Happy Friday technology investors, operators, and enthusiasts!

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news.

Q1 Saas M&A Market Update

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join over 6,000 readers for a summary our favorite SaaS insights, articles, podcasts, tweets, and news headlines, subscribe below:

Bloom Announces Several New Appointments

Bloom welcomes several new team members – we’re delighted to announce several new appointments across our investment, value creation, and operating teams, including professionals from Vista Equity Partners, K1 Investment Management and Blackstone. To accommodate our rapidly growing team in deploying Fund I, the Bloom team has moved into larger office space in Midtown Manhattan.

For more information: https://www.bloomequitypartners.com/post/press-release-4-27-23-bloomequitypartners-new-appointments

Q1 SaaS M&A Market Update

The Q1 SaaS M&A Update Report by SEG (Software Equity Group) was recently released, and it's packed with valuable insights and trends on both SaaS public market and M&A. We dove deep into the report and found some interesting data points and findings we'd love to share with you.

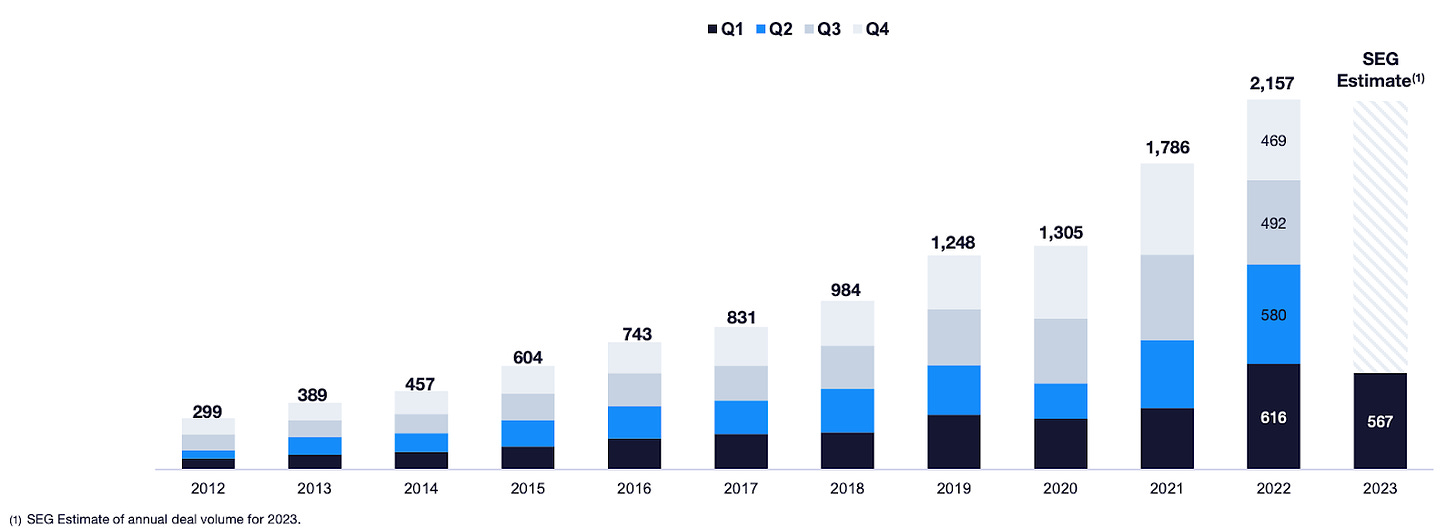

M&A Deal volume increased 21% over the previous quarter

The total deal volume of 567 represents a two-year growth rate of 58%.

SaaS M&A is still the preferred asset class, despite ever-changing macroeconomic and environmental factors, constituting 66% of total aggregate software sales.

SaaS revenues, cloud-service adoption by a growing number of businesses, as well as the ability to scale with high margins means investors and buyers keep coming back for more.

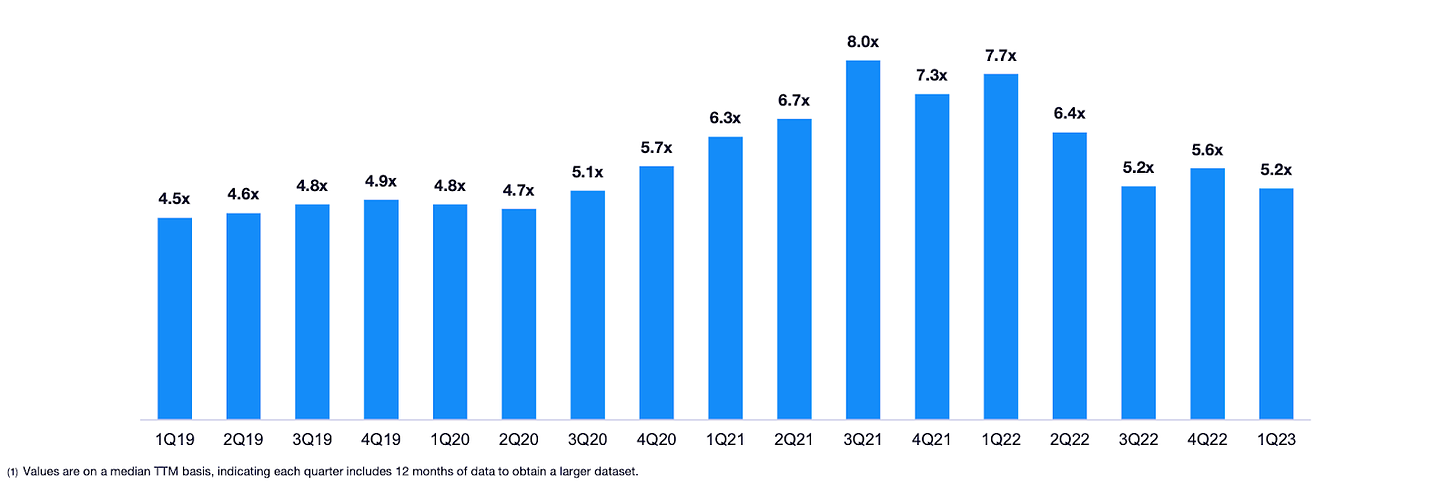

Q1 Median EV/TTM Revenue Multiple Retreating Compared to Q1 2022

Q1 boasted an impressive 5.2x EV/Revenue multiple, although this is lower than the Q1 2022 multiple, which had a 7.7x multiple.

Q1 is still in line with historic quarters prior to the COVID-19 pandemic and the loose monetary policy that drove rapid valuations.

High-quality assets with strong metrics and recession-resistant end markets receive higher valuations in SaaS M&A deals.

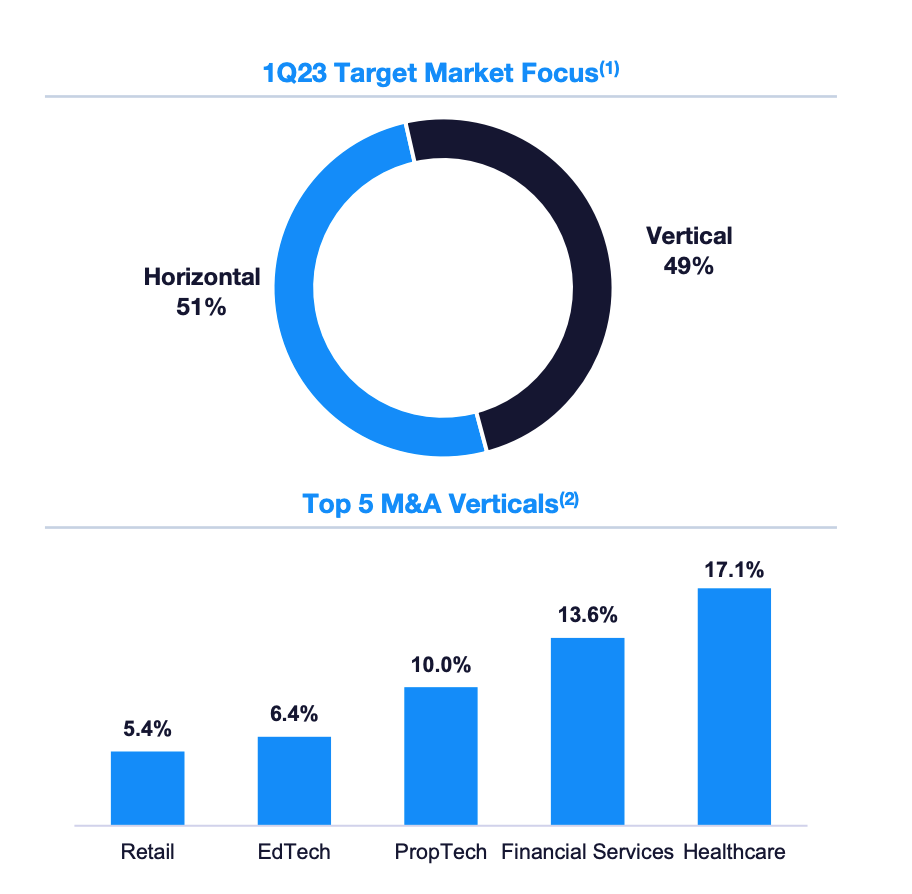

Horizontal and vertical offerings are at a nearly 50/50 split

Vertical offerings in Q1 made up 49% of the target market focus with horizontal offerings making up the remaining 51%.

Healthcare software remained the top vertical making up 17.1%. Aging demographics and COVID-related technology adoption are providing tailwinds and strongly impacting the strength of the healthcare SaaS.

You can check out the full report👇

About Bloom Equity Partners

We're big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment in their business, we would love to learn more! We just launched our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

Skin in the game: Why GPs are putting more money into their own funds

Rising to the Challenge: Slowing Investment Cycles Test Private Equity Strategies

Bloom Equity Partners Career Opportunity

Investing from our debut Fund, we’re actively hiring for our investment team, linked below. Reach out to careers@bloomequitypartners.com or on the specific job ad if you'd like to learn more / recommend someone for a role.

Favorites from the Ecosystem

Investors…

Operators….

If you're enjoying The Bi-Weekly Bloom, we'd appreciate it if you shared it with your network.