PE Consolidations Expected to Continue in Tech

News, insights and updates from the team at Bloom Equity Partners

Happy Friday Folks!

Thank you for stopping by for another edition of The Weekly Bloom.

If you want to join ~4500 other readers, tune in for a weekly roundup of our team’s favorite SaaS insights, articles, podcasts, tweets, and news headlines, subscribe below:

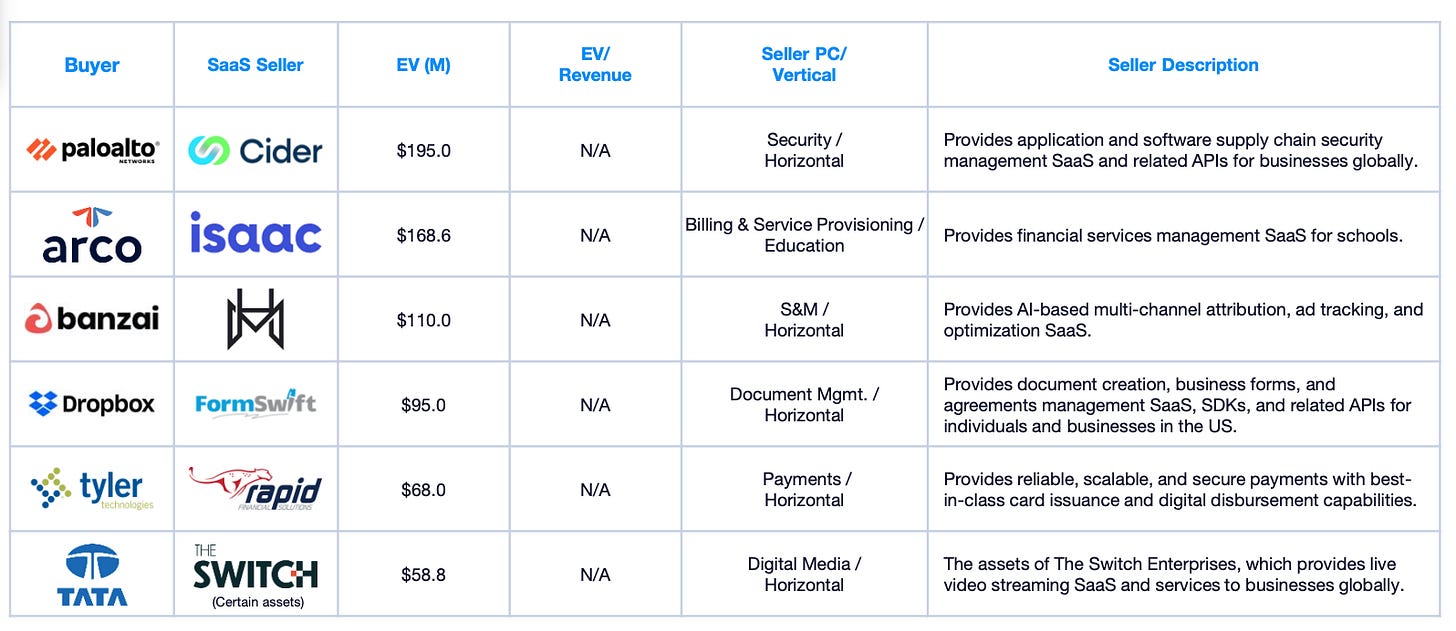

2022 Notable SaaS Deals, Lower-Mid Market

SaaS 2022 M&A summary:

Private equity capital overhang and fierce strategic competition catalyzed SaaS M&A activity and buoyed EV/Revenue multiples in 2022, despite broader macroeconomic turbulence.

Tech PE Firms are leveraging strategic consolidations

The “Buy to build” sector consolidation playbook, seems to be a growing trend amongst tech’s biggest financial acquirers. Record levels of dry powder paired with weak public valuations and antitrust efforts limiting strategic acquisitions, PE-backed consolidations should continue in 2023.

A recent S&P report highlighted a few notable consolidation strategies:

Vista Equity Partners <> ERP SaaS

Vista has made more than 40 acquisitions in the enterprise resource management space over the past five years.

Thoma Bravo <> Cybersecurity

Thoma Bravo has spent an estimated ~$37B on cybersecurity companies since 2017.

This is more than 10 times the amount invested by the largest industry buyer.

Industrywide, PE firms completed $23.08 billion of cybersecurity deals last year, almost three times the total for strategic buyers

The challenge for these platform plays is that these larger companies are harder to exit and the IPO market may take some time to stabilize. Aggressive antitrust policies may also play a challenge.

Quote of the Week: M&A Trends

Investors, both corporates and private equity, have sizable investment capital at the ready to take advantage of current valuations with many companies in need of liquidity while financing costs remain high

- Spencer Klein, M&A Partner @ Morrison Foerster

Deals From Across the Industry

What We Look For: Our Investment Criteria

We're big fans of mission-critical technology and software businesses with a competitive moat and a sticky and diversified customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure.

Investment Criteria

Industry: Enterprise Software and Tech-Enabled Services

Geography: North America, Europe, or Australasia

Revenue: $3M - $20M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% annual customer retention

Profitability: Positive EBITDA or near breakeven within 12 months

Investment Type: Operational control required

Business Characteristics

Significant recurring revenue

Sustainable competitive advantage with high switching cost

No heavy mandatory R&D spend, with a repeatable and scalable S&M process

Strong organic and inorganic growth potential

Capital efficient

Strong management team

If you or someone you know is considering selling or taking investment, we might be able to help out. We also just launched our referral partner program! If you want to be compensated for sharing business leads make sure to join.

Reply to this thread and we can get acquainted!

What We’re Reading and Listening To…

📚 Exceptions to the Rule of 40: Why Good SaaS Companies Sometimes Fall Below the Threshold

📚 Private equity deals and few IPOs: how 2023 looks for tech

Favorites from the Ecosystem

Investors👇…..

Operators👇….

End Note 🔚

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.