LP Allocations Remain Strong in PE

News, insights and updates from the team at Bloom Equity Partners

Happy Friday fellow technology investors and operators.

We’re back with The Weekly Bloom - a must-read for investors, operators, and founders navigating the world of software private equity. This week we’re looking at:

LPs outlook on the private markets

Chart of the week: most active PE investors

Our teams’ favorite articles and podcasts from the last week

Rule of 40 Growth Multiplier

M&A rollups breakdown

If you want to join ~4500 other readers for a weekly roundup of our favorite SaaS insights, articles, podcasts, tweets, and news headlines, subscribe below:

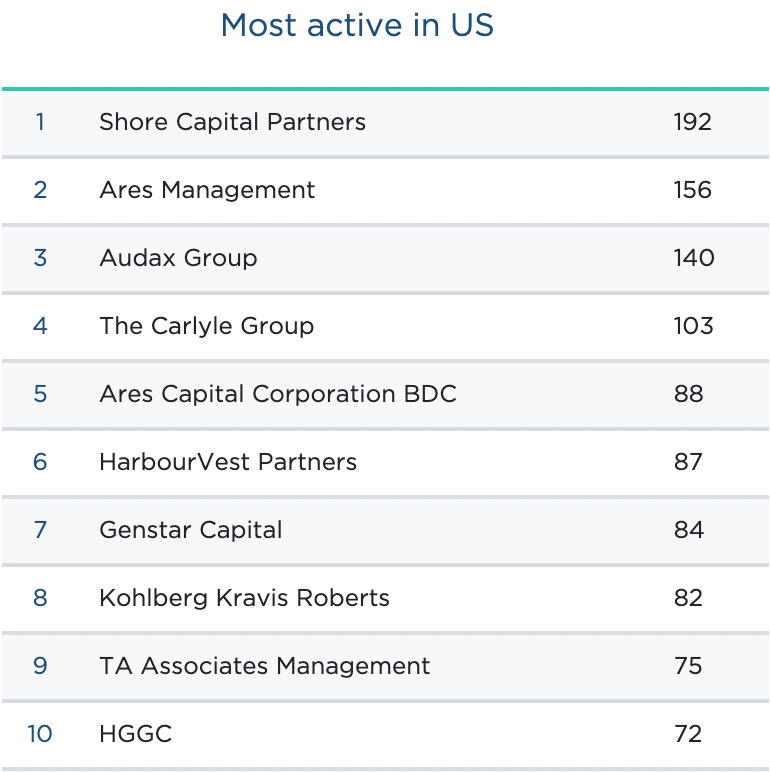

2022 Global League Tables: Most Active PE Investors

Last week Pitchbook released its, 2022 Global League Tables, ranking the most active investors across asset classes. Here’s a list of the most active PE firms in the US (all deal types):

Source: Pitchbook

LP Allocations Remain Strong In Private Markets

Institutional investors continue to hold a positive outlook on private equity, despite increasing challenges in the private market landscape. In the recent State Street Private Markets Study 2023, 63% of the 480 surveyed participants said they expect that their largest allocation will be to PE in the next couple of years.

Institutional investors have allocated enormous amounts to PE for the past three decades with their allocations ever-increasing. Despite growing headwinds, the private markets have remained profitable over the last 15 years, with many of the strongest vintages arising from recessionary periods. Institutional investors, therefore, will continue to allocate to private market asset classes to gain exposure to what are expected to be some of the best vintages to come.

-Alexis Weber

A few other interesting findings from the report:

68% of respondents said they plan to keep their allocations to the private markets in line with current targets over the next two to three years.

81% of asset owners agreed that the higher cost of borrowing is likely to negatively impact the attractiveness of private market investments that are highly leveraged.

This is an optimistic outlook for an asset class faced with a rising cost of capital, inflation concerns, and the aftermath of the denominator effect, which hit institutional portfolios hard in 2022.

If you enjoy our weekly insights, make sure to subscribe below so you can get it sent directly to your inbox every week:

Partner with Bloom Equity Partners

We're big fans of mission-critical IT services and software businesses with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure.

Investment Criteria

Industry: Enterprise Software and Tech-Enabled Services

Geography: North America, Europe, or Australasia

Revenue: $3M - $20M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% annual customer retention

Profitability: Positive EBITDA or near breakeven within 12 months

Investment Type: Operational control required

Business Characteristics

Significant recurring revenue

Sustainable competitive advantage with high switching cost

No heavy mandatory R&D spend, with a repeatable and scalable S&M process

Strong organic and inorganic growth potential

Capital efficient

Strong management team

If you or someone you know is considering selling or taking investment, we might be able to help out. We also just launched our referral partner program! If you want to be compensated for sharing business leads make sure to join.

Reply to this thread and we can get acquainted!

What We’re Reading and Listening To…

Data and Software: No Longer the Wild West

Deals From Across The Industry

KKR-backed BMC Software confidentially files for U.S. IPO

Blackstone to acquire event software firm, Cvent Holding Corp

Francisco Partners invests in payroll and accounting software specialist

Bloom Equity Partners Career Opportunity

We're looking for folks with decorated experiences as a CEO/COO/CRO/CFO, specifically with LMM B2B Technology companies ($5-50m in revenues) to join Bloom Equity Partners' internal consulting group. We are open to flexible arrangements (full-time, part-time, or contract).

This effort is to support our goal of providing stage-appropriate strategic and tactical advice to the management teams that we are fortunate to partner with, on our quest to develop already great companies into market leaders.

Please reach out if there's a fit or if you would like to learn more.

Link to job posting: Operating Partner

Favorites from the Ecosystem

Investors….

Operators….

Finders Program

Bloom Equity referral partners are our boots-on-the-ground referral network helping us scope out mission-critical, vertical SaaS businesses with $3M+ in revenue who are looking for their next phase of growth.

If you know of or run a business that may be a good fit for us, submit your lead and we’ll get back to you shortly:

End Note

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.