How Private Equity Can Foster Digital Transformation in Software Companies

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition, we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join nearly 10,000 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

How Private Equity Fosters Digital Transformation in Software Companies

Private equity firms have realized the importance of executing digital transformation strategies within their portfolio to tackle fundamental challenges associated with data management and reporting, operational efficiency and portfolio performance optimization.

A strong digital strategy will include the implementation of cloud-based applications and analytics tools to improve operational workstreams and facilitate ad hoc reporting for portfolio executives and shareholders who want deeper insights into operational risks and want to run comparative analysis and predictive modeling to understand the health of the company in real time.

Many private equity firms have established operational “value creation teams” that provide their portfolio companies with the resources and expertise to navigate widescale digitization to stay competitive during this technology revolution.

Why Digital Transformation Matters for Companies in Pursuit of Operational Excellence

For PE-backed software companies, a successful digital transformation offers a wealth of benefits, including:

Boosted Revenue and Profitability

Employing thoughtful digital systems that automate and execute revenue generating workstreams enable sales and customer success teams to measure and react in real time to customer’s needs and continually align efforts toward KPI attainment.

Sharper Competitive Edge

Staying ahead of technological advancements allows software companies to remain competitive in a rapidly changing market by developing and collaborating with customers, suppliers and partners to create innovative solutions and features to meet a specific industries evolving needs.

Smoother Exits

A digitally transformed software company is more attractive to potential acquirers, proving the ability to execute and maintain a culture of who embraces process innovation and efficiency leading to higher valuations and smoother due diligence and proceeding exits for PE firms.

Driving Digital Transformation

PE firms actively support their portfolio companies' digital transformation journeys in various ways, including:

Strategic Guidance

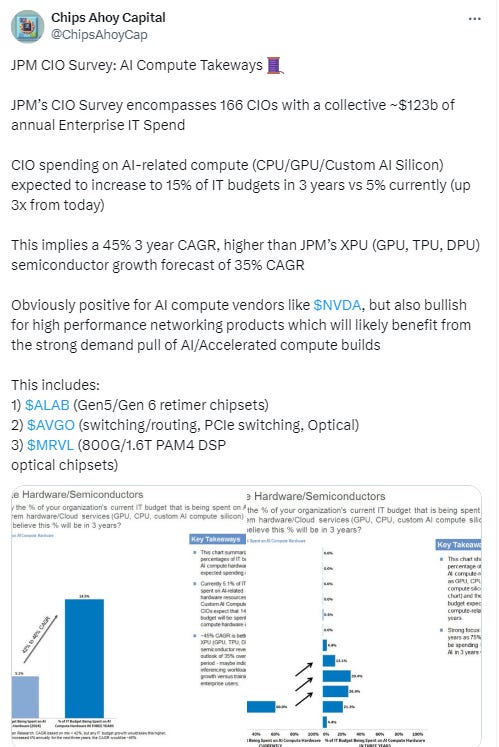

PE Firms offer expertise in identifying areas ripe for digital transformation and help companies develop a clear and comprehensive plan that aligns with their business goals. These areas include learning how to leverage AI/ML, data and analytics, high-performance computing, cloud-based solutions, cybersecurity and big data.

Financial Resources

PE firms provide the capital for crucial technology, talent and training investments to propel the digital transformation journey.

Industry Knowledge

PE firms with experience in the software sector can share best practices, provide insights into industry trends and connect portfolio companies with relevant industry experts and technology partners.

Strategies for Fostering Digital Transformation

Here are some specific ways PE firms can help software companies translate their potential into impactful action:

Conduct Digital Maturity Assessments

Evaluate the current digital state of portfolio companies to identify strengths, weaknesses and areas ripe for investment.

Establish Digital Transformation Task Forces

PE firms should assemble teams with technology, business strategy and change management expertise to guide portfolio companies.

Invest in Digital Leadership

Recruit or develop talent within portfolio companies with the vision and skills to spearhead digital transformation initiatives.

Promote a Culture of Innovation

Encourage experimentation, data-driven decision-making and embracing of new technologies.

Measure and Track Progress

Monitor key metrics to gauge the effectiveness of digital transformation efforts and make adjustments as needed.

Benefits for All Stakeholders

Digital transformation driven by PE firms creates a win-win situation for all stakeholders.

PE firms generate higher investment returns by helping portfolio companies become more efficient, competitive and future-proof.

Software companies gain a significant competitive edge while increasing market share and profitability.

Customers enjoy a better experience with innovative, user-centric products and services.

The Road Ahead

Digital transformation is an ongoing process, not a one-time event. PE firms are well-positioned to play a critical role in this journey, ensuring their portfolio companies remain agile, relevant and primed for long-term success in the ever-evolving digital landscape.

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or investing in their business, we would love to learn more! Check out our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

Bridging Private Equity’s Value Creation Gap

How SaaS Companies Can Prepare for Embedded Finance

Favorites from the Ecosystem

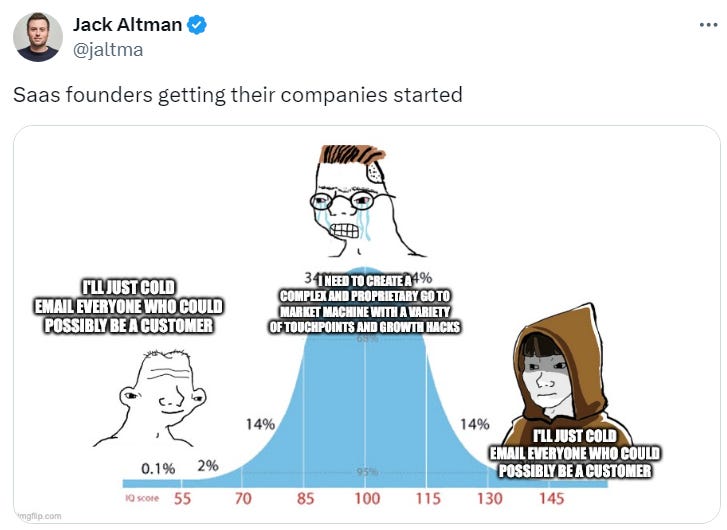

Investors…

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.