Happy Friday Founders and Friends!

We hope you enjoyed last week’s newsletter on the different types of acquisitions that can happen in private equity. In this week’s Weekly Bloom, we wanted to dive a bit deeper into the two forms of add-on acquisitions, Bolt-on v.s. Tuck-in.

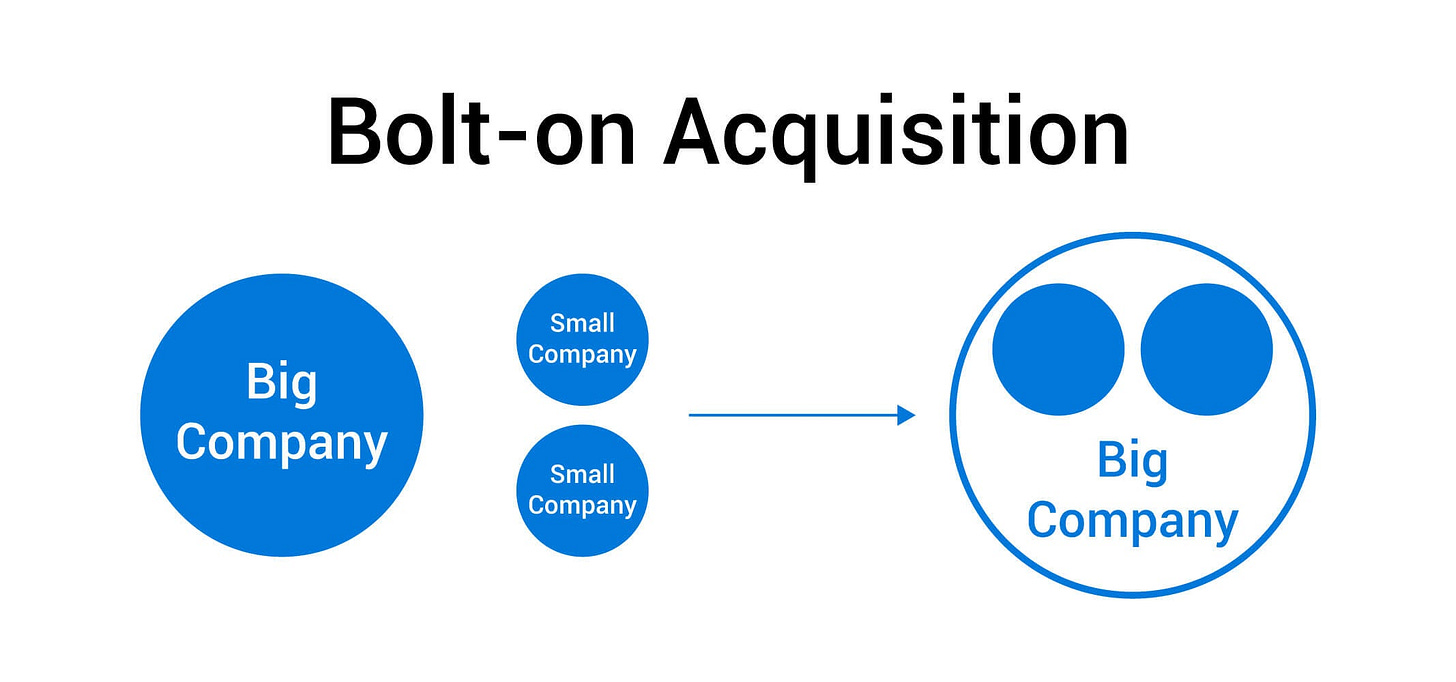

Bolt-on acquisition; What is it?

In a bolt-in acquisition, the acquired company remains intact to some degree. In a lot of cases, the company continues to operate under its own brand (names, identity, etc.) but this factor is deal-specific.

The platform company will look for bolt-on acquisitions that provide similar services, technology or offer a geographic expansion opportunity for the platform company. Additionally, platform companies will look for bolt-on acquisition targets that can be quickly integrated into the platform company’s “infrastructure”.

A great example of a bolt-on acquisition is Facebook’s acquisition of Instagram in 2012.

Source: deal room

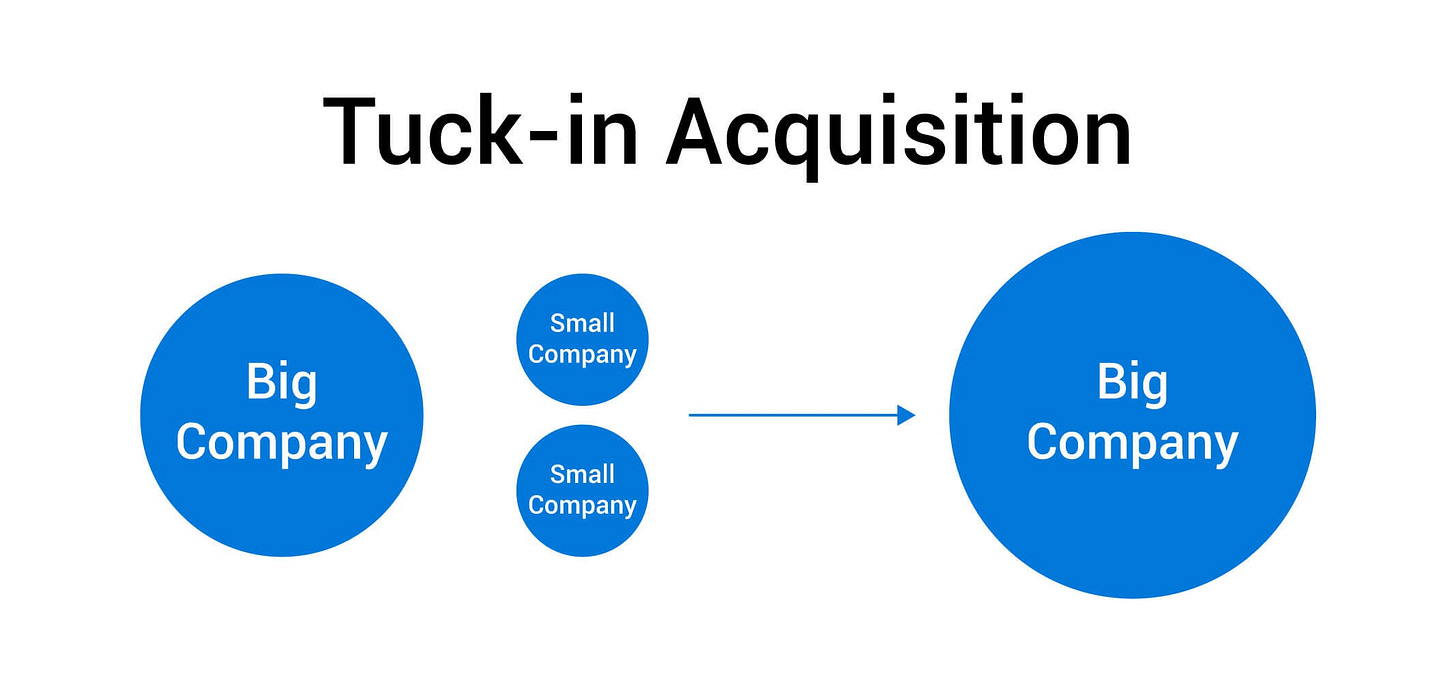

Tuck-in acquisition; What is it?

Tuck-in acquisitions are largely similar to bolt-ons except for the fact that the smaller company is completely absorbed into the platform company. Tuck-in acquisitions lose their corporate identity and their structure becomes indistinguishable (product, branding, etc) from the platform co.

An example of a tuck-in was Uber’s acquisition of Jump Bikes in 2018

Source: deal room

Interested in learning more about this topic?? Make sure to check out the following below 👇

📚 Bolt-on Acquisitions: Everything You Need to Know

📚 Using systematic bolt-on acquisitions to drive growth

📚 How Do Business Model Differences Impact Your M&A Operating Model Framework

What We’re Reading and Listening To…

📚 Why Private Equity Likes Founder and Family Owned Businesses

News from the Industry: deals, deals, and more deals 💰

Intuit confirms $12B deal to buy Mailchimp

SpotOn raises $300M at a $3.15B valuation and acquires Appetize

ConnectWise: $200 Million War Chest for Tuck-In Acquisitions

Microsoft acquires TakeLessons, an online and in-person tutoring platform

Favorites from the Ecosystem

Investors👇…..

Founders👇…..

Operators👇….

Good Laugh👇….

About Bloom Venture Partners

Bloom Venture Partners is a lower mid-market software-focused private equity firm, leveraging deep operational and commercial experience to create enduring market value for the benefit of our investors, founders, and their companies.

End Note

Thanks for joining us for another edition of the weekly bloom. At Bloom Venture Partners we buy, build + invest in SaaS.

We’re excited to continue backing remarkable teams on their quest of changing the way we work, live + create.

As always, if you enjoyed this week’s newsletter we'd love it if you shared it with a friend, co-founder, or anyone that would find value.