An In-Depth Look at the 2023 Lower Middle Market

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news.

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join over 6,000 readers for a summary our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

An In-Depth Look at the 2023 Lower Middle Market

Tree Line Capital recently published its third annual Ascend report, a helpful summary of lower middle market private equity and sponsor investment expectations for 2023.

The report reflects feedback from over 80 sponsors and analyzes the current lower-middle market deal environment, identifying sponsors’ top concerns in the year ahead and the sectors they are targeting.

We have reviewed the report and identified some key insights for you.

Market Slowdown Continues, but Add-Ons Grow

While the focus is often on larger private equity funds, the report illustrates that LMM private equity growth remains robust, offering the investors exposure to favorable returns. Although markets encountered turbulence across the private credit asset class, capital continues to flow to LMM due to a significant addressable set of acquisition targets and opportunities for sponsors to drive value through attractive valuations as well as buy-and-build strategies.

During 2022, in response to broader economic challenges, almost half of private equity sponsors delayed taking portfolio companies to market to maximize value. In addition, the lack of high-quality platforms drove capital deployment down in 2022 vs. 2021.

LMM sponsors expect the same trends to continue in 2023 — both a decline in purchase multiples and amount of leverage utilized. However, add-on acquisitions will draw more interest from sponsors than in recent years.

Other key findings:

62% of sponsors plan to deploy the same or less capital in 2023 compared to 2022

45% of sponsors predict using less leverage in 2023 compared to 2022

57% of sponsors expect less lower middle market M&A activity in 2023

64% users expect purchase multiples to decrease in 2023 compared to 2022.

Fundraising

Although fundraising slowed in 2022, the report states that private equity dry powder remains near all-time highs, driving deal flow and the need for private debt. Existing dry powder estimates of $400B will require ~$400B of debt financing, assuming a 1:1 debt-to-equity contribution.

With sponsor sentiment worsening, fundraising will slow from its peak levels in 2021 (198 LMM funds raised) and 2022 (156 LMM funds raised). However, LMM growth increased its share of fundraising, accounting for 43% of funds closed in 2022 versus 33% in 2021.

Only 8% forecasted fundraising headwinds in 2022, while 57% predicted them in 2023.

However, over 80% of sponsors said their fundraising did not decrease as a result of the economic slowdown

Top Market Concerns

When asked to rate their major concerns for 2023, inflation held the top spot for sponsors, up 28% from 2022, while debt is less of a worry due to the availability of significant private debt ($1.2T) and dry powder ($395B).

Long-term recession concerns, rising interest rates, availability, labor cost, and shifting supply-chain and end-market risk rounded out the list of concerns.

Only 18% believe we will enter a prolonged recession will occur in 2023

However, 90% say recessionary concerns are impacting their view on valuation

Targeted Sectors

The report notes that 60% of sponsors plan to target tech-enabled services and 21% plan to target software companies in 2023.

You can view the full report here.

About Bloom Equity Partners

We're big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment in their business, we would love to learn more! We just launched our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

The Evolving Landscape of Enterprise SaaS

Favorites from the Ecosystem

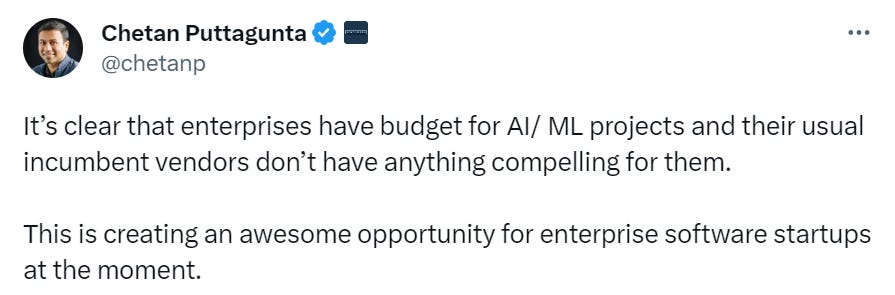

Investors…

Operators….

If you're enjoying The Bi-Weekly Bloom, we'd appreciate it if you shared it with your network.