Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition, we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join nearly 10,000 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

Q1 2024 Private Equity Breakdown

Keeping up with the latest trends is essential as the private equity landscape evolves. To that end, Pitchbook recently released its 2024 Q1 US PE Breakdown, sharing some notable trends across the overall US PE market as well as the tech space. We took a deep dive into the report and wanted to share some key data points and findings for the overall PE market as well as Technology to help you make informed decisions:

Here are some key takeaways from our latest report:

Private Equity Deals

Overall

In 2023, US PE dealmaking was down 41.2% from 2021’s all-time peak of $1.2 trillion.

Over the past few quarters, PE deal flow appears to have stabilized. In Q1 2024, the estimated deal count was slightly higher than the past four quarters, but the deal value is lower.

Platform LBO deals continue to be scarce due to their greater dependency on leverage, and their share of all PE deals declined to 19.0% in Q1 2024 from 19.6% for all of 2023.

Technology Deals

Q1 deal value totaled $28.8 billion, a decline of 8.0% QoQ and a sharper decline of 34.9% from Q1 of the previous year.

With 361 deals in Q1, the deal volume increased 5.2% from Q4 2023 and 18.3% from last year.

Software PE deal value totaled $17.6 billion, a 6.4% decline QoQ and a significant 46.5% drop YoY.

The volume of software deals increased, with 247 deals announced or completed, although there was a shift towards smaller deals.

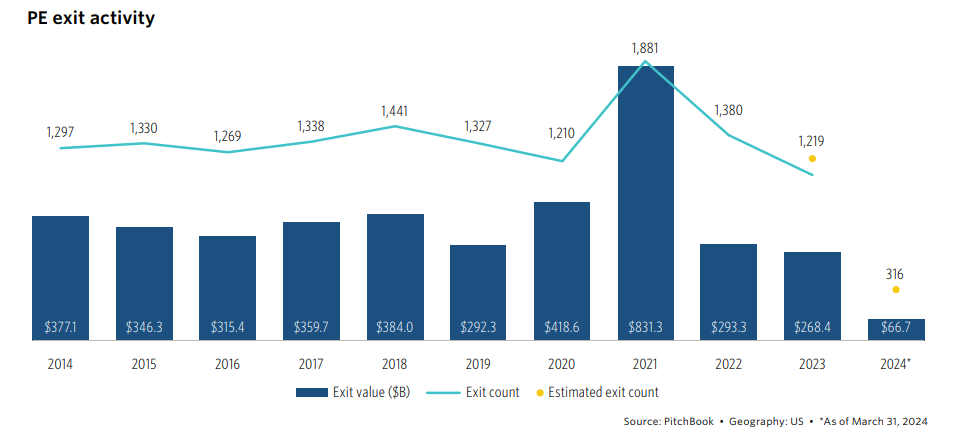

Exits

Overall

US PE exit activity started 2024 slowly, with an estimated 316 exits for an aggregate of $66.7 billion in Q1 2024. This was a 19% decrease in exit value QoQ, reversing the upward trajectory in Q3 2023.

The quarterly exit value was 22.7% lower than the 75% pre-pandemic average.

Exit count is up slightly, +0.9%, from Q4 2023.

Technology

PE exits for tech companies climbed to $7.9 billion from $5.7 billion in Q4 2023. Only 37 exits were recorded, the lowest since Q2 2020, indicating high-quality assets receive high valuations.

The tech sector received the highest valuations in 2023 — at 3.9x revenue — and the improved exit value in Q1 suggests that the winning assets in tech continue garnering interest and are finding increasingly more success in securing attractive exits.

Tech exits accounted for 11.9% of total PE exit value and 18.4% of exit count in Q1, demonstrating the sector’s relative resilience in an otherwise down market.

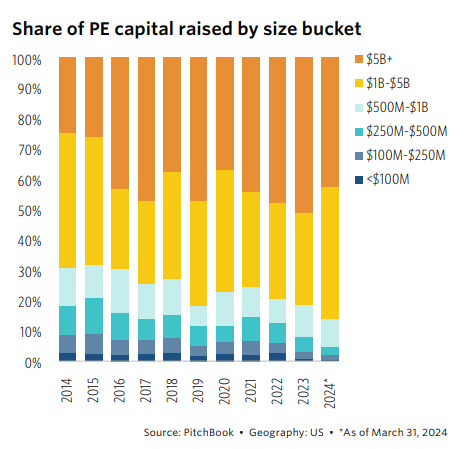

Fundraising

PE

US PE closed 63 funds on $76.8 billion in Q1 2024, compared to $80.2 billion in the first quarter of last year.

Fund closing time increased from 2.7 years in 2022 to 2.9 years in Q1 2024.

Middle Market

Middle-market funds raised a collective $177.3 billion, falling just shy of the record $194.3 billion raised in 2021 and $189.9 billion raised in 2022.

Through the first quarter of 2024, middle-market managers closed on funds worth $43.5 billion.

In Q1, middle-market funds accounted for 56.7% of the total PE capital raised, below the five-year average of 62.9%.

Over the past year, middle-market fundraising has benefited from the more challenging macroeconomic landscape as investors have gravitated toward smaller funds that focus on smaller deals.

You can view the full report here.

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or investing in their business, we would love to learn more! Check out our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

Bloom Equity Open Roles:

Business Development Associate

Bloom Equity is looking for Business Development Associate, who will help with new deal origination through identifying, cultivating, and collaborating with target company executives, investment advisors, corporate finance teams and financial sponsors. To learn more, please visit the LinkedIn posting to learn more and follow directions to apply.

What We’re Reading and Listening To…

What AI means for the future of SaaS: Reality vs. hype

The Rise Of Data-Blind SaaS: Moving Toward Built-In Proactive Data Protection

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.

Thanks for including our podcast with SEG