Net Working Capital in M&A

breaking down the nitty-gritty of NWC negotiations

Happy Friday Founders and Friends,

In this weeks newsletter, we wanted to share some further insights on NWC and its impact on SaaS M&A as this is especially relevant to all our PE readers :)

We have previously written about networking capital, make sure to check it out below:

Refresher; What is Net Working capital?

NWC is calculated as current assets minus current liabilities.

For the purpose of SaaS M&A- NWC is often calculated as current assets (less cash), minus current liabilities (less debt). This is the case as it is very common for acquisitions to be completed on a cash and debt-free basis.

Why is NWC so critical in M&A?

M&A transactions are done assuming a “normalized level” of working capital is left in the business.

Normalized Level: Enough working capital is available post-close to fund normal operations of the business.

The implications of this are that both the buyers and sellers must negotiate on a normalized level- which is quite a time-consuming and nuanced process.

How do you calculate a normalized NWC figure?

The first step in calculating a normalized NWC figure is agreeing upon the “cash” and “debt” figures as they both have a dollar-per-dollar impact on the purchase price.

The buyer and seller must then agree upon the balance sheet items. Depending on the accounting practices of the seller, adjustments may need to be made to normalize asset and liability figures.

The buyer and seller will then analyze historical financials to determine a target NWC figure. The target figure is the amount of NWC that the seller expects to have at close.

A forecasted balance sheet as of the close date will be used to compare the estimated NWC with the forecasted figure. Any discrepancies will have a direct dollar impact on the purchase price.

Post close there is a 30-90 day “true-up” period in which actual NWC will be finalized. Any difference is transferred to either the buyer or seller.

if the actual NWC is lower than the estimated, the buyer is paid out. Vice versa.

If you enjoyed learning about NWC in M&A and want to learn more, make sure to check out the following below 👇

📚 The Economic Implications of Net Working Capital for Founders

What We’re Reading and Listening To…

📚 A Brief History of Private Equity Through Five Deals

P.S. If you are enjoying our bit-sized insights make sure to subscribe 👇👇

News from the Industry: deals, deals, and more deals 💰

Software AG can log onto buyout boom

Private Equity Now Accounts for 30% of M&A Activity

Carlyle to Buy Switzerland’s AutoForm Engineering in $2 Billion Deal

Hellman & Friedman, Bain Capital to buy Athenahealth in $17B deal

Favorites from the Ecosystem

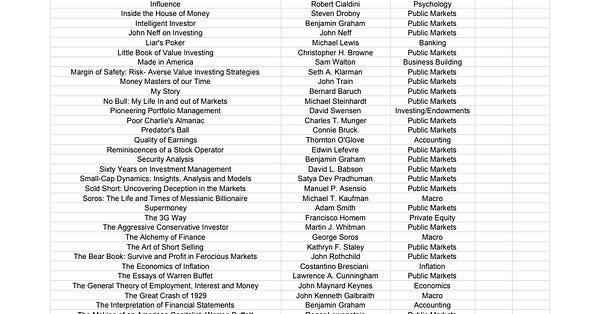

Investors👇…..

Founders👇…..

Operators👇….

About Bloom Equity Partners

Bloom Equity Partners is a lower mid-market software-focused private equity firm, leveraging deep operational and commercial experience to create enduring market value for the benefit of our investors, founders, and their companies.

End Note

Thanks for joining us for another edition of the weekly bloom.

We’re excited to continue backing remarkable teams on their quest of changing the way we work, live + create.

As always, if you enjoyed this week’s newsletter we'd love it if you shared it with a friend, co-founder, or anyone that would find value.