PE Midyear Reality Check: Liquidity Pressure Is Creating Opportunity

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition, we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join nearly 10,000 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

PE Midyear Reality Check: Liquidity Pressure Is Creating Opportunity

Bain & Company’s Private Equity Midyear Report 2025 highlights an M&A market that’s recalibrating in real time. After a promising start to the year, deal activity slowed in Q2 as tariff-related uncertainty rippled through the global economy, pulling down valuations and freezing IPO plans. But beneath the volatility lies a clear message: disciplined, well-capitalized investors are going on offense while others sit out.

Here are the key trends we’re tracking and why we believe this environment is setting up strong vintages for long-term returns.

Deal Activity: A Temporary Pause, Not a Breakdown

Q1 2025 saw the strongest global buyout volume since mid-2022, driven by a steady pipeline of sponsor-to-sponsor and strategic transactions. But deal value declined 24% in Q2, with count down 22% from Q1 averages, as trade-related uncertainty and macro headwinds slowed execution. IPO markets remain stalled, with several high-profile companies delaying listings amid valuation resets. Notable examples include Klarna, which paused its US listing plan, 1Komma5 Grad, an AI-powered German clean‑energy startup, and Stada, the European healthcare company—each citing market volatility as the rationale.

Still, this isn’t a structural breakdown. Strategic acquirers continue to pursue critical assets, and GPs with conviction are leaning in—particularly in sectors like software, where recurring revenue, margin durability, and scalability offer downside protection.

Liquidity Pressure Is Redefining Exit Behavior

Perhaps the most consequential insight from Bain’s report is the deepening liquidity squeeze. For U.S. and Western European funds raised in 2018, distributions to paid-in capital (DPI) stand at just 0.6x—well below the long-term benchmark of 0.8x. With aging portfolios and limited realizations, LPs are pushing harder for full exits over partial liquidity options.

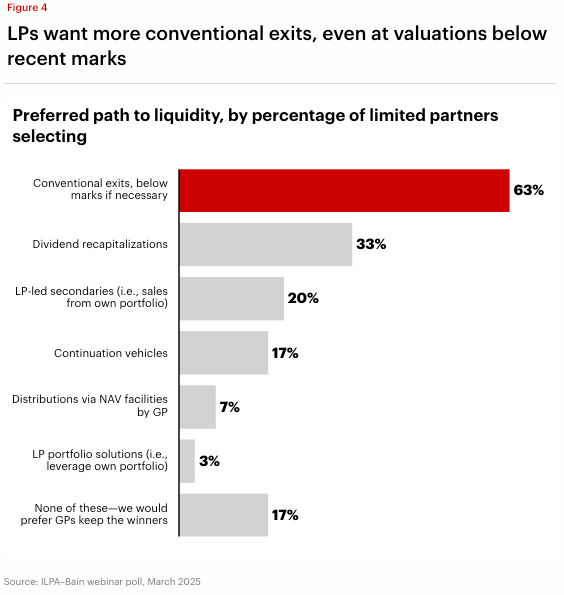

According to a recent ILPA survey, over 60% of LPs now prefer full exits—even at lower valuations—rather than dividend recaps or continuation vehicles. The secondary market is responding, with multi-billion-dollar LP portfolio sales accelerating in Q2 as institutions take liquidity into their own hands.

This is driving a rise in sponsor-to-sponsor transactions, where motivated sellers are increasingly willing to prioritize liquidity over pricing in order to return capital.

Fundraising Headwinds Are Widening the Supply-Demand Gap

Q1 2025 marked a sobering milestone: not a single buyout fund closed above $5B. Bain reports more than 18,000 funds competing for a shrinking pool of LP capital, with roughly $3 of demand for every $1 of supply. Traditional allocators are pivoting to private credit and infrastructure, drawn by more predictable income streams amid economic volatility.

Geographic preferences are shifting as well. Nearly a third of Canadian and European LPs are dialing back U.S. exposure in favor of Europe and other regions, a move tied to trade tensions and a desire for portfolio diversification.

Software Investors Are Well Positioned

For investors focused on enterprise software and technology, this environment presents a distinct advantage. Recurring revenue, flexible cost structures, and the absence of physical supply chains allow software businesses to weather volatility better than asset-heavy counterparts. The scalability of cloud-native platforms and accelerating adoption of generative AI create clear tailwinds for operational leverage and margin expansion.

Vertical SaaS, particularly in regulated or mission-critical sectors like healthcare and financial services, continues to benefit from strong switching costs and high customer retention, providing further resilience.

What We’re Watching in 2H 2025

Operational Value Creation Over Multiple Expansion: With organic valuation growth unlikely, the focus is on margin improvement, cost optimization, and product-led expansion. EBITDA growth—not just top-line momentum—will drive exit premiums.

Updated Value Creation Plans: Portfolio companies held longer than expected must develop credible new growth narratives supported by real financial progress. Outdated investment theses are unlikely to attract buyers in a selective M&A market.

Strategic Buyer Alignment: With public markets less accessible, corporate acquirers remain the most reliable path to exit. GPs who build relationships early and understand strategic roadmaps will be better positioned to transact.

The Bottom Line

The current dislocation is not a reason to pause - it’s a call to act with precision. Liquidity constraints, shifting LP sentiment, and valuation resets are reshaping the market. For well-capitalized investors with sector focus and disciplined underwriting, this moment offers compelling opportunities to buy high-quality assets at more attractive prices.

Bain’s report confirms what we’ve observed firsthand: the next great buying opportunity is already here. The firms who lean in now will define the next chapter of private equity performance.

Sources:

Bain & Company – Private Equity Midyear Report 2025

Reuters - German tech startup 1Komma5 joins Klarna in shelving US IPO plans; Stada reschedules IPO due to market volatility, sources say

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: B2B Software and Technology-Enabled Companies

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M

Growth: No requirement

Profitability: Negative - $10M EBITDA

Investment Type: Operational control required

Business Development Team:

Abe Borden – Principal – abe@bloomequitypartners.com

Adam Kaseff – Senior Associate – adam.kaseff@bloomequitypartners.com

If you or someone you know is considering selling or investing in their business, we would love to learn more! Check out our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

Q1 2025: Global Private Market Fundraising Report

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.