Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition, we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join nearly 9,000 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

Private Equity 2024 Outlook

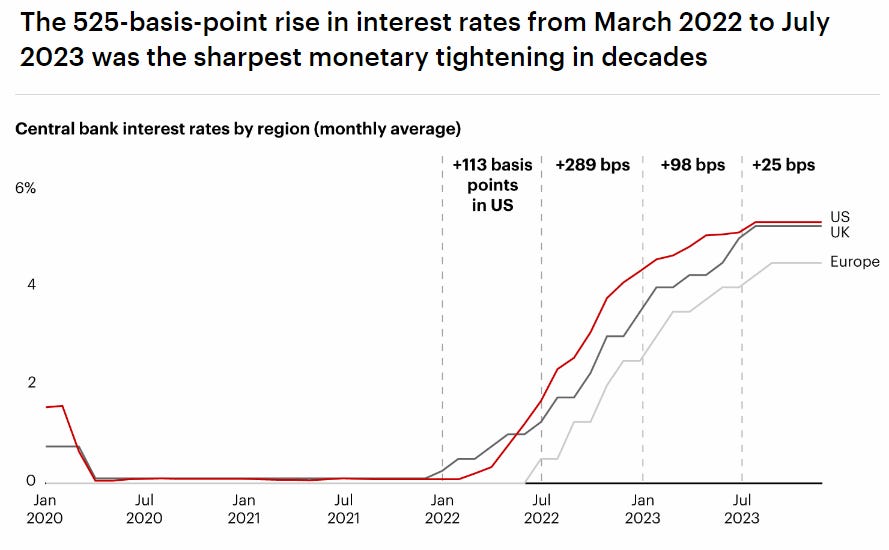

While rapidly rising interest rates led to sharp declines in private equity dealmaking, exits and fundraising, the long-term outlook remains positive as long as PE firms take action on value creation and liquidity solution innovation, according to the long-awaited Bain Capital Global Private Equity Report 2024.

The report offers a forecast for the year ahead in private equity and also looks back at the challenges of 2023. We reviewed the report and gleaned some important insights.

Report Highlights

Private equity continued to reel in 2023 as rapidly rising interest rates led to sharp dealmaking, exits, and fund-raising declines.

The exit conundrum emerged as the most pressing problem, as LPs starved for distributions to pull back new allocations from all but the most significant, reliable funds.

The long-term outlook remains sound, but breaking the logjam will require more robust approaches to value creation and rapid innovation in liquidity solutions.

2023 in Review

The PE industry entered 2023 with a sense of foreboding and witnessed a market stalled by the sharp and rapid increase in central bank rates, which caused general partners to hit the pause button.

Deal value fell by 37%, and exit value slid by almost half. Fundraising dropped across private capital, and 38% fewer buyout funds closed. Interestingly, dollar commitments in buyouts surged as many high-performing funds came to market. However, just 20 funds accounted for more than half of all buyout capital raised.

The private equity industry has never experienced anything like this in the past 24 months. The sharp drop in deal activity in late 2022 and 2023 is similar to the period following the 2008 Global Financial Crisis. Business conditions are unpredictable, and interest rates have risen faster than ever since the 1980s. It’s unclear when interest rates will eventually settle.

Concerns about a recession continue to linger despite it not having happened yet, but to the surprise of many analysts, the economy is moving along nicely.

Record-low unemployment, reasonable growth and surging public markets in the US suggest the possibility that the economic turmoil may end in a soft landing.

These crossed signals have hamstrung private equity. Few in the industry experienced the sheer velocity of the interest rate shock, and its impact on value has driven a wedge between buyers and sellers.

Early Signs of a Turnaround

While it’s difficult to predict what will happen next, the Bain report suggests that signs of a recovery are coming.

Predicting what will happen next is the most challenging aspect of this gridlock. However, Bain believes rates will likely moderate in the coming year, barring any new macro shocks or geopolitical crises.

Even slight cuts spur dealmaking as long as the macro outlook remains relatively stable. Buyout funds alone are sitting on a record $1.2 trillion in dry powder, and 26% are four years old or older, up from 22% in 2022. This creates a more considerable incentive for GPs to start buying, even if conditions aren’t ideal.

Activity is already ticking upward, and with help from the Fed and the European Central Bank, 2024 is likely to see the upside regarding deal count and value.

Barring a sharper-than-anticipated rate drop, sellers will continue to face hurdles to unloading companies to strategic buyers, other sponsors or the public markets.

Actions Needed for 2024

With sponsors struggling to send cash back to their LPs, 2024 will likely be defined by how creatively the industry can generate liquidity. What’s clear is that passively waiting for conditions to recover is not a viable strategy. The report explores how these dynamics play out and what the most forward-thinking GPs work on. Getting unstuck will demand action in several directions at once:

Doubling down on value creation

The exit situation demonstrates how critical it is to generate operating leverage in a market where tailwinds from multiple expansions have turned into headwinds. While you can’t control the direction of rates, you can get better at underwriting value and capturing it through crisp execution.

The industry has relied disproportionately on rising multiples and revenue gains to generate returns, while margin improvement has contributed practically nothing. That no longer works when rising rates serve as ballast for asset multiples.

Portfolio companies need to use every means possible to boost EBITDA efficiently to showcase to the next owner that it’s a stand out worthy of investing in.

Funds need to improve their ability to find and pull value-creation levers that generate organic growth—inclusive of pricing, salesforce effectiveness and product innovation.

The companies selling for maximum value are not those that have merely gotten bigger, but the premium is on generating strong and profitable organic growth.

Managing Across the Portfolio

While strategies focused on EBITDA growth take time, a ballooning exit backlog also presents more immediate concerns. Funds need to develop a clear-eyed, pragmatic appraisal of where each portfolio company sits regarding its return profile, capital structure and prospects.

As long as rates stay elevated, GPs have choices: Which companies will reap an acceptable return if we sell now? Which should we sell anyway so we can return cash to LPs? Which companies face loan expirations, and where can we effectively “amend and extend” to reshape a balance sheet without too much pain? What are our options for generating liquidity through the burgeoning secondary market?

If the industry’s growing inventory of unsold assets isn’t going to be a problem, there are a few things you have to believe. First, with a large volume of portfolio companies facing refinancing hurdles, it will be critical that debt holders take the stance they did in 2008–09. Lenders didn’t want the keys to many troubled portfolio companies then and probably don’t want them now, leaving the opportunity to pay a penalty, add some equity and arrive at a workable capital structure.

You must also believe there are enough innovative solutions, like continuation funds, securitizations and NAV financing, to help GPs recap prized assets and wait for returns to ripen while keeping economic interests aligned between GPs and LPs. The secondary space is still small and somewhat controversial, but it is growing rapidly and represents the kind of financial innovation private equity specializes in.

Professionalizing fundraising

A compelling portfolio scan should provide a clear, practical roadmap for steering the fund through a challenging period. The next step is to communicate to LPs how portfolio managers are using all the tools at their disposal to act as trusted stewards of investor capital. GPs aren’t particularly adept at this kind of communication because they haven’t had to be in the past. Ad hoc, anecdotal conversations about a single portfolio company were sufficient when overall performance wasn’t in question.

Now, performance is everything, and the competition for a limited pool of capital has never been fiercer. This is spurring the most proactive funds to consider changing how they approach investors by professionalizing processes and honing their go-to-market capabilities.

The firms out-raising others are strategically mapping out who their LPs should be and developing the capabilities and tools necessary to understand what it takes to win with them and expand their share of wallet. They are building the kind of commercial organizations the best B2B sellers rely on daily.

None of this is easy, but the PE industry has consistently demonstrated resilience during past downturns.

You can view the rest of the report here.

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or investing in their business, we would love to learn more! Check out our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

Bloom Equity Open Roles: Operating Advisor - Strategic Cost Optimization

Bloom Equity is looking for a part-time, contract, Operating Advisor to focus on strategic cost optimization. To learn more, please visit the LinkedIn posting to learn more and follow directions to apply.

What We’re Reading and Listening To…

13 SaaS Trends for 2024 — Elevate Your Software Stack

10 Key Insights From Developing a SaaS Application

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.