PE Fundraising Holds Strong in Q1

News, insights and updates from the team at Bloom Equity Partners

Welcome back to another edition of The Weekly Bloom - one of the best weekly resources for Private Equity, Enterprise Software, and Technology news.

We hope that you enjoyed last week’s Software M&A Outlook in 2 Charts.

This week’s edition features:

Q1 US PE Breakdown

What We’re Reading and Listening To…

Bloom Equity Partners Career Opportunity

Portfolio Spotlight: Viostream

Favorites from the Ecosystem

Q1 US PE Breakdown

Earlier this month Pitchbook released its 2023 Q1 US PE Breakdown, breaking down some notable trends happening across the US PE space. As middle-market software investors, our team took a deep dive into the report and wanted to share some key data points and findings:

Tech take-private deals have less leverage

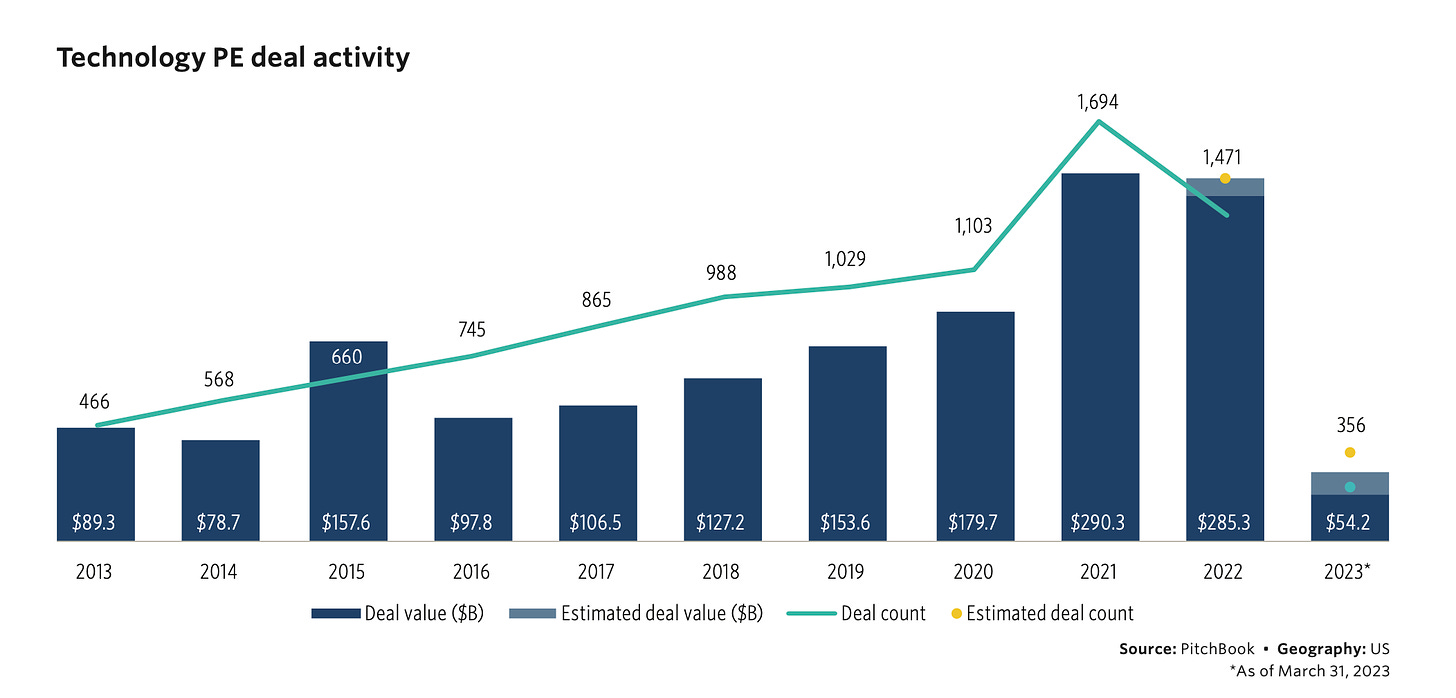

In Q1 2023, 356 deals closed for $54.2 billion, accounting for 20.7% of total US PE deal activity.

Tech take-private buyouts in Q1 were financed with less debt than in recent history.

Notable deals from March required 70% to 92% equity contributions, much higher than the typical median equity contribution of around 48%.

Price dislocation is beginning to close

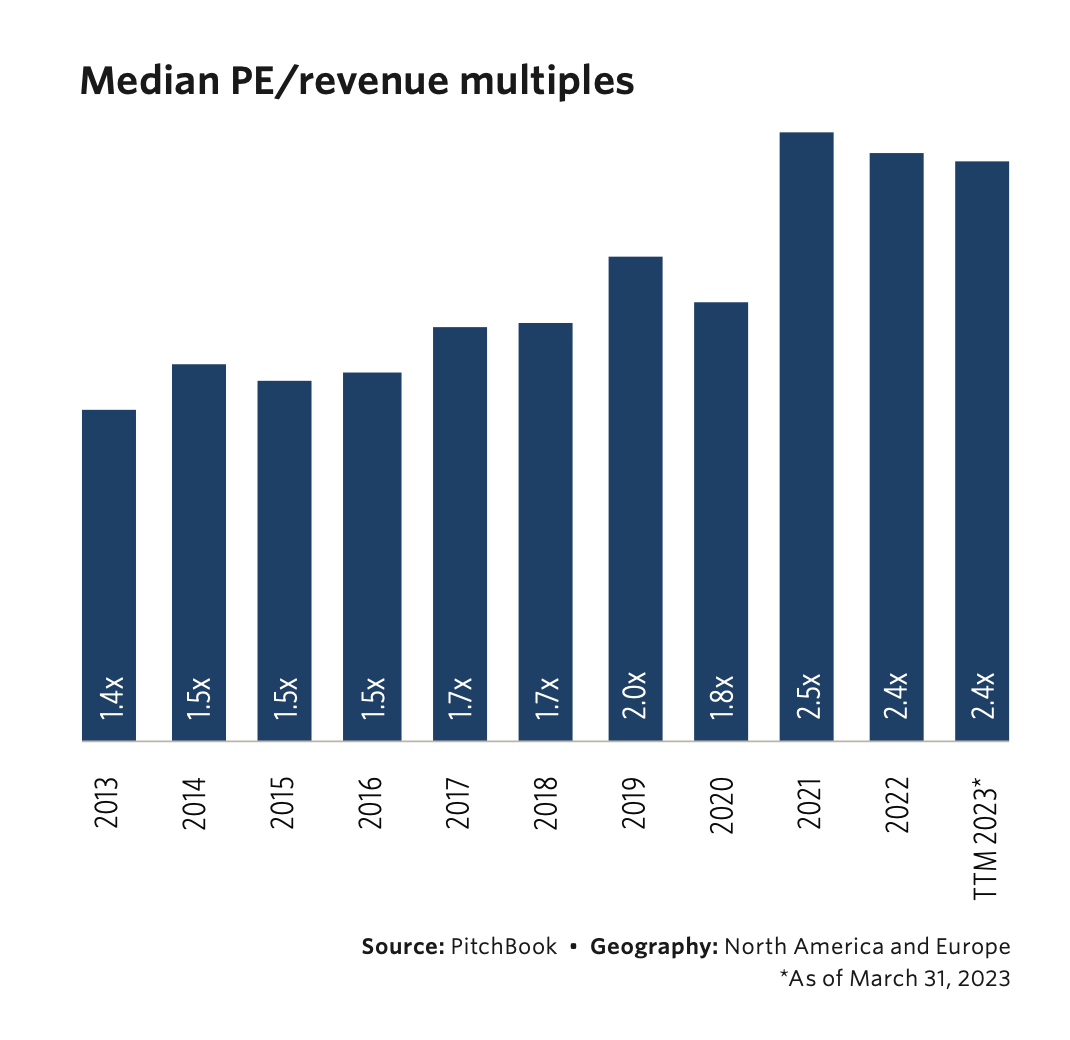

The dislocation in prices between buyers and sellers is beginning to close. as purchase price multiples paid by PE buyers are in full correction mode.

After holding firm at 2.4x to 2.5x for the last two years, the median EV-to-revenue multiple has fallen to 1.7x on PE buyouts so far this year.

This is good news for the recent vintage funds that are able to buy at compelling prices to augment returns and compensate for the reduction in debt.

Fundraising holds strong

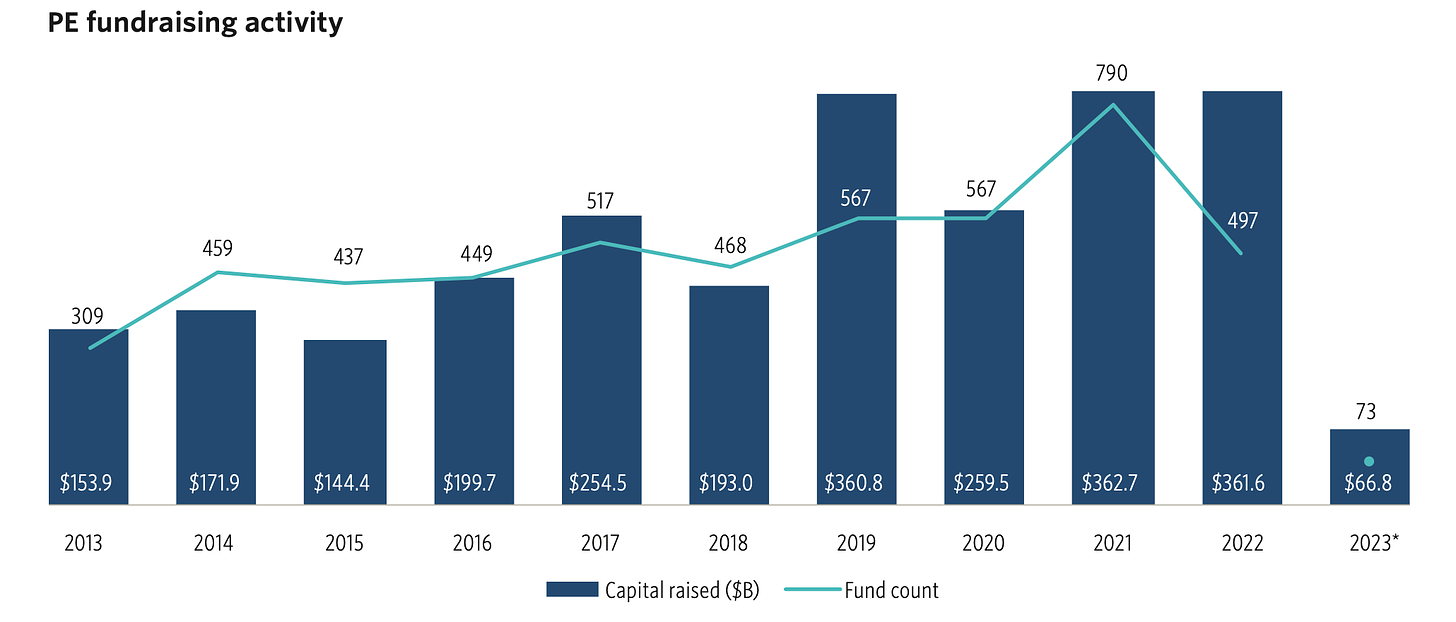

Fundraising was also surprisingly strong at $66.8 billion in funds closed, dead even with last year.

The median time to close a fund has sped up to 8.6 months in 2023 versus 2022’s 11.9 months.

Indicating funds are being raised and closed in record time, despite a more congested fundraising environment.

You can check out the full report👇

About Bloom Equity Partners

We're big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment in their business, we would love to learn more! We just launched our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

Blackrock 2023 Private Markets Outlook

Bloom Equity Partners Career Opportunity

Investing from our debut Fund, we’re actively hiring for our investment team, linked below. Reach out to careers@bloomequitypartners.com or on the specific job ad if you'd like to learn more / recommend someone for a role.

Portfolio Spotlight: Viostream

Viostream is a leading video platform to create, manage and share videos securely, specifically designed for investor relations and communications professionals.

Deliver secure, ad-free videos to anyone, anywhere. Measure, track, and analyze viewer engagement on every single video, and evaluate performance with absolute ease!

Favorites from the Ecosystem

Investors…

Operators….

If you're enjoying The Weekly Bloom, we'd appreciate it if you shared it with your network.