PE Software Deals Primed for 2024 Upswing

News, insights and updates from the team at Bloom Equity Partners

Happy Friday and Happy 2024 technology investors, operators, and enthusiasts.

We’re kicking off the New Year with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join over 8,500 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

PE Software Deals Primed for 2024 Upswing

Despite recent headwinds, conditions are ripe for PE-backed software companies to go on a significant run in 2024, according to a recent PitchBook analyst note.

While a challenging market for exit activity along with the lingering denominator effect is limiting deployment, preconditions are in place for another strong run by private software companies with leading PE sponsors at the helm.

Software sector valuations in public markets have sharply reset and are now below the mean. The performance of recent vintage PE funds has suffered, particularly those focused on technology. But this creates an opportunity, as the companies composing the sector operate with a compelling business model, and the business fundamentals are intact.

Key Takeaways:

Software providers’ margins improved in 2023 after economic storminess

Public market software firms are trading at premiums to private market companies on an EV/revenue basis

Tech deal activity is above pre-pandemic levels

SaaS business models are still compelling

Some of the best software company managers are in the PE space

We identified some of the specific details from the report indicating a promising software deal market in 2024.

Q3 2023 Deal Activity

Global Technology

Technology-focused PE deal value faded globally in Q3 2023 to $82.8 billion, down 2.0% from last quarter and down 26.3% from last year’s Q3, as conditions for dealmaking continue to be challenging. On a volume basis, with 655 deals in the quarter, down 8.4% from last quarter and 20.6% from Q3 2022.

PE activity in the IT sector is besting pre-pandemic levels, with 2023 YTD totaling $266.3 billion, a stout 28.5% above the 2017-2019 nine-month average of $207.2 billion. The 2023 deal volume YTD total is 2,121, 27.5% above the pre-pandemic average of 1,664.

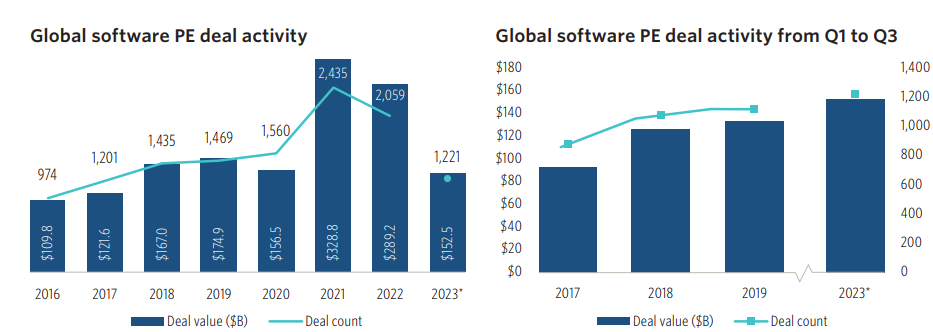

Global Software

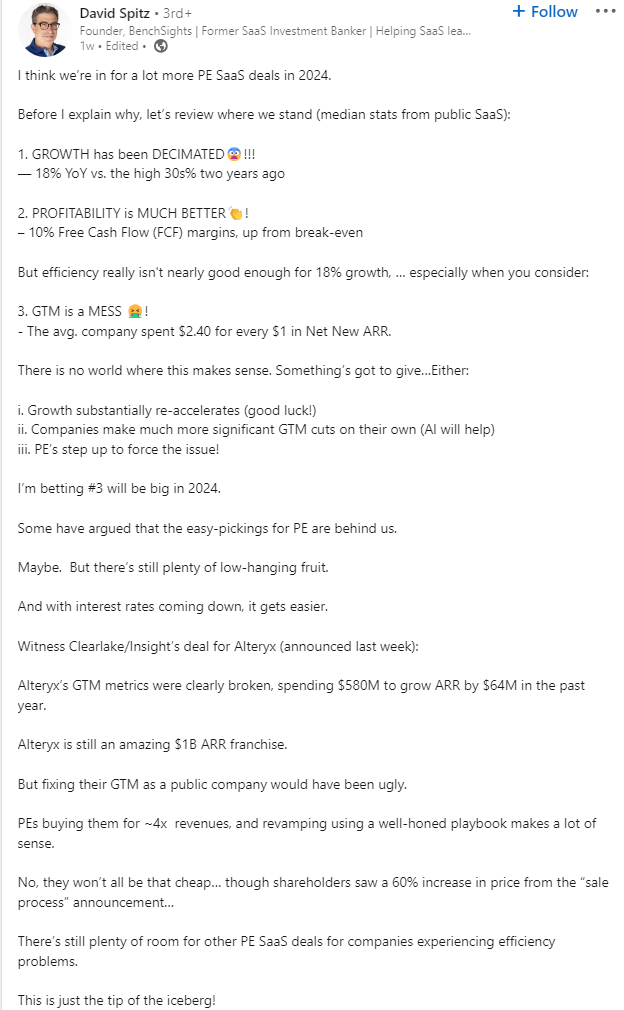

Although below the exceptional levels of 2021-2022, this year’s activity is still above pre-pandemic levels. Compared to the average first nine months of 2017 to 2019, 2023’s deal activity remains 30.0% higher in value, reaching $152.5 billion and 20.9% higher by volume, with 1,221 deals. While deal activity has waned from the frenzied levels of 2020-2021, it reflects a healthy appetite relative to the “old normal.”

Valuations: Public Software

The software sector is an integral and high-performing component of investment portfolios, delivering attractive risk-adjusted returns despite occasional market volatility. During the unprecedented times of the COVID-19 pandemic, the sector saw a remarkable surge in investor demand, pushing valuations to extraordinary heights. This period was marked by exuberant investor sentiment, escalating growth expectations to levels that were ultimately unsustainable.

With rising interest rates and a decelerating economy shifting the landscape, economic projections reset, heightening recession risk in 2022 and prompting investors to reduce allocations in the software sector. In response, public market stock prices and valuations declined.

Amid a backdrop of heightened interest rates and macroeconomic and geopolitical uncertainties, publicly traded software companies have demonstrated remarkable resilience in 2023, as evidenced by their continued growth in EBITDA margins.

Software revenue expansion results from a strategic blend of pricing optimization, tactical acquisitions, customer retention enhancements, and increased spending per customer. Each component propels financial performance forward, as evidenced by the recent rise in EBITDA margins among public software companies. Software, more than any other sector, can yield solid improvements for a well-managed firm.

PE’s Software Playbook

There are encouraging signs of a technology M&A rebound in coming quarters for PE investors, such as:

Banks have slowly returned to lending to LBOs after freezing in H2 2022.

PE firms hold ample dry powder, and valuation levels have reset from two years ago.

LPs and specialized PE firms are inclined to invest in the tech software vertical because the business model lends itself to the transformation from unprofitable growth-at-all-costs to a state of solid growth with robust profitability. Successful execution of this strategy often results in outsize returns.

The software model is advantageous because companies sell on a recurring model (usually SaaS), a recurring license model, or a perpetual license with maintenance and support agreements. The recurring base provides stability during a recession since a business is not dependent on the next sale for profitability and viability.

With B2B software, the customer receives a significant economic advantage from the product through higher productivity and efficiency, keeping churn low.

Software companies in their early stages often chase growth with high spending on marketing and sales, and growth can exceed 50% YoY, which often results in a significant cash burn and an unprofitable business. When growth resets to a more sustainable pace, the management team may try investing in a product, making a significant acquisition or decline to lower sales spending. These situations often result in a sharp valuation reversal, creating opportunities for PE buyers.

PE firms can help these unprofitable software companies adopt a growth and high-profit model by identifying and purchasing market-leading software companies with a solid customer base. The PE managers can then instill best practices and implement a more efficient structure emphasizing customer support, renewal sales, and upselling existing customers.

Performance

During the pre-pandemic period between 2017-2019, Global PE IT-focused firms in PitchBook’s sample delivered an average return of 28.3% versus global PE performance of 15.0%, a performance premium of 1,330 basis points (bps). This calculation is based on an average of quarterly one-year rolling IRRs.

As the broader market conditions begin to recalibrate toward equilibrium, technology and software will capture the investment community’s interest, normalizing valuation multiples, and aligning them more closely to historical averages.

Fundraising and dry powder

Fundraising by technology-focused PE firms

Technology PE firms are confronting a fundraising landscape that is more challenging than many anticipated at the outset of this year.

The recent stabilization in interest rates is an encouraging sign that fundraising will brighten somewhat in 2024 relative to a gloomy 2023. This stabilization is poised to catalyze more favorable market conditions, potentially reinvigorating the fundraising apparatus for technology PE firms, but it is unlikely to match the record volume of funds closed in 2022 that were chasing the extraordinary returns of 2021.

Dry Powder at Technology-Focused Funds

PitchBook found that their roster of technology and software-centric PE firms had $163.8 billion in aggregate unallocated capital reserves, or “dry powder,” at their disposal as of the close of Q3 2023.

Summary

The software industry’s robust fundamentals, high margins, low capital expenditures, and competitive moats make it an appealing investment target, presenting a blend of challenges and opportunities. Those investors who can navigate with insight and agility will capitalize on the sector’s strengths.

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or investing in their business, we would love to learn more! We just launched our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

What Does the Future Look Like for SaaS Multiples

To SaaS or Not to SaaS: SaaS Security Challenges and How to Overcome Them

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.