Q3 SaaS M&A Report: Opportunities Abound

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news.

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join over 8,500 readers for a summary our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

Q3 SaaS M&A Report: Opportunities Abound

Despite a challenging market, investors are still buying SaaS companies, according to the recently released Software Equity Group (SEG) 2023 Q3 SaaS M&A Report, which reviews the key trends and dynamics impacting the SaaS industry.

Based on data from previous quarters, all indications point to the SaaS industry achieving a record-breaking year.

We reviewed the report and found valuable insights and trends to help investors make critical business decisions.

Global IT & Software Spend Summary

Global IT and Enterprise Software growth and spending are poised to continue strong growth. In 2021, both categories experienced unprecedented growth due to rapid digitization driven by COVID. However, 2022 marked a regression from peak growth.

Both categories are expected to cross impressive thresholds in 2024, with Global IT spending surpassing $5T and enterprise software spending surpassing $1T for the first time. Enterprise software, the fastest-growing IT segment, is projected to expand by 12.3% in 2023 and 13.1% in 2024, outpacing the broader IT category's growth of 5.5% and 8.6%, respectively. With software spending maintaining a 13% average growth rate in the four years before 2021, it is expected to grow at a healthy pre-COVID clip as global enterprises adopt software.

Q3 Saas M&A Summary

Aggregate software industry M&A deal volume remains strong, reaching 873 total deals in 3Q23, in line with recent and pre-COVID quarterly performance and up 9% over 3Q22.

Deal activity for SaaS M&A remains high relative to historical periods, as noted in the chart below. The 539 SaaS transactions in 3Q23 represent similar activity to the prior period ( 538 transactions in 2Q23). Compared to the four quarters before 3Q21, which averaged 389 transactions per quarter, the last four quarters averaged 528 transactions each—marking a 36% increase and setting 2023 on pace for a record year. This pace points to 2023 witnessing 58% of total software transactions from SaaS, marking the second consecutive year SaaS comprises nearly 60% of aggregate software transactions. Overall, increases in SaaS M&A activity have proven to be more than a pandemic-driven trend, with more businesses globally turning towards cloud-based, modern technology.

While aggregate software M&A settled into pre-COVID levels, SaaS M&A volume is tremendously higher, up 36% on average over the activity before the market peak in the second half of 21’ and first half of 22’. With a strong Q3 (up 10% YOY), the 2023 SaaS M&A volume is now on pace to surpass 2022 with 2,178 transactions, representing another record year. SaaS deals are expected to comprise 58% of all aggregate software deals, second only to 2022 (59%).

The average EV/TTM Revenue multiple for 3Q23 was 5.8x. A growing gap exists between the average and median multiple, with the median declining to 4.2x in Q3. This increasing spread points to a dynamic of a high volume of low valuations paired with enough high-value multiples. This dynamic is driven by high-quality assets continuing to receive solid valuations, but also many companies forced to exit, for a myriad of reasons, at sub-optimal multiples.

Vertical SaaS comprised 48% of all SaaS M&A deals in 3Q23. Healthcare, Financial Services, and Government represented the three most active verticals. Government more than doubled its percentage of deals in 3Q23 (9.2% versus 4.2% in 3Q22), underlining the continued M&A activity in recession-resistant and essential verticals.

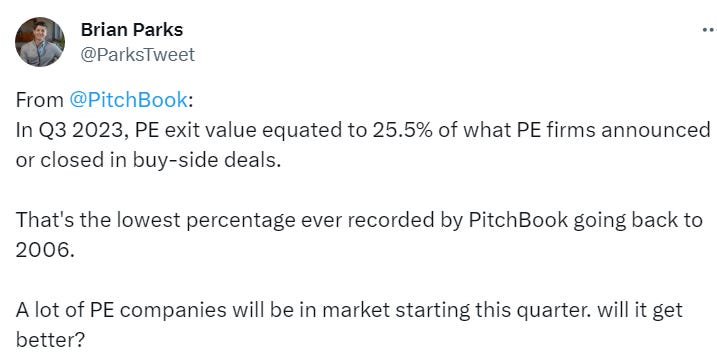

Private equity appetite for SaaS M&A remains high as it represented the majority (60.3%) of SaaS deals in 3Q23. PE-backed strategics have continued to seize the opportunity presented by record levels of dry powder and strategic synergies, representing 50% of all deals.

You can view the full report here.

About Bloom Equity Partners

We're big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment in their business, we would love to learn more! Bloom has a referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

Take-privates dominate top PE-backed enterprise software deals

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you're enjoying The Bi-Weekly Bloom, we'd appreciate it if you shared it with your network.