Navigating the High Cost of Capital in Private Equity

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition, we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join nearly 10,000 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

Navigating the High Cost of Capital in Private Equity

In an economic landscape marked by high interest rates and heightened volatility, the high cost of capital is reshaping the private equity sector, challenging investors and portfolio companies to adapt to a new reality in which borrowing is more expensive and returns generated through the use of debt financing are more elusive.

Current Economic Conditions and the High Cost of Capital

A high cost of capital refers to the increased expense associated with borrowing money. This can be attributed to several factors, including:

Interest rate hikes: Central banks, particularly the U.S. Federal Reserve, raised interest rates to curb inflation. Higher rates lead to expensive debt, increasing borrowing costs.

Economic uncertainty: Geopolitical tensions and recessionary fears increase risk premiums, increasing interest rates.

Inflation: Rising inflation erodes the purchasing power of a country’s federal currency, prompting lenders to demand higher interest rates to compensate for the diminished value of their funds.

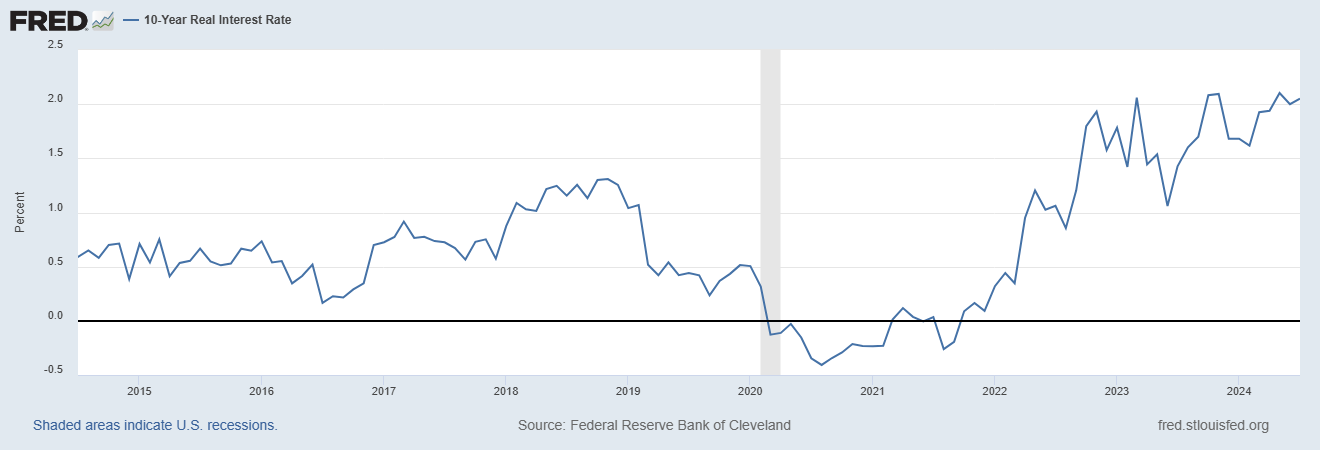

As illustrated in the chart, interest rates have climbed steadily since 2021, leading to a marked increase in borrowing costs for private equity firms. This has resulted in a noticeable slowdown in deal-making activities and circumstances in which it is more difficult to generate financially-engineered returns through the use of leverage.

These factors have combined over the past several years to create a less hospitable environment for deal-making. Firms that were once able to secure cheap debt to fund acquisitions or growth are now facing a starkly different reality. Leverage, the cornerstone of many private equity buyout strategies, innately becomes less attractive when borrowing costs are elevated. This forces firms to rely more heavily on equity when completing new deals.

Impact on Private Equity Investors

The high cost of capital has had a direct impact on deal flow, which has profound implications for private equity firms.

Delayed Exits

The goal for private equity firms is to exit investments realizing a maximum profit for their investors. Still, as the chart below indicates, the high cost of capital is leading some firms to delay exits as unfavorable market conditions threaten to erode potential returns. Private equity firms have been extending their holding periods for longer periods to improve a company’s performance and generate returns, justifying higher debt costs. In 2023, the PE environment saw a record 7.1 years holding a portfolio company, versus the previous median of closer to five years.

Higher Return Rate & Valuation Adjustments

Due to the increased cost of capital, private equity firms require higher returns to justify investments, making it challenging to find attractive deals that meet their return expectations. As the cost of capital rises, the present value of future cash flows decreases, impacting valuations and leading to lower offer prices and fewer deals being completed.

Effect on Portfolio Companies

The ripple effects of high borrowing costs are not confined to the firms themselves; they extend to the portfolio companies under their management. These companies, often saddled with significant debt loads due to leveraged buyouts, now face higher interest payments or have higher borrowing costs resulting in limited opportunities to make large investments in their organizations to maintain competitiveness including M&A.

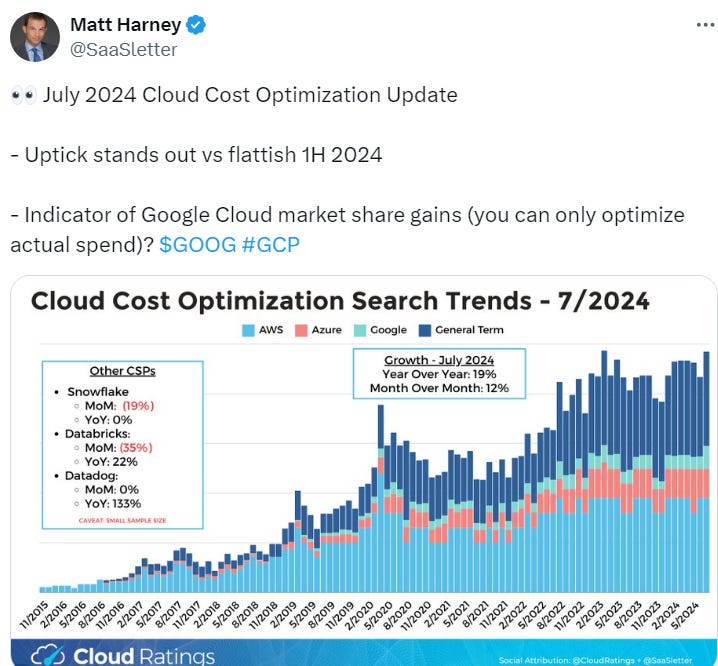

Cost-cutting measures become standard as portfolio companies look to preserve cash flow and maintain profitability in a more challenging economic environment. This increased focus on efficiency may involve reducing headcount, streamlining operations or renegotiating supplier contracts. In some cases, growth initiatives may be put on hold.

Strategies for Mitigating High Capital Costs

In this challenging environment, private equity firms are adopting several strategies to mitigate the impact of higher capital costs.

Optimism that PE firms' strategies appear to work abounds, as E&Y reported an increase in private equity deal value in Q2 2024 for the first time since 2022. Private equity (PE) activity saw its strongest quarter in two years in Q2 2024. Firms announced 122 deals valued at $196b, nearly double the $100b announced in Q1, making it the most substantial period for capital deployment since the downturn began in the third quarter of 2022.

Targeting Lower-Leverage and Smaller Deals

Private equity firms are moving away from highly leveraged buyouts, opting for deals with lower debt levels. By doing so, firms can decrease their exposure to rising interest rates and avoid the burden of servicing expensive debt. Additionally, they are shifting their focus to smaller, less capital-intensive deals or those with shorter holding periods to further mitigate the impact of higher borrowing costs.

Focus on Operational Improvements

With less emphasis on financial engineering, private equity investors concentrate on creating value through operational improvements, including streamlining operations, enhancing efficiencies, and driving revenue growth within portfolio companies to boost returns.

Exploring Alternative Financing Sources

Some private equity firms are exploring alternative financing sources such as private debt funds, mezzanine financing and public markets to navigate tighter credit markets. These alternatives offer more flexible terms and lower costs than traditional bank loans.

Increasing Focus on Add-On Acquisitions

Rather than pursuing significant, transformative acquisitions, private equity firms focus on smaller add-on acquisitions that complement existing portfolio companies. These smaller deals often require less capital and can be financed more quickly in the current environment.

According to Pitchbook, add-on transactions in the second quarter of 2024 accounted for 77.4% of all PE buyouts, an increase of 226 basis points over the 2023 average.

Active Portfolio Management

Private equity firms are more hands-on in managing their portfolio companies. By actively monitoring performance, adjusting strategies, and providing operational support, firms aim to maximize value even in a high-cost environment.

Hedging Interest Rate Exposure

Some firms use financial instruments such as interest rate swaps or caps to hedge against rising interest rates. These tools protect by locking in lower rates or limiting the impact of rate increases on existing debt.

Investor Relations

As limited partners (LPs) adjust their expectations in light of changing market conditions, private equity firms are working to maintain transparency and manage expectations, communicating the challenges posed by the high cost of capital and the steps they are taking to navigate them.

The Private Equity New Landscape

As the economic landscape continues to evolve, private equity firms must remain agile, balancing the demands of higher capital costs with the pursuit of value creation. Those who can adapt to a high-interest rate environment will be well-positioned to thrive and provide consistent returns to their investors regardless of the economic cycle and the availability of low-cost debt.

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or investing in their business, we would love to learn more! Check out our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

SaaS Buyout Deal Volume Nears 5-Year High

The SaaS Trends Report Q2 2024

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.

Great edition + thanks for including our research