SaaS M&A Report: Setting the Stage for 2025

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition, we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join nearly 10,000 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

SaaS M&A Report: Setting the Stage for 2025

Software Equity Group recently released their Annual SaaS report for 2025 highlighting a resilient and evolving M&A landscape, with SaaS deal activity remaining strong despite broader macroeconomic uncertainty. With transaction volumes near record levels and valuations showing signs of stabilization, the sector enters 2025 with positive momentum and several tailwinds supporting further growth. We have highlighted some key insights below:

SaaS M&A Volume Remains Elevated

The aggregate software industry recorded 3,452 deals in 2024, representing a 3% increase from 2023. More significantly, SaaS-specific transactions reached 2,107 deals, establishing 2024 as the second-highest year on record for SaaS M&A activity, only slightly below 2022’s peak. The fourth quarter's performance was particularly noteworthy, with 534 transactions marking the highest Q4 volume on record and representing a 15% year-over-year increase.

The increasing dominance of SaaS within the broader software M&A landscape is evident, with SaaS transactions now comprising 61% of all software deals—a dramatic increase from 43% in 2020 and 27% in 2015. This structural shift reflects both the maturation of the SaaS model and the acceleration of cloud adoption across industries.

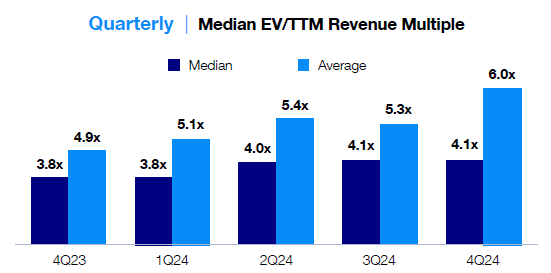

Valuations Stabilizing, With Potential Upside in 2025

Fourth quarter valuations showed meaningful appreciation, with the median EV/TTM revenue multiple (a ratio used to compare enterprise value to total revenue over a trailing twelve months) reaching 4.1x, an 8% increase year-over-year. The average multiple expanded to 6.0x, marking the highest quarterly TTM average since Q1 2023. This divergence between median and average multiples suggests a bifurcated market where premium assets command increasingly attractive valuations.

The anticipated Federal Reserve rate cuts in 2025 may serve as a catalyst for multiple expansion, particularly given the correlation between lower borrowing costs and SaaS valuations historically. Strategic buyers and investors surveyed by SEG indicate expectations for gradual multiple expansion throughout 2025, contingent upon continued improvement in inflation metrics and economic stability.

Sector and Strategic Focus

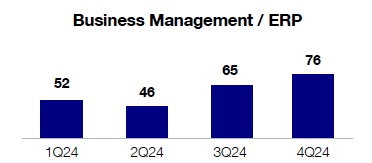

Sector specialization continues to drive significant transaction activity, with healthcare maintaining its position as the most active vertical at 16% of deals, followed closely by Financial Services at 15%. The Analytics and Data Management category has seen unprecedented growth, particularly in AI-related transactions, recording 100 deals in Q4 2024 alone.

Mission-critical enterprise applications remain highly sought after. Business management and ERP solutions saw 76 deals in Q4, a 17 percent increase from the prior quarter, as buyers continue to prioritize deeply embedded, high-retention software platforms.

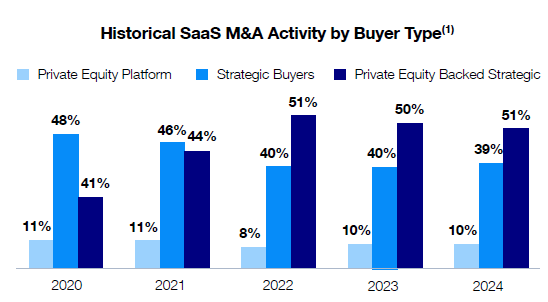

Private Equity Continues to Dominate Buyer Activity

Private equity's influence on the market remains substantial, with PE-backed strategics accounting for 51% of all transactions in 2024. Total private equity involvement, including both platform acquisitions and portfolio company add-ons, reached 61% of all SaaS deals. Traditional strategic buyers, both public and private, represented 39% of transactions, maintaining consistent levels from recent years but below their historical share of 40-50% seen in 2021-2022.

Forward Outlook for 2025

The M&A market enters 2025 with strong momentum, supported by stabilizing macroeconomic conditions and robust buyer appetite. The combination of record private equity dry powder, anticipated interest rate cuts, and the continued evolution toward cloud-based solutions suggests sustained transaction activity. Vertical-specific solutions, particularly in healthcare and financial services, are likely to command premium valuations given their mission-critical nature and strong customer relationships.

As we progress through 2025, we will continue to monitor the pace and magnitude of Federal Reserve rate cuts, the evolution of AI-driven deal activity, and the potential for increased strategic buyer participation as public market valuations stabilize.

Source: SEG 2025 Annual SaaS Report

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: B2B Software and Technology-Enabled Companies

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M

Growth: No requirement

Profitability: Negative - $10M EBITDA

Investment Type: Operational control required

If you or someone you know is considering selling or investing in their business, we would love to learn more! Check out our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

25 predictions for SaaS in 2025

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.