Hey Founders and Friends,

We hope that you have been enjoying the first few Weekly Blooms of 2022. If you have any specific topic/question that you would like us to discuss in The Weekly Bloom, email us and we will be sure to address them!

Now let’s jump into this week’s newsletter!

Q1 is quickly coming to a close and the report that we constantly look forward to has arrived. Earlier this week Bain & Co. released the 2022 Private Equity Report. This gives an exceptional breakdown of key trends and insights from across the buyout market and is a must-read for any founder, operator, and investor.

We wanted to share some notable trends as it relates to software investing:

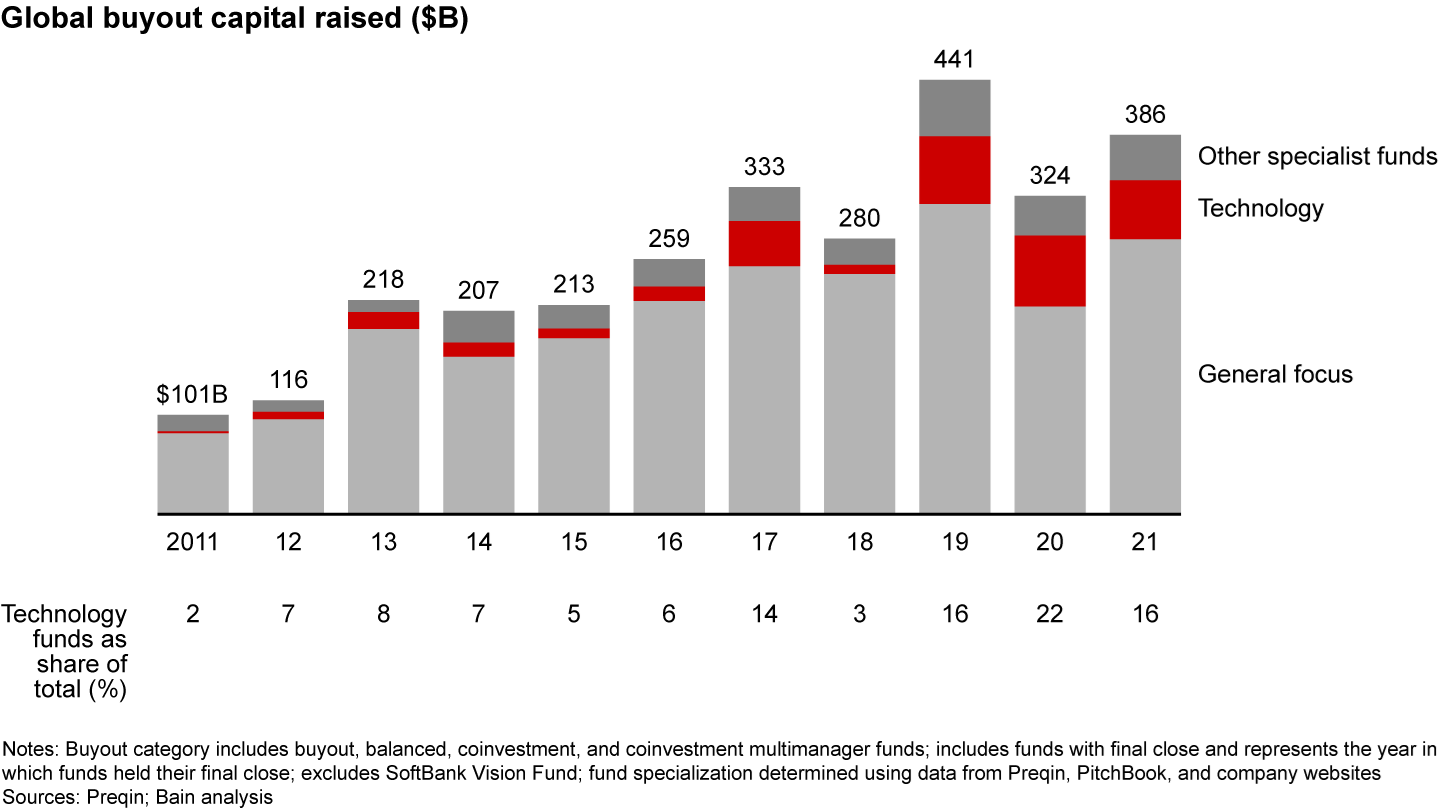

Technology now accounts for 31% of the buyout market

Since 2016 tech buyout funds have raised more than $270 billion.

Funds aimed specifically at technology buyouts have expanded significantly over the past decade

16% of buyout funds in 2021 were technology focused.

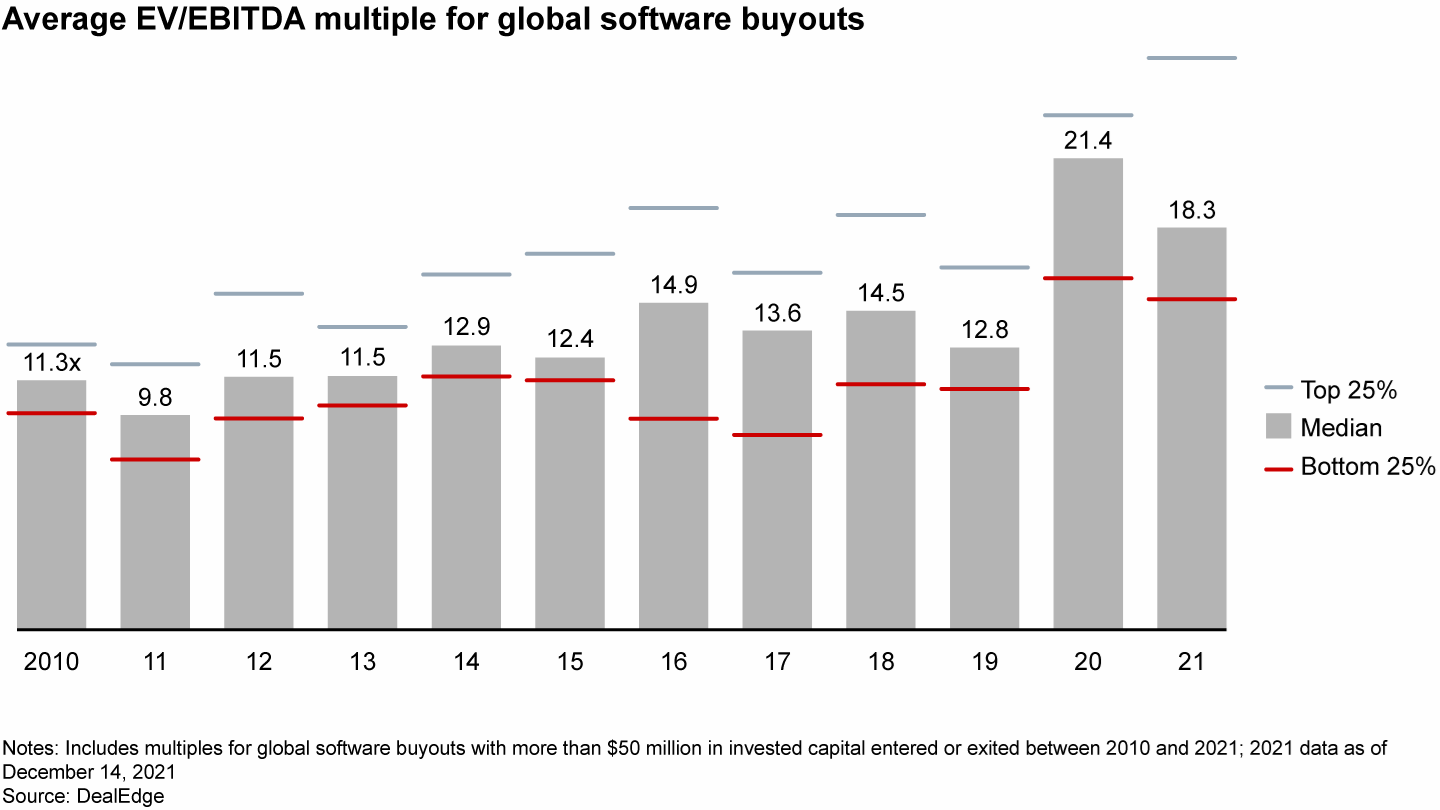

Buyout multiples continue to rise as new capital hits the market

The median EV/EBITDA multiple for tech buyouts in 2021 was 18.3, down slightly from 21.4 in 2020.

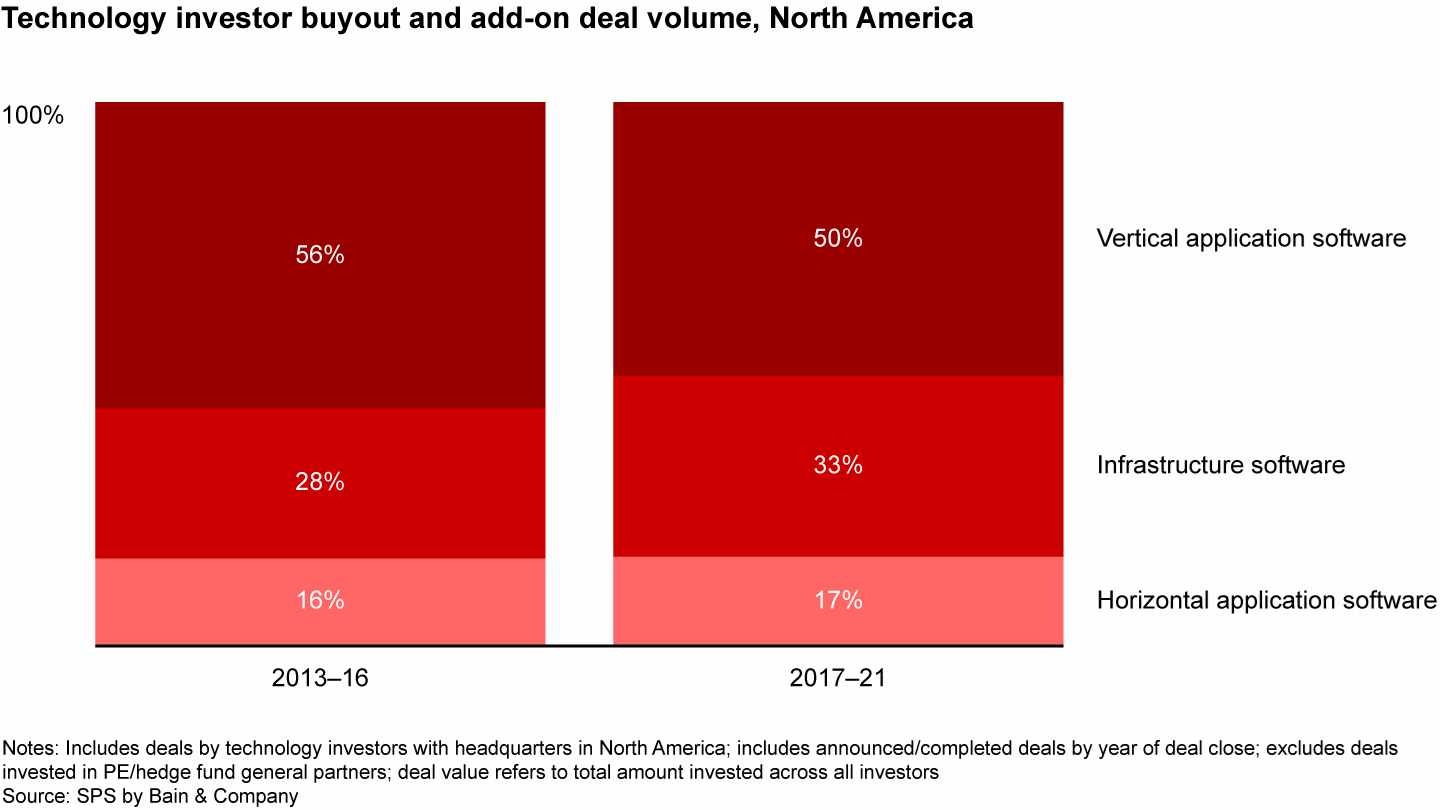

Software buyout funds are becoming increasingly comprised of infrastructure software and horizontal application software.

Buyout firms will continue to increase their portfolio weights in these categories over the coming years given the growth opportunities. The subsectors that have benefited the most from these sustained tailwinds include cloud computing, DevOps and Martech.

If you enjoyed this breakdown make sure to check out the following must-read articles in the report 👇

📚 Private Equity’s Inflation Challenge

📚 Chasing Disruption: The Brave New World of Growth Investing

P.S. If you are enjoying our bit-sized insights make sure to subscribe

Favorites from the Ecosystem

Investors👇…..

Founders👇……

Operators👇…..

What We’re Reading and Listening To…

News from the Industry: deals, deals, and more deals 💰

UserZoom Announces Strategic Growth Investment from Thoma Bravo

Securonix Receives Over $1 Billion Growth Investment

Banneker comes back to market quickly with Fund II

End Note 🔚

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.