How Low Will SaaS Valuations Go.....

News, insights and updates from the team at Bloom Equity Partners

Happy Friday fellow weekly bloom readers!

We are back- with your go-to weekly newsletter on all things SaaS.

We’re starting things off with some insights into SaaS valuations from one of the leading investors in the space.

Let’s get into it 🔥

How low will SaaS Valuations Go??

Last Week, Tomasz Tunguz, MD at Redpoint, shared his insights into the question many of us are asking ourselves “how low will SaaS valuations go”. His findings included:

The Federal Reserve Bank raising rates has been a strong depressor of valuations.

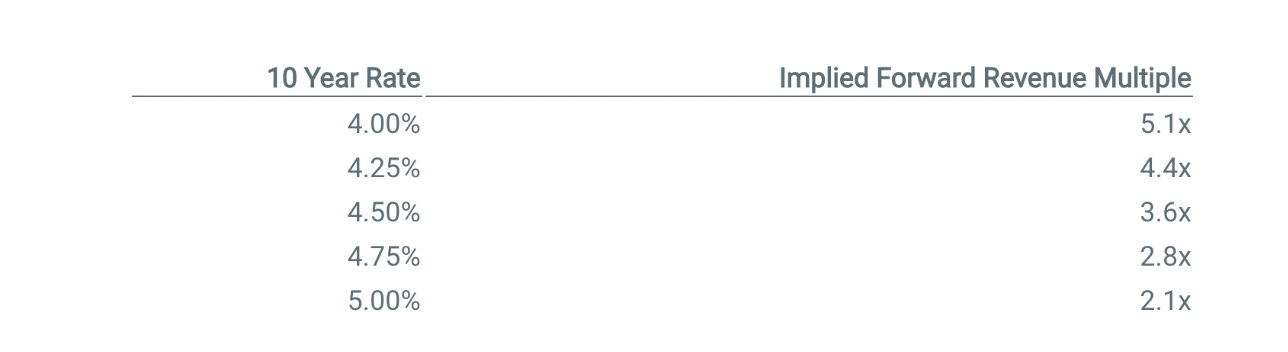

The rates on the 10-year bond correlate at -0.49 R^2, meaning yield changes explain about half of the forward multiple’s movements since 2019.

A basic linear regression using the data above with the 10-year bond’s data shows just how sensitive multiples are to these hikes:

TLDR: As interest rates continue to rise, it's becoming increasingly likely that we will see a drop in SaaS valuations. While rates have not yet reached the levels seen in early 2016, they are still climbing, and if they continue to do so, we could see SaaS valuations drop below 3x. While this is not a sure thing, it is something that investors should be aware of, and be prepared for.

Noteworthy news from the industry

📚 GrowthCap’s Top 25 Software Investors of 2022

GrowthCap released its fourth annual list of the top software growth investors for 2022 earlier this week. Each investor was rated based on breadth of deal experience, recent investments and exits, demonstrated leadership, and uniqueness of capabilities, among other attributes.

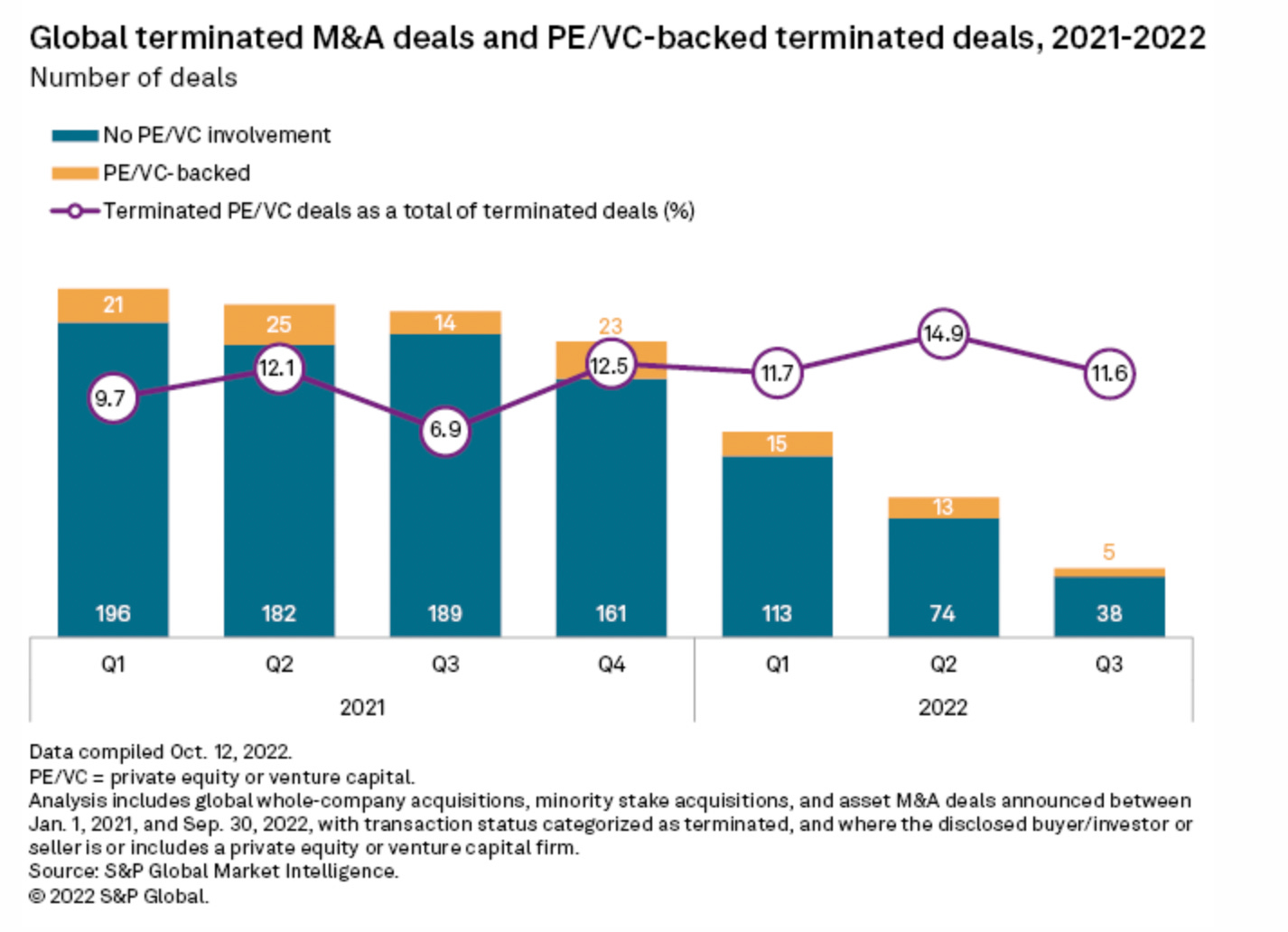

📚 PE's share of terminated M&A deals up YOY in Q3

Even though private equity's share of terminated M&A deals declined on a quarter-over-quarter basis in the third quarter, it remains elevated over the third quarter of 2021.

What We’re Reading and Listening To…

📚 How Marketing Teams Can Help B2B SaaS Businesses Thrive in a Recession

One of the biggest mistakes a SaaS business can make is putting marketing behind product and ops, particularly during a recession. Here’s the thing, when done right, marketing can actually help companies weather the storm of a recession by bringing down CAC, finding opportunities to launch low-cost, high-impact campaigns, and finding ways to mitigate losses from churned users… and this is only a few examples. Read the full article to see what else marketing can do.

📚 Mastering Founder-Sales: 10 Lessons from 150+ Early-Stage Start-Ups

Favorites from the Ecosystem

Investors👇…..

Founders👇…..

Operators👇….

News from the Industry: deals, deals, and more deals 💰

Who will become Carlyle’s next chief executive?

Cloud firm acquisition targets

End Note 🔚

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.

About Bloom Equity Partners

Bloom Equity Partners is a lower mid-market software-focused private equity firm, leveraging deep operational and commercial experience to create enduring market value for the benefit of our investors, founders, and their companies.

If you or someone you know is considering selling or taking investment, we might be able to help out. Just reply to this thread and we can get acquainted!