Happy Friday bloom community!

We are back with your favorite weekly newsletter! We are switching things up this week and sharing some public SaaS insights. We’ll be diving into Q2 earning seasons and breaking down these markets further for you folks!

Favor to ask before we get into things, if you’ve been finding our writing insightful, please pay it forward by sharing the newsletter with friends and colleagues.

If you’re reading this and haven’t subscribed yet, please enter your email to subscribe.

Now let’s get on with it 🔥

Q2 SaaS Earnings Season Update

Earnings season is underway and given the market dynamic we thought it would be best to share with you some insights on the public markets. It’s pretty obvious at this point that some weakness is showing up in software. 15% of companies missed revenue estimates for Q2, historically only 5% miss them.

Jamin Ball did a great breakdown on the earnings reports so far so make sure to check it out! Here’s a quick breakdown of what he covered 👇

Update on multiples

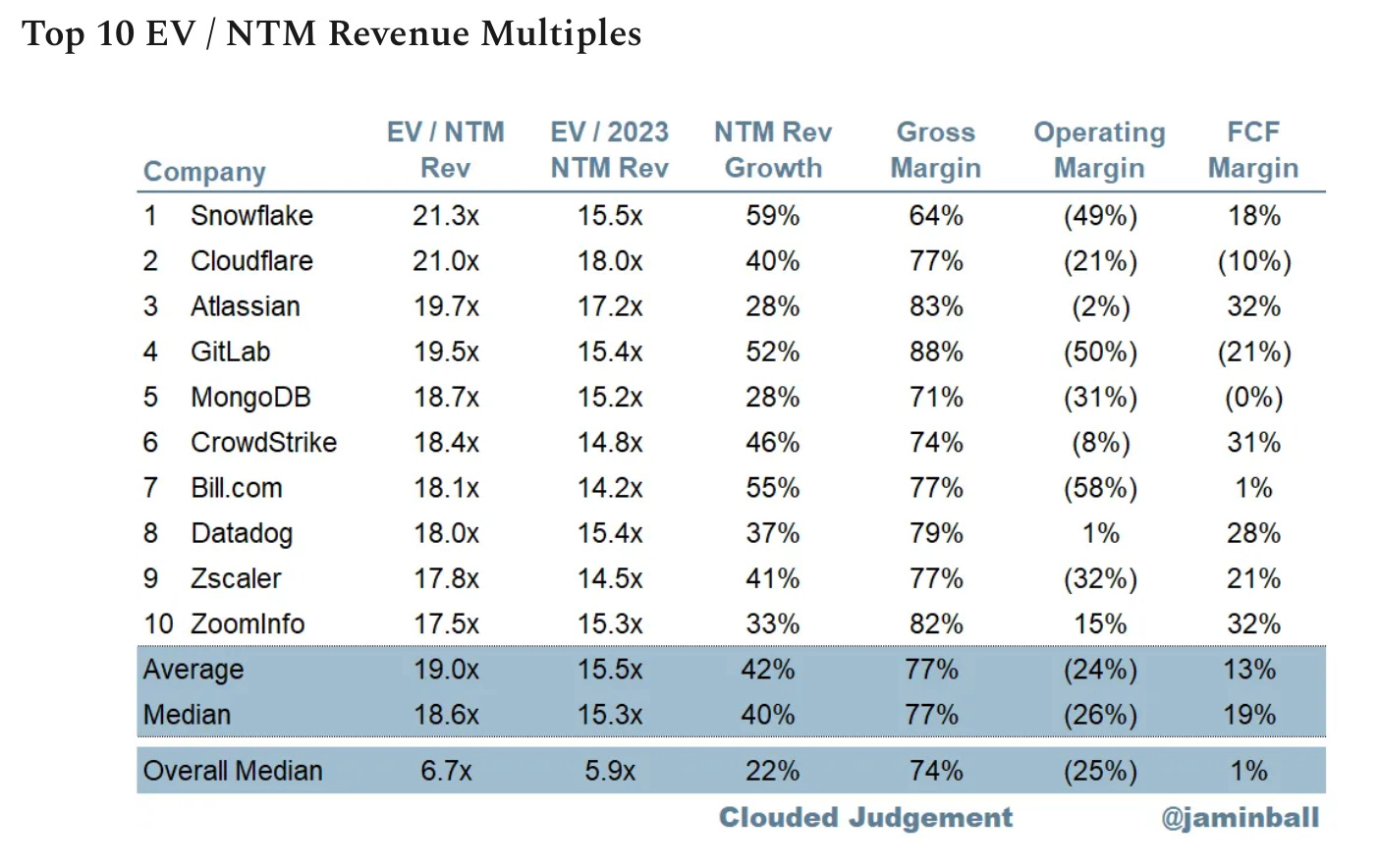

overall median for software companies was 6.7x

The top 5 median was 19.7x

Here are the top 10 EV/NTM Revenue Multiples

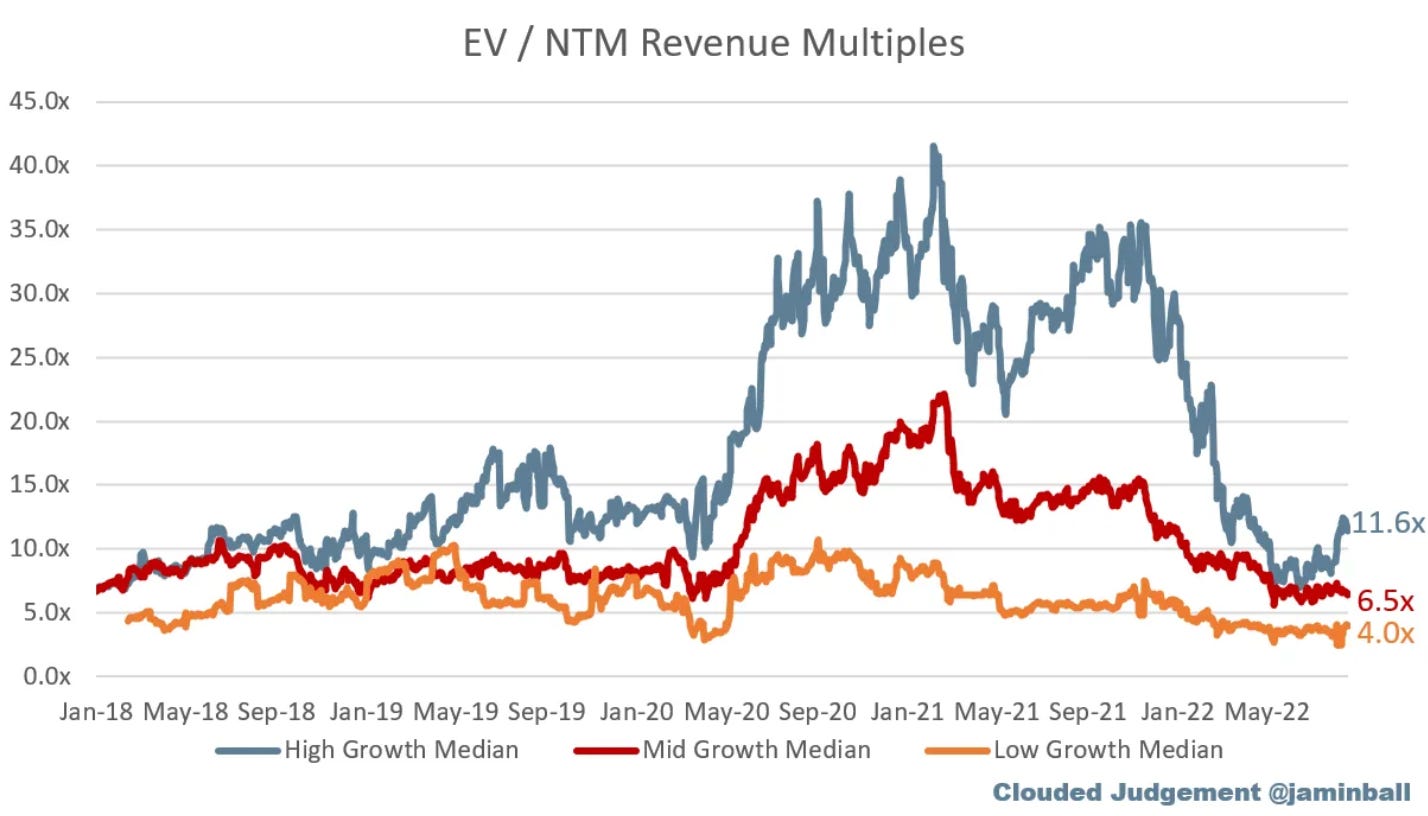

Break down of multiples by growth rate:

(high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%)

Important Operating Metrics

Median Gross Margin: 74%

Median Net Retention: 120%

Median CAC Payback: 35 months

Median NTM growth rate: 22%

The SaaS market has reset. We've transitioned from a "Capital is cheap, grow at all costs" era to one where every board room is asking "How should we think about top-line growth if we want to conserve cash and prioritize efficiency but still create value?" - Meritech

This sums up the market pretty well. It will be interesting to see how things play out with the changing macro environment and the runoff that will be created in the private markets.

If you enjoyed this quick breakdown make sure to check to give it a share

What We’re Reading and Listening To…

📚 Demystifying Interest Rates vs. Valuation for High-Growth SaaS

Favorites from the Ecosystem

Investors👇…..

Founders👇…..

Operators👇….

News from the Industry: deals, deals, and more deals 💰

BV Investment Partners Announces Sale of RKD Group To Incline Equity Partners

iCIMS, Vista Equity Partners and TA Associates Complete Transaction

Private Equity Firm Reinvests in Forterro Five Months After Exit

End Note 🔚

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.

About Bloom Equity Partners

Bloom Equity Partners is a lower mid-market software-focused private equity firm, leveraging deep operational and commercial experience to create enduring market value for the benefit of our investors, founders, and their companies.