Happy Friday Founders & Friends!

We are back with another week of The Weekly Bloom newsletter! We hope that you enjoyed last week’s newsletter on subjectivity in valuations. Continuing on the theme of valuations, we wanted to share our insights on a metric metric that plays a big role in valuations……. burn rate 💰

We have spoken about this topic previously, so make sure to give it a read…

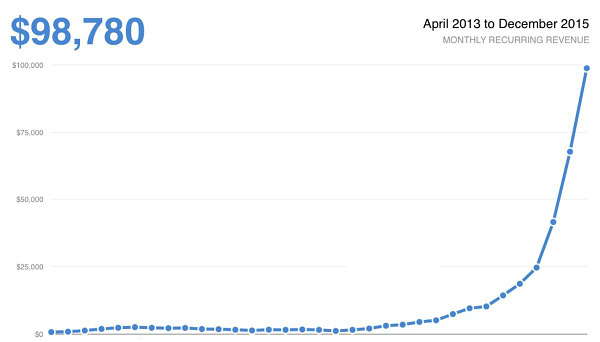

In regards to burn rate there are often misconceptions from business owners on how it is calculated. What is burn rate? How is it calculated? Is it a net or gross term? Below is a simple framework for understanding burn rate in regards to SaaS companies:

Burn is the gap between recurring expenses and recurring revenue

Burn is a net term. Your monthly expense total is not your burn rate. Your burn rate is your MRR minus expenses. Example: If your monthly payroll and expenses are $150k total and your MMR is $100k, your monthly burn is $50k.

Burn is a measure of the present gap between revenue and expenses. Not prior months.

Do not include one time expenses in burn. These should be deducted from your businesses’ cash on hand.

Runway = (cash + receivables) / (monthly burn)

Burn is based off revenue not cashflows.

Interested in learning more about burn rate for SaaS co’s?? Make sure to check out the following below 👇

📚 Burn Rate: Calibrating SaaS Cash Burn

📚Understanding What Your Startup’s Burn Rate Really Means

If you are enjoying our bit-sized insights make sure to subscribe

What We’re Reading and Listening To…

📚 Bottoms-Up SaaS & The Weather

📚 Why I’d Rather Be Acquired by Vista Than a Big Tech Company

News from the Industry: deals, deals, and more deals 💰

KKR to buy cybersecurity firm Barracuda from Thoma Bravo in deal worth about $4 bln

Thoma Bravo to buy SailPoint for $6.1 billion

Critical Start Secures Over $215 Million Strategic Growth Investment from Vista Equity Partners

Favorites from the Ecosystem

Investors👇…..

Founders👇…..

Operators👇….

End Note 🔚

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.

About Bloom Equity Partners

Bloom Equity Partners is a lower mid-market software-focused private equity firm, leveraging deep operational and commercial experience to create enduring market value for the benefit of our investors, founders, and their companies.