Just Launched: Bloom Equity Referral Program

News, insights and updates from the team at Bloom Equity Partners

Happy Friday folks. 2023 is off to a hot start. We just launched our referral program so before we jump into the insights, here’s a quick overview of the program:

📌 Become a Bloom Equity Referral Partner

Bloom Equity referral partners are our boots-on-the-ground referral network helping us scope out mission-critical, vertical SaaS businesses with $3M+ in revenue who are looking for their next phase of growth. Depending on the size of the transaction you can receive anywhere from $25,000 - $400,000!

If you know of or run a business that may be a good fit for us, submit your lead and we’ll get back to you shortly:

Now onto the good stuff!

2023 Private Equity Predictions

As we are almost 3 weeks into January, our team has deconstructed a variety of private market outlook reports. We jumped on Pitchbook’s US PE market outlook webinar last week and wanted to share a few key takeaways:

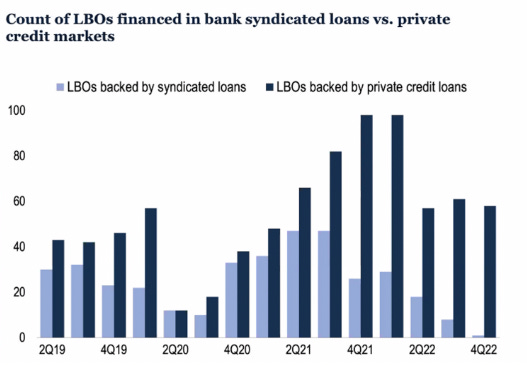

1. Direct lenders will continue to dominate the LBO debt markets

The federal reserves tightening cycle in 2022 cut off the main vehicle for financing LBOs: the bank-led leveraged loan market.

Stepping in to fill the void has been nonbank “direct lenders”. These private debt funds have become the sole debt providers to new LBOs in 2022 which should continue into early 2023.

Banks will likely gradually return to underwriting new LBO loans late in 2023 as the backlog clears and the leveraged loan market becomes more liquid

2. PE exit to investment ratio will trend lower

As of Q3 2022, the exit-to-investment ratio stood at 0.38x, the lowest figure seen since the 2008 financial crisis. The exit market has been hammered by macro headwinds yet many funds are sitting on record levels of dry powder and continue to take advantage of the softening valuations.

3. Take-privates will migrate to the middle market

The take-private strategy was a winner in 2022, as sponsors looked to scoop up public companies trading at attractive discounts.

A fair chunk of the companies that were taken public during the 2020-2022 frenzy did not start out as middle-market businesses yet have since entered that sub $1B valuation range.

644 have individual market caps below $1 billion, or $164.5 billion in aggregate, down 76.5% from the aggregate inception value of $698.7 billion

Our Investment Focus 🚀

We're big fans of mission-critical technology and software businesses with a competitive moat and a sticky and diversified customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure.

Target Company Attributes

B2B SaaS generating $3m to $20m+ in ARR

90%+ annual retention rate

A mature and proven product

Highly talented management team

Transaction Focus

Majority investments & growth-oriented buyouts

Management-led buyouts

Add-on acquisitions

Carve-outs & divestitures

If you or someone you know is considering selling or taking investment, we might be able to help out.

Just reply to this thread and we can get acquainted!

What We’re Reading and Listening To…

📚 Why Investors are Focused on Efficiency

Favorites from the Ecosystem

Investors👇…..

Why? 👇

Operators👇….

News from the Industry: deals, deals, and more deals 💰

Thoma Bravo and Sunstone Partners Complete Acquisition of UserTesting

HIG sells healthcare RCM solutions provider to Alpine

Shoreline closes second PE fund at $450m

End Note 🔚

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.