Founders & Friends, Happy Friday!

This week, we’ll be sharing some insights from some of the best capital allocators in the space, as well as announcing our newest venture (this one’s a little different — it’s not an acquisition!).

Our goal with The Weekly Bloom is to become the #1 most informative industry digest for lower-middle market software PE professionals and investors. We try to make it one of the best emails you get each week, and we hope you're enjoying it.

Capital Provider Sentiment

Over the last few months, the team @bigfootcap interviewed over 50 early/growth stage equity and debt investors to understand their current market outlook and sentiment. Well, the results are in and you can check them out in their comprehensive report: here. Our team had a great time reading the report and wanted to share some key takeaways:

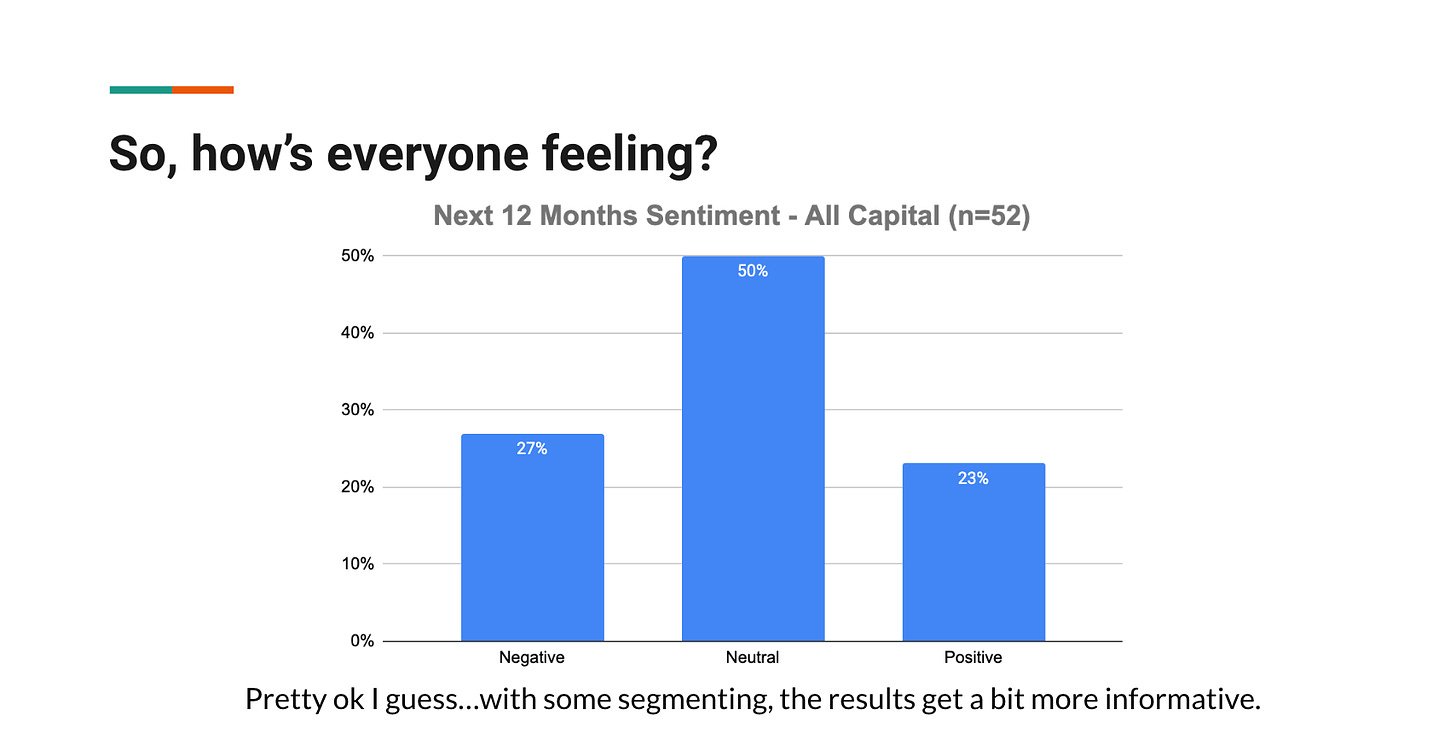

While 90% of respondents believe that there will be a recession in the next 12 months, investor sentiment varies across the board. Banks are the most negative, with seed/series A investors being the most positive across the board.

40-50% of Seed/A VC, A/B/Growth VC and PE and non-bank lenders indicated some shift in capital allocation strategy. Common themes emerged including; discipline, focus on fundamentals, reserving and raising capital.

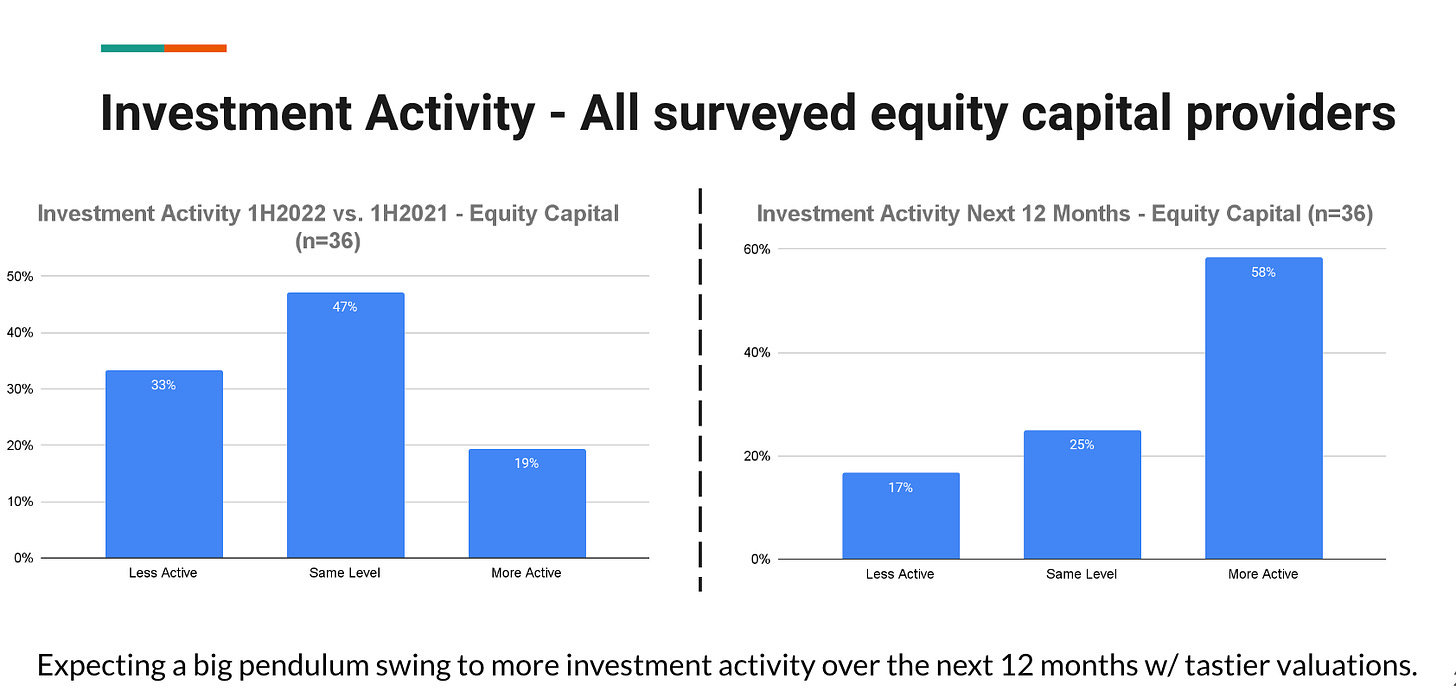

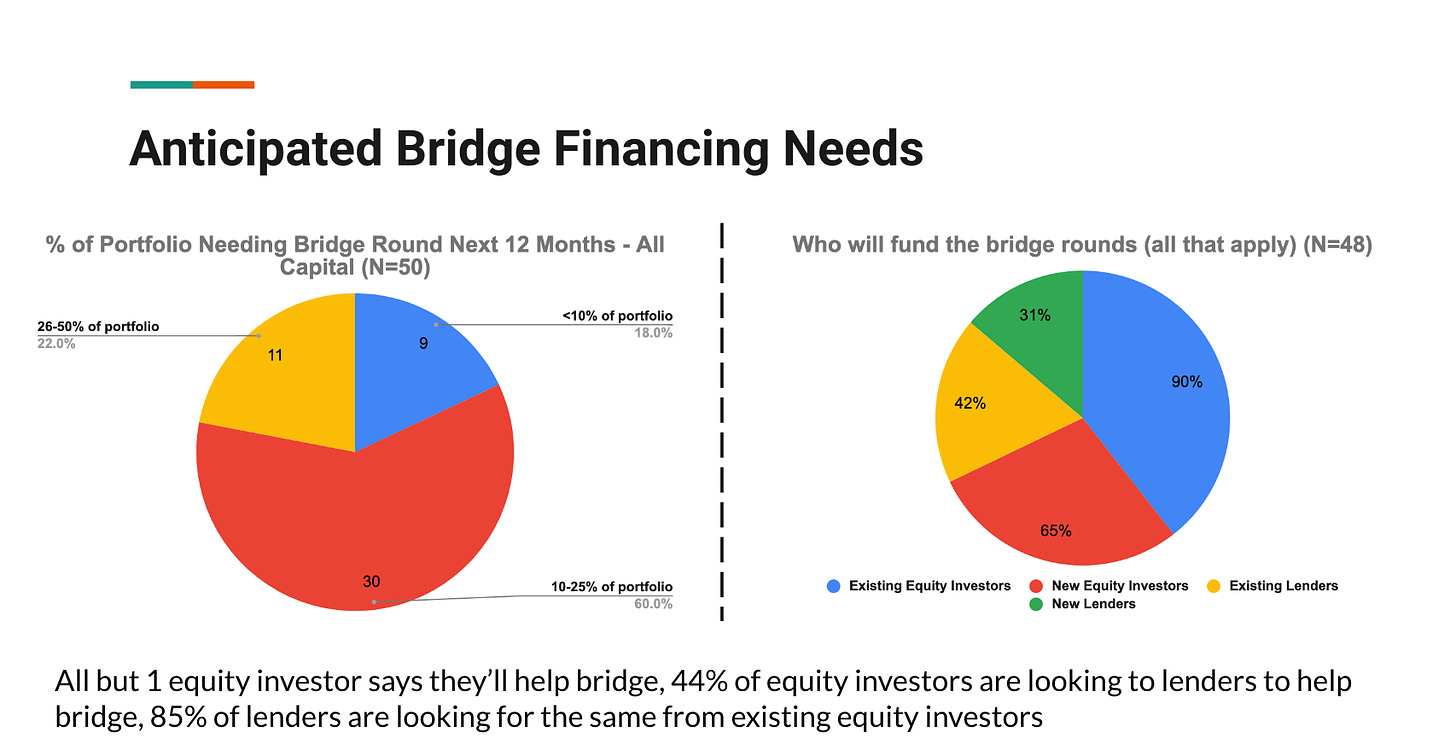

60% of the 53 respondents indicated that they will increase their investment activity over the next 12 months. 60% also indicated that they expect up to 25% their portfolio to require bridge financing over the next 12 months

Once again, high shoutout to the team @bigfootcap for putting this report together. It gives us capital allocators some great insight into how our fellow allocators are adjusting to the times ahead. You can check out the full report here

Announcing Bloom Growth Studio 🎯

What originally started as a Growth SWAT squad exclusively for Bloom Portfolio Companies, we’ve now opened publicly, sharing our growth frameworks and talent bench with friends in our network, helping B2B SaaS companies hit their MRR goals with proven playbooks in inbound marketing and outbound sales development.

Interested in reducing the time, headaches, and wasted $ in scaling your SaaSCo – Bloom Growth Studio is now accepting the next intake of clients and taking the guesswork out of SaaS growth.

Reach out to the team today, or, refer a client & earn 💰

PS – we’re hiring several roles across Marketing & Sales & CS 🚀

Bloom Equity Job Advert:

Our team is searching for a high-impact General Manager to join one of our Portfolio Companies. This is a strategic and operational role that will span analyzing market trends, managing a global workforce, creating strategic go-to-market plans and managing a P&L for mid-7 figure revenue SoftwareCo.

Interested in learning more? Check out the job description here.

What We’re Reading and Listening To…

📚 Ten lessons from a decade of vertical software investing

News from the Industry: deals, deals, and more deals 💰

ANZ in talks to buy KKR's accounting software firm in reported $3 bln deal

Permira Hits $16 Billion Milestone for Latest Flagship Fund

Carlyle to Sell Unison Software to Buyout Firm Madison Dearborn

Favorites from the Ecosystem

Investors👇…..

Founders👇…..

Operators👇….

End Note 🔚

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.

About Bloom Equity Partners

Bloom Equity Partners is a lower mid-market software-focused private equity firm, leveraging deep operational and commercial experience to create enduring market value for the benefit of our investors, founders, and their companies.