Rebounding Software Sector: Insights from Carlsquare’s Fall 2024 Report

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition, we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join nearly 10,000 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

Rebounding Software Sector: Insights from Carlsquare’s Fall 2024 Report

As the year draws to a close, this will be our final newsletter for 2024. We’ve appreciated sharing our insights with you throughout the year and look forward to bringing you more updates in 2025. Until then, here’s a deep dive into the trends shaping the software sector from the Carlsquare’s Fall 2024 report.

Investor Confidence Grows as Multiples Rebound

Valuation multiples are climbing back, reflecting renewed confidence in resilient software companies with strong recurring revenue models. In Q3 2024, EV/Revenue multiples reached 4.2x for profitable firms, surpassing the 3.7x seen for high-growth but unprofitable companies. This marks a shift in investor preference toward stability and cash generation amidst ongoing macroeconomic uncertainties.

Public-to-Private Deals at Record Highs

Public-to-private (P2P) transactions surged by 17% year-over-year, continuing a multi-year trend. With fewer competing bidders from private equity, strategic buyers dominate the market, leveraging opportunities to acquire scalable software assets. Mega-deals such as Blackstone and Vista’s $8.4 billion acquisition of Smartsheet highlight the focus on high-quality targets.

Bloom Equity Partners contributed to this trend with the take-private of GRC International (GRCI) from the London Stock Exchange’s AIM. GRCI, a leader in governance, risk, and compliance (GRC) solutions, delivers consulting, training, content, and software to address IT and cyber compliance concerns across the UK, Europe, and North America. These transactions highlight the focus on acquiring high-quality, defensible assets in today’s evolving market.

Profitability Takes Center Stage

While growth remains an important metric, investors are rewarding profitability over high-revenue growth. Profitable software companies now command higher multiples, signaling a clear preference for cash flow stability over the aggressive growth strategies that defined the sector in previous years. Unprofitable growth firms, despite showing higher revenue growth rates (13.3% vs. 9.6%), are increasingly devalued in favor of mature, cash-generating peers.

Strategic Drivers of M&A

Election-Driven Compliance Investment: Regulatory uncertainty surrounding the U.S. elections is prompting a wave of deals in cybersecurity, compliance, and infrastructure solutions.

Lower Borrowing Costs: Falling interest rates are encouraging companies to leverage debt for strategic acquisitions. This environment enables buyers to secure premium assets at attractive financing terms.

Focus on High-Quality Assets: Despite a decline in transaction volumes, disclosed deal values are rising as investors concentrate on resilient software companies with defensible market positions.

The Rule of 40 Remains Key

The Rule of 40, which combines growth rate and EBITDA margin, remains a critical metric for evaluating SaaS companies. Firms meeting or exceeding this threshold continue to attract premium valuations, with median EV/Revenue multiples of 8.9x for those achieving high growth and profitability.

Funding Landscape Stabilizes

The funding environment is showing signs of normalization. Although valuation multiples have dipped below their four-year average, disclosed funding values rebounded to $39 billion in Q3 2024. This highlights a cautious yet deliberate focus on quality investment opportunities.

Larger Firms Benefit from Scale Premiums

Larger companies continue to command higher valuations, with EV/Revenue multiples reaching 7.7x for large firms compared to 2.2x for smaller peers. Their profitability and operational efficiency offer resilience in a competitive market, further solidifying their premium status.

Innovation Remains Paramount

Despite compressed valuations, companies are doubling down on innovation. R&D spending has increased to $0.20 per $1 in operating expenses. This reflects a long-term focus on product development and competitive differentiation, even in challenging macroeconomic conditions.

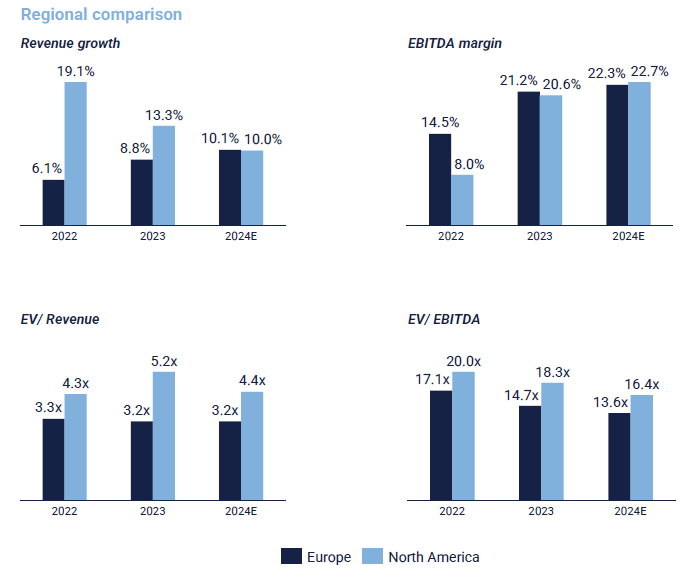

Regional Comparisons Favor North America

North American software companies maintain a valuation edge over European peers, achieving a 1.2x premium in EV/Revenue multiples. However, the gap in profitability and growth rates between the two regions has narrowed to its smallest level in years, signaling increased competition.

The report underscores a sector in transition, balancing profitability and innovation with strategic growth initiatives. As market conditions improve, these trends set the stage for continued evolution and opportunity in 2024 and beyond.

Click here to read the full report.

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: B2B Software and Technology-Enabled Companies

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M

Growth: No requirement

Profitability: Negative - $10M EBITDA

Investment Type: Operational control required

If you or someone you know is considering selling or investing in their business, we would love to learn more! Check out our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

The Barbell Approach to CEO Time Management

The biggest enterprise technology M&A deals of the year (so far)

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.