Q2 SaaS M&A Report: Poised for Strong Finish in 2024

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition, we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join nearly 10,000 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

Q2 SaaS M&A Report: Poised for Strong Finish in 2024

Software Equity Group recently released their 2Q24 SaaS and Public Market Report which sheds light on the performance of publicly traded B2B SaaS companies in the first half of 2024. The data shows a mixed environment with improving valuations for certain sectors, continued interest from private equity, and a strong performance among high-growth SaaS companies. Deal volume has steadied at pre-COVID levels, with expectations of a strong finish to 2024. Below, we summarize the key takeaways and trends from the report.

Macroeconomic Landscape

The macroeconomic environment remains dynamic, with cooling inflation and the Federal Reserve likely cutting interest rates heading into the latter half of 2024, which could serve as a tailwind for SaaS M&A, making capital more affordable and enhancing transaction volumes.

Global IT & Enterprise Software Spend Outlook

Global IT and Enterprise Software growth and spending are expected to continue to grow meaningfully in 2024, with Global IT spending surpassing $5T and enterprise software surpassing $1T for the first time. Enterprise Software, the fastest growing IT segment, grew 11.5% in 2023, with a projected growth rate of 12.6% in 2024. In 2021, both categories experienced unprecedented growth due to the rapid adoption of cloud and digital solutions driven by the pandemic. However, 2022 marked a regression from peak growth and a return to more typical historical patterns.

2Q24 SaaS M&A Summary

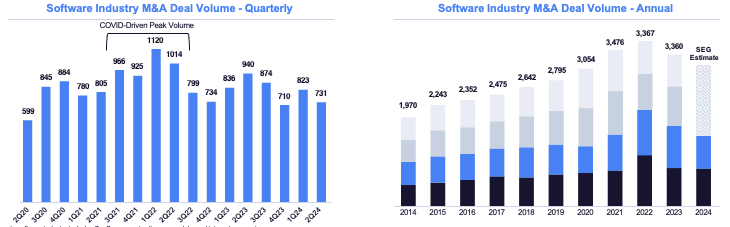

Aggregate software industry M&A deal volume has settled into a steady state consistent with pre-COVID levels, recording 731 total deals in 2Q24 and averaging 806 deals per quarter over the last eight quarters.

Growing optimism around interest rate cuts has led to an increase in M&A discussions leading to a potential increase in transactions heading into the end of 2024. SEG projects that the sector will see more than 1,900 transactions in 2024, having the potential to be the 3rd highest year on record (trailing ‘22 and ‘23 only).

2Q24 represents the first quarter in over two years (since 1Q22) that both the median and average EV/TTM revenue multiples increased Quarter over Quarter, with the median increasing from 3.8x to 4.0x (5% increase) and the average from 5.1x to 5.4x (6% increase). These multiples are reported on a TTM basis, which undersells how strong the second quarter was, as the in-quarter median and average multiples were 4.4x and 5.7x, respectively.

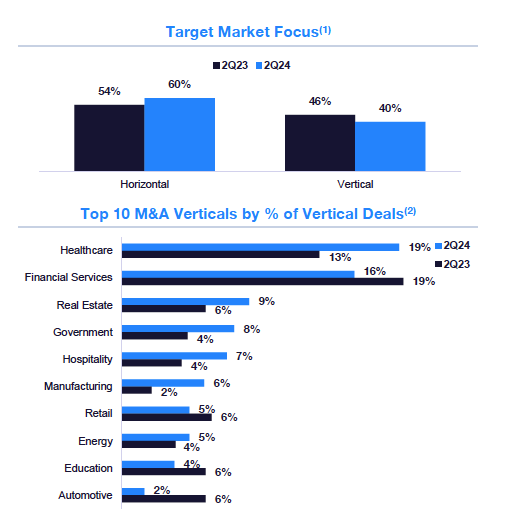

Vertical SaaS comprised 40% of all SaaS M&A deals in 2Q24, continuing the trend of investors and acquirers seeking purpose-built, mission-critical applications that are the calling card of vertical software companies. Healthcare (19% of vertical SaaS deals in 2Q24 vs. 13% in 2Q23) was the most active vertical in the second quarter, seeing a strong increase Year over Year. A challenged U.S. healthcare system at the end of a pandemic is rapidly adopting modern SaaS solutions to accelerate digital transformation in care environments. Financial Services, Real Estate, and Government represented the next most active verticals.

Private Equity Maintains Strong SaaS M&A Presence

Private equity investors continue to be very active in SaaS M&A. Whether acquiring platforms (9.7% of 2Q24 deals) or buying via their portfolio companies as PE-backed strategics (48.5%), private equity was involved in 58.2% of SaaS transactions in 2Q24.

You can view the full report here.

Looking Ahead: Why Optimism is Rising

With rate cuts on the horizon and improving market conditions, SaaS M&A is expected to accelerate throughout Q4 2024 and into 2025 as buyers and sellers return to the table. The growth in EV/Revenue multiples sets the stage for an robust backlog of sellers to engage in formal sell side processes, with optimism that performing companies will continue to warrant premium valuations throughout the coming quarters.

At Bloom Equity Partners, we continue to monitor these trends and anticipate opportunities to partner with innovative SaaS companies looking to capitalize on the dynamic market environment.

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: B2B Software and Technology-Enabled Companies

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M

Growth: No requirement

Profitability: Negative - $10M EBITDA

Investment Type: Operational control required

If you or someone you know is considering selling or investing in their business, we would love to learn more! Check out our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

Growth equity deals surpass LBOs, defying historical trend

Hiding in Plain Sight: The Search for Take-Private Opportunities

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.