How to drive growth for your SaaS business

News, insights and updates from the team at Bloom Equity Partners

Happy Friday Founders & Friends!

Welcome back to The Weekly Bloom! We hope that you have been enjoying our insights on everything from board meeting governance to valuation misconceptions.

If you’d like for us to share insights on a particular topic, feel free to comment below.

What we’ve been reading and listening to recently..

📚 5 Interesting Learnings from Zscaler at $1B in ARR

Levers that can drive growth for your SaaS business

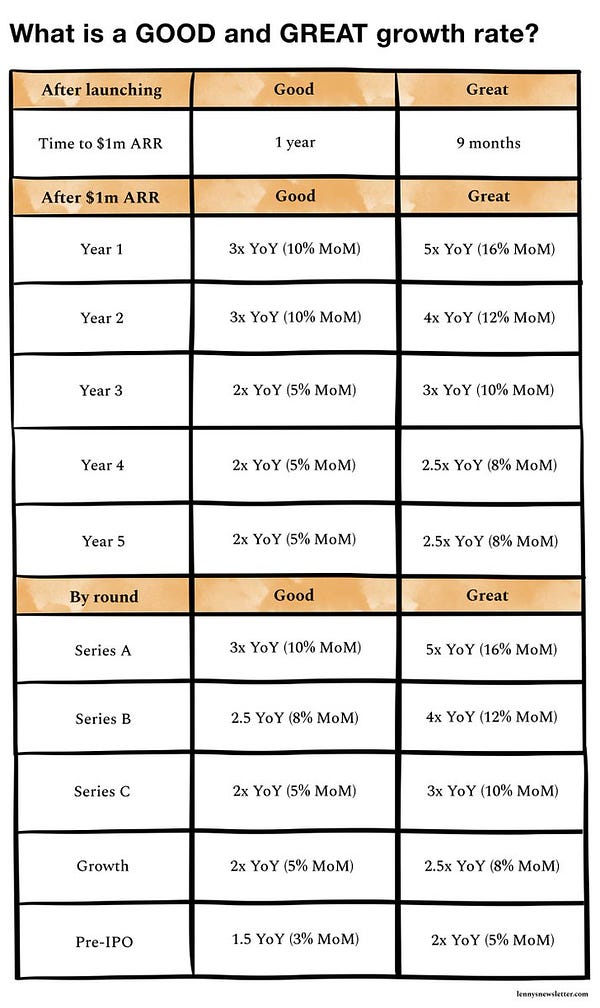

SaaS businesses are heavily metric driven and a slight tweak to a particular metric can have a big impact on the overall health and growth of your business. In this weeks newsletter we wanted to share some metrics that can act as growth levers for any SaaS business.

Funnel Metrics

Identify the most profitable lead sources and double down on them. Heavily monitor poor lead sources and only invest heavily when they can become profitable.

Focus on increasing conversion rates at the various stages of the funnel.

Focus on increasing top of funnel leads.

Segmentation Analysis

Invest heavily on the most profitable customer segments.

Look at ways to make your least profitable segments more profitable (price changes, sales and marketing tactics, product change).

Pricing

Pricing your product can have a major impact on your ARR and growth rates.

Experiment with different pricing strategies that are most effective for your businesses unit economics (tiered, usage based, multi-axis).

Product metrics

Sales conversion rates to qualified leads is an important metric to focus on.

Conversion rates for free trials should be around 15-25%.

If you enjoyed learning about SaaS metrics and want to learn more, make sure to check out the following below 👇

📚 Metrics That Matter: Sales Efficiency

📚 Metrics That Matter: Cash Burn

News from the Industry: deals, deals, and more deals 💰

Thoma Bravo Approaches Banking Software Specialist Temenos About Takeover

Accel-KKR buys majority stake in Aussie software company

KKR on taking an active approach in a maturing asset class

Favorites from the Ecosystem

Investors👇…..

Founders👇…..

Operators👇….

End Note 🔚

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.

About Bloom Equity Partners

Bloom Equity Partners is a lower mid-market software-focused private equity firm, leveraging deep operational and commercial experience to create enduring market value for the benefit of our investors, founders, and their companies.