outcomes in the M&A markets.

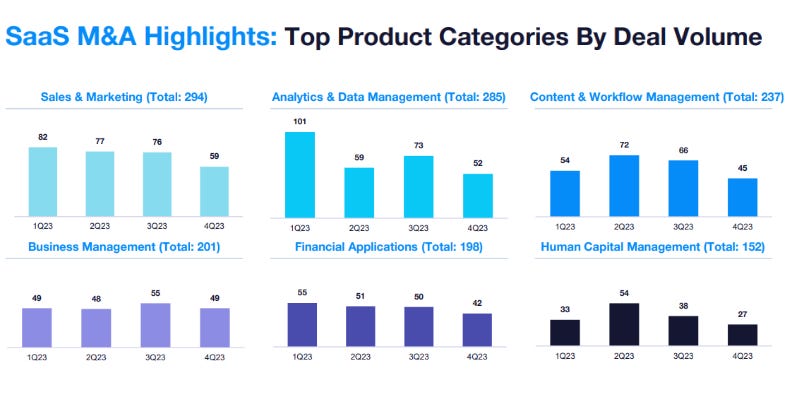

Top Products by Deal Volume

Sales & Marketing was the most active product category in 2023, with 294 transactions and 59 in 4Q23.

Analytics and Data Management was second in Q423 and 2023, with 52 and 285 deals, respectively.

ERP / Business Management experienced stable quarterly volume in 2023, mirroring its consistent growth and steady valuations in the public markets, reinforcing the category’s mission-critical nature.

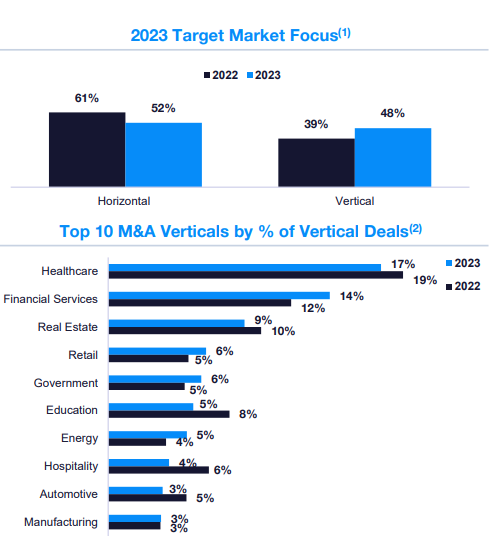

Target Market Focus

Vertical SaaS comprised 48% of all SaaS M&A deals in 2023, up from 39% in 2022, continuing the trend of buyers and investors seeking purpose-built, mission-critical applications from vertical software companies.

Healthcare, Financial Services, and Real Estate represented the three most active verticals.

Healthcare remained the most active vertical (17% of vertical SaaS deals), driven by the need for healthcare operations, regardless of economic climate.

Financial Services came in second (14%, up YOY from 12%), driven by financial firms leaning on technology despite a tight operating environment due to the increased cost of capital.

Government and Energy verticals also increased YOY, with the M&A volume in these critical sectors resilient to market dynamics.

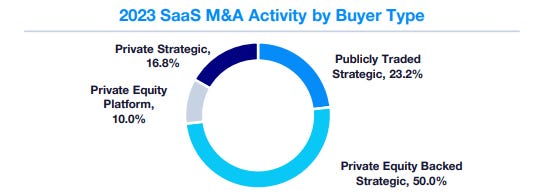

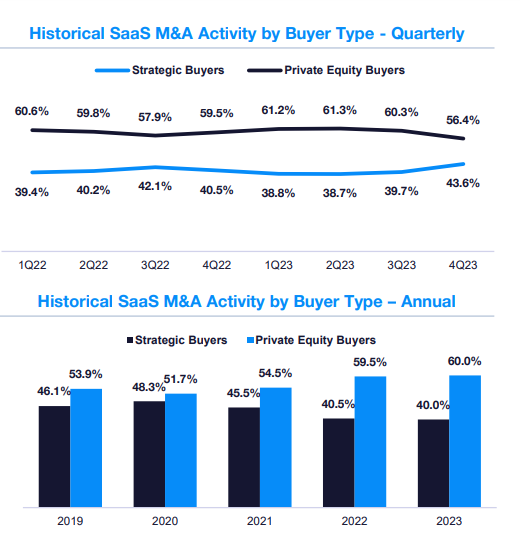

Private Equity Deals

Private equity interest in SaaS M&A remains high, representing the majority (56%) of SaaS deals in 4Q23.

The percentage was slightly down YOY (from 60% in 4Q22) and QOQ (from 60% in 3Q23). This is broken down further into PE-backed strategics (45%) and platform investments (11%).

The amount of dry powder ($3.7T at the end of ‘22)(2) within private equity and public SaaS strategic buyers pulling back on acquisitions in recent years, due to the challenging stock market environment created a substantial opportunity for private equity to be active in SaaS acquisitions.

If Q4 is any indication, the tides may be turning. Strategic buyers (44% of Q4 deals) had their most active quarter since 1Q22, and while private equity will remain strong in 2024, strategic buyers are expected to be more active with public equities rebounding.

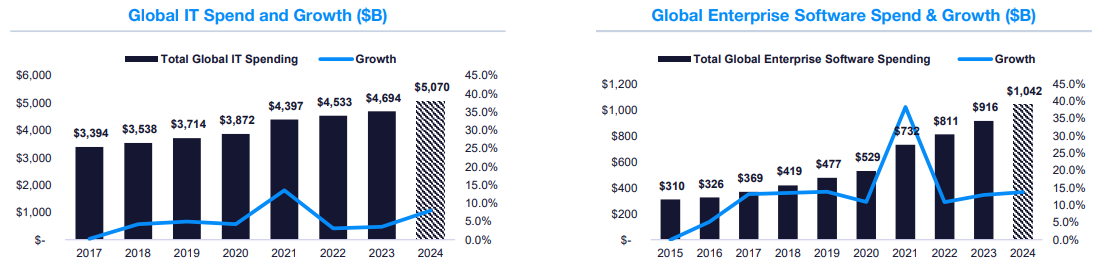

2024 Global IT & Enterprise Software Outlook

Global IT and Enterprise Software growth and spending are expected to grow strongly. In 2021, both categories experienced unprecedented growth due to rapid digitization driven by COVID. However, 2022 marked a regression from peak growth and a return to more typical historical patterns.

Both categories are poised to cross impressive thresholds in 2024, with Global IT spending surpassing $5T and enterprise software spending surpassing $1T for the first time.

Enterprise software, the fastest-growing IT segment, is expected to have grown 12.9% in 2023, with 2024 projected growth at 13.8%, outpacing the broader IT category's growth of 3.5% and 8.0%, respectively.

Software spending as a % of overall IT spending has nearly doubled since 2017 (10% to 20%), a remarkable feat considering the large dollar volume of IT spending (nearly $4.7T in 2023).

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or investing in their business, we would love to learn more! We just launched our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

Kicking Off 2024 with Momentum: Bloom Equity Reflects on a Year of Growth

2023 was a banner year of growth for Bloom Equity marked by strategic investments and team expansion. We are thrilled to share our successes as we continue building on our commitment to delivering superior returns for our investors and enabling impactful growth and partnerships across our portfolio. Read more about Bloom’s reflections from 2023 and a look-forward to 2024 here.

Operating Advisor Wanted: Strategic Cost Optimization

Bloom Equity is looking for a part-time, contract, Operating Advisor to focus on strategic cost optimization. To learn more, please visit the LinkedIn posting to learn more and follow directions to apply.

What We’re Reading and Listening To…

How to Optimize SaaS R&D Spend

Guide to Headcount Efficiency | And Salary Benchmarks for Finance Roles

How Next-Gen Design Systems Can Transform SaaS Products

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.