PE Dry Powder Nears Record High

News, insights and updates from the team at Bloom Equity Partners

Happy Friday folks.

We're back with the first Weekly Bloom of 2023.

If you are a new reader, welcome 👋 to The Weekly Bloom. Every Friday, we share our favorite SaaS articles, podcasts, tweets, and news headlines from across the industry to now ~4,500 readers. We also share some insights from our team and other successful professionals in the industry.

This week, we’re covering:

Insights from our team: 2022 SaaS market review

A few of our favorite reads and listens from the past few weeks

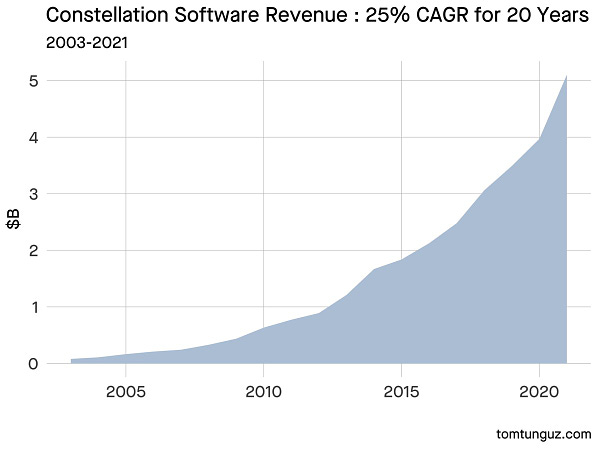

Tweets from around the industry (insights from Thomas Ince, Tomasz Tunguz, and many more)

Chart of the week: PE dry powder nears record high

There is a widespread belief that times of economic turmoil also produce some of private equity's best vintages

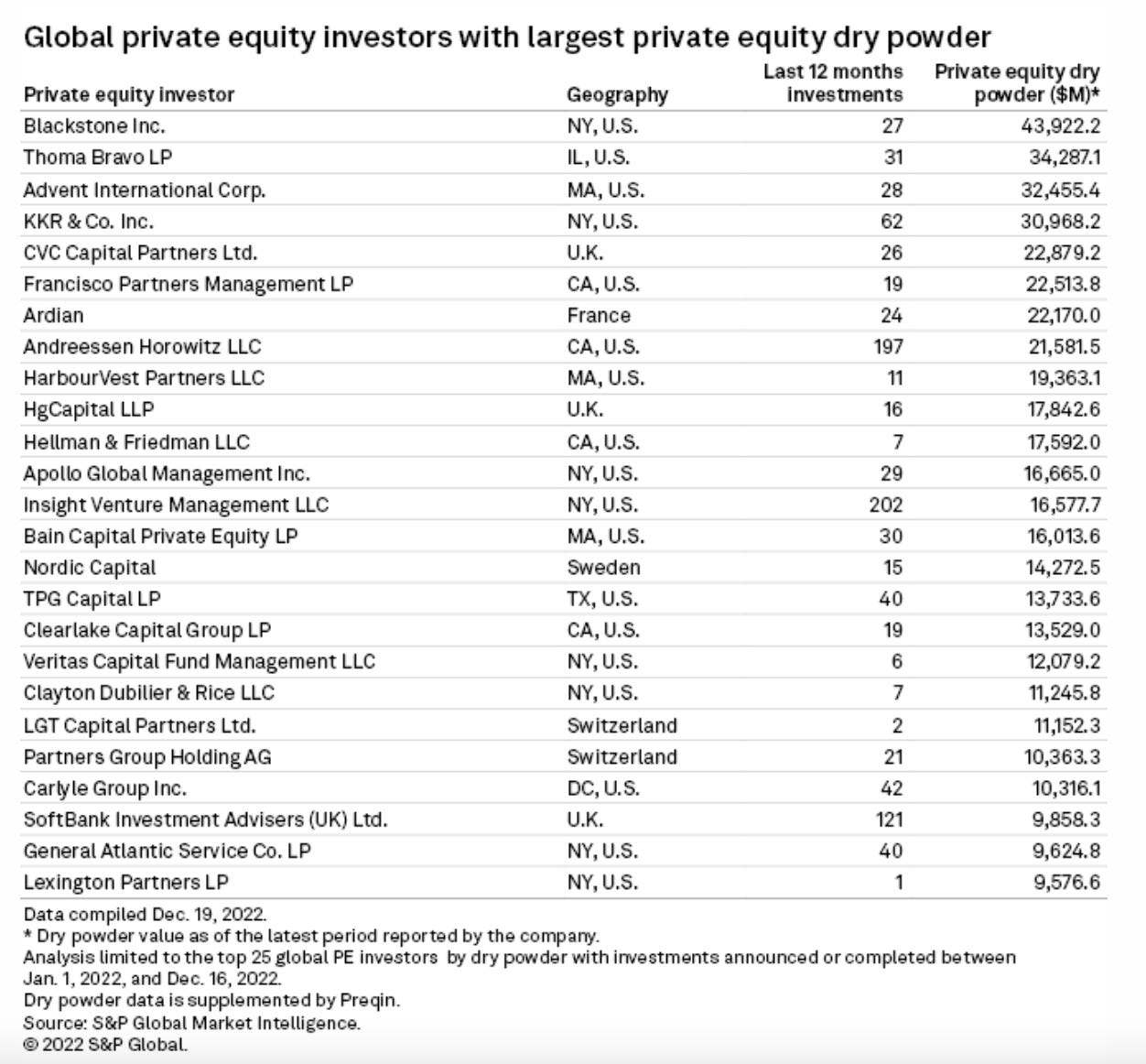

According to Preqin, Global private equity and venture capital dry powder stood at a record $1.96 trillion as of Dec. 15.

📌 Become a Bloom Equity Referral Partner 📌

Bloom Equity referral partners are our boots-on-the-ground referral network helping us scope out mission-critical, vertical SaaS businesses with $3M+ in revenue who are looking for their next phase of growth. Depending on the size of the transaction you can receive anywhere from $25,000 - $400,000!

If you know of or run a business that may be a good fit for us, submit your lead and we’ll get back to you shortly:

Insights: 2022 SaaS Review

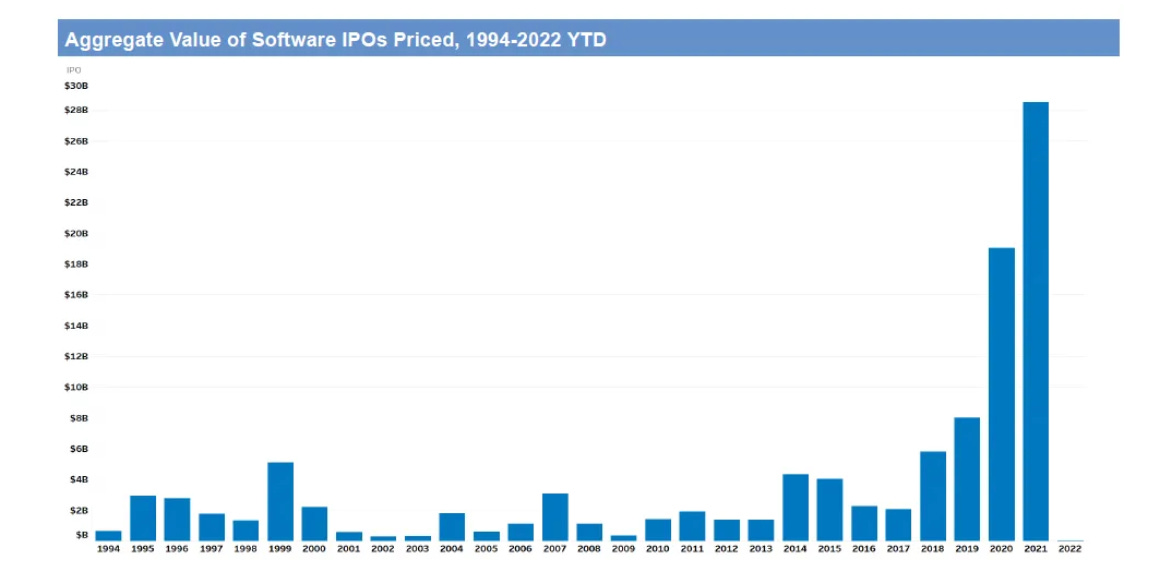

2022 was a note-worthy year on many levels in both the public and private software market. It certainly was not the year many of us expected coming off 2021 with a record IPO volume and the total public cloud market cap reaching a peak of $2.7T.

The tide turned quickly in 2022 with the fed pivot which had a big impact on public SaaS valuations. According to a recent report from Morgan Stanley, average EV/sales multiples for public SaaS companies were down over 50% from the peak.

A few other related metrics from the past year in software:

SaaS IPO activity dropped off significantly in 2022 with an aggregate value of less than $1B. The aggregate value of software IPOs in 2021 was ~$28B.

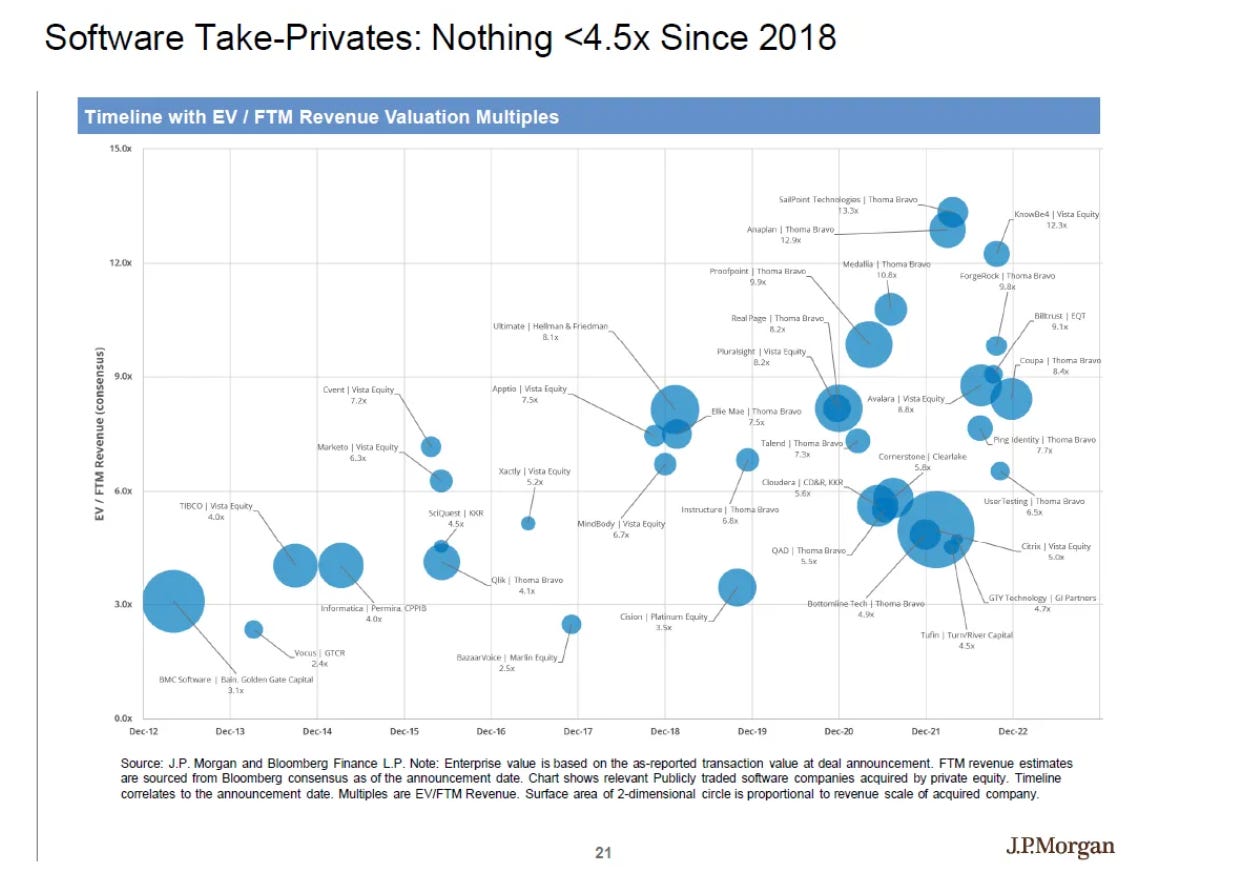

2022 was a record year for software take-privates. This trend can be expected to continue in 2023 as financial buyers are looking to take advantage of the softening public valuations. Not to forget the record amounts of dry powder looking to be deployed in the upcoming year.

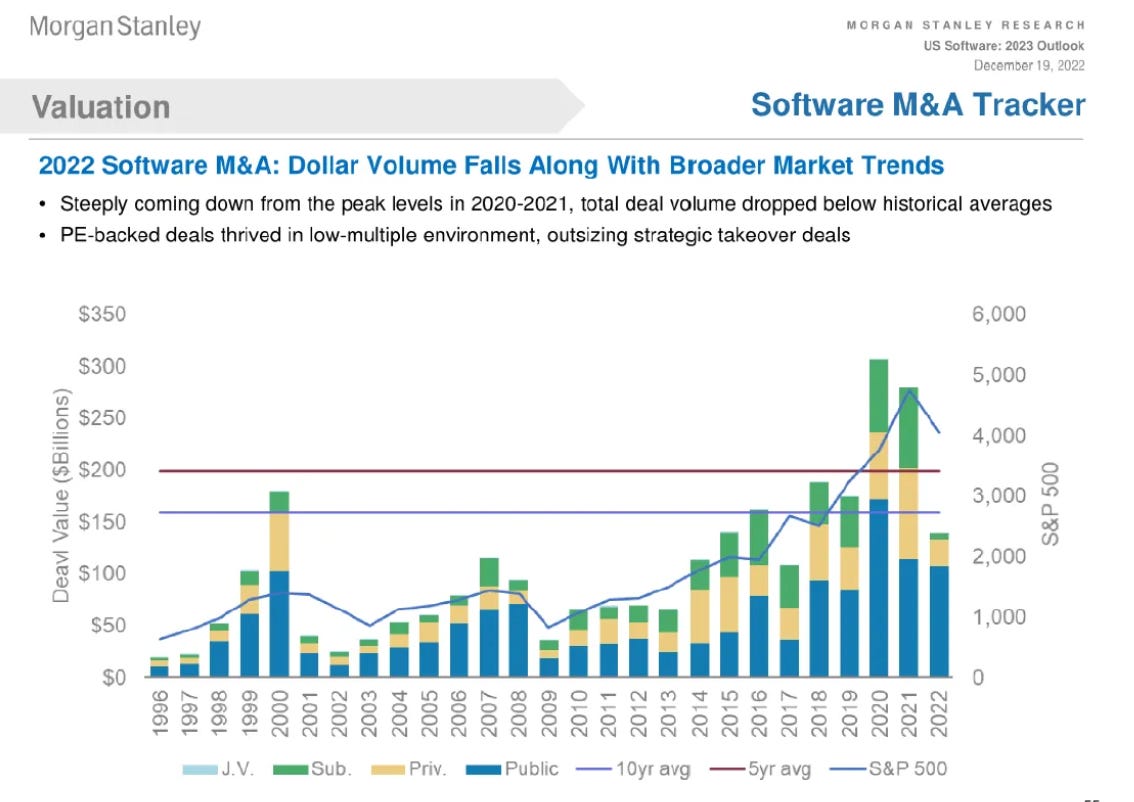

Software M&A activity (in terms of deal value) fell below the 10-year averages. PE-backed deals thrive in a low-multiple environment, and we can expect to see a rise in sponsor-to-sponsor M&A activity in 2023.

About Bloom Equity Partners 🚀

Bloom Equity Partners unlocks growth in lower-middle market enterprise software & tech-enabled services companies through control investments and further developing already-great businesses into market leaders.

Led by a team of tech-focused investors and industry operators, Bloom injects the capital, operational resources, and playbooks in recession-resistant businesses to rapidly unlock transformational growth and deliver superior risk-adjusted returns to our investment partners and management teams.

If you or someone you know is considering selling or taking investment, we might be able to help out. Just reply to this thread and we can get acquainted!

What We’re Reading and Listening To…

📚 How to Read Balance Sheets - Software Edition

📚 Mostly Experts: Mistakes you're making with financial metrics

Favorites from the Ecosystem

Investors👇…..

Founders👇….

Operators👇….

Are you a software founder or operator looking for a marketing partner?

Bloom Growth Studio, founded by Bart and a talented team of growth specialists last year, is taking on new clients for their Q1 Cohort to support companies looking to scale up growth via Inbound Marketing + Outbound BD. BGS is growing rapidly and adding more clients each week. If you’re interested in this service, send an email to grant@bloomgrowth.studio or click here for an introduction into the Bloom Growth team.

News from the Industry: deals, deals, and more deals 💰

Vista Equity Partners to acquire insurance software company Duck Creek for $2.6B

Private equity dominated the top 10 enterprise M&A deals in 2022

Vector Capital agreed to sell its portfolio company, MarkLogic, to Progress Software Corp

End Note 🔚

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.