Navigating Global Expansion: Strategies for SaaS Success

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition, we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join nearly 10,000 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

Navigating Global Expansion: Strategies for SaaS Success

For SaaS companies that have achieved product-market fit and established stable growth in their home markets, global expansion represents both a significant opportunity and a complex challenge. Recent research from McKinsey and Capchase reveals that while expansion can accelerate growth, it requires careful planning, strategic resource allocation, and a deep understanding of market-specific dynamics.

As we've observed across our portfolio companies, the decision of when and how to expand internationally can make or break a scaling SaaS business. Let's examine the key strategies and pitfalls uncovered in recent industry research.

Understanding Expansion Readiness

McKinsey's research into B2B SaaS "centaurs" (companies exceeding $100M ARR) identified expanding to new markets as one of seven critical "Growth Boosters" that separate high-performing companies from the rest. However, the data suggests timing is everything and that you should only expand when your organization is ready.

Key considerations before global expansion:

Solid home market foundation: Companies should have a demonstrable and repeatable sales process and strong unit economics in their primary market before diverting resources to new geographies.

Financial runway: Capchase's analysis reveals that successful global expansion requires significant upfront investment, with payback periods often exceeding 12 months. Companies need sufficient capital reserves to weather this period.

Market fit assessment: Different SaaS sectors demonstrate varying degrees of transferability across markets. According to Capchase's sector analysis, data solutions and corporate services SaaS typically require less localization than real estate or healthcare solutions because they tend to offer more standardized, back-end products that aren't heavily dependent on regional regulations, cultural norms, or customer workflows—unlike real estate or healthcare software, which must adapt to complex, location-specific compliance standards and user expectations.

The Execution Playbook: Lessons from Fast-Growing SaaS Companies

McKinsey's interviews with CEOs of centaur companies revealed several consistent execution patterns for successful global expansion:

1. Build Local Leadership Early

Key finding: Companies that doubled their leadership and support teams before entering new markets scaled more successfully.

Case example: Trax, a retail SaaS company, established strong local leadership in each new market rather than attempting to manage remotely. This approach enabled them to navigate cultural nuances and develop region-specific strategies that accelerated adoption.

2. Create Scalable Operational Infrastructure

Before expanding, successful companies established:

Standardized but adaptable onboarding processes

Localized customer success functions

Centralized knowledge management systems

24/7 support capabilities spanning multiple time zones

3. Leverage Strategic Partnerships

The McKinsey report emphasizes that late-stage SaaS companies significantly accelerate expansion through channel partners:

System integrators who can provide implementation resources

Platform partnerships that open access to established customer bases

Reseller networks that bring local market knowledge and existing relationships

These partnerships created what McKinsey terms a "flywheel effect" that enhances long-term growth while reducing direct investment requirements.

Common Pitfalls to Avoid

The research highlights several recurring expansion mistakes:

Premature scaling: Many companies expand before establishing a truly repeatable sales model, leading to inefficient resource allocation.

Underestimating localization needs: From regulatory compliance to cultural preferences, the degree of required adaptation is often underestimated.

Insufficient executive attention: Successful expansion requires significant leadership bandwidth—companies that treated new markets as "side projects" consistently underperformed.

Over-reliance on remote management: Virtual management works for some functions, but Capchase's findings suggest that in-market presence dramatically increases success rates.

Essential Metrics to Track During Global Expansion

These key metrics help companies gauge expansion success:

CAC payback period by market: Understand how acquisition costs and timelines vary by region

Market-specific retention rates: Monitor whether your value proposition translates across cultures

Regional pricing efficiency: Track whether pricing models require adjustment for market conditions

Speed to market maturity: Measure how quickly new markets reach performance comparable to established regions

Conclusion: A Strategic Roadmap for Your Expansion Journey

Global expansion represents a significant growth lever for SaaS companies, but success depends on methodical execution and strategic patience. Both the McKinsey and Capchase research highlights that companies who invest in thorough preparation, local leadership, and adaptable systems are best positioned to capture international opportunities.

Before embarking on your expansion journey, ensure you've built a strong foundation in your home market, developed a deep understanding of your target regions, and established the operational infrastructure needed to support distributed teams and customers.

As one CEO interviewed in the McKinsey report advised: "Expand when ready, not when convenient." Those companies that strike the right balance between ambition and preparation will find themselves well-positioned to join the elite ranks of global SaaS leaders.

Sources:

McKinsey & Company: From start-up to centaur: Leadership lessons on scaling

Capchase: The Pulse of SaaS IV: Navigating the New Normal

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: B2B Software and Technology-Enabled Companies

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M

Growth: No requirement

Profitability: Negative - $10M EBITDA

Investment Type: Operational control required

Business Development Team:

Abe Borden – Principal – abe@bloomequitypartners.com

Adam Kaseff – Senior Associate – adam.kaseff@bloomequitypartners.com

If you or someone you know is considering selling or investing in their business, we would love to learn more! Check out our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

PE Weekly: Software Takes the M&A Spotlight

Favorites from the Ecosystem

Investors…

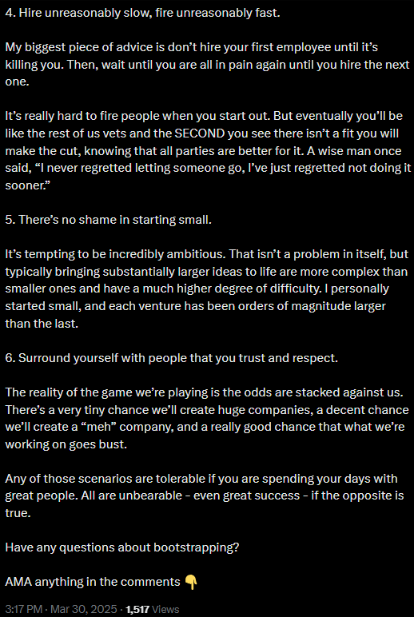

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.