SaaS Trends: 2023 Year-in-Review & 2024 Predictions

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition, we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join nearly 9,000 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

SaaS Trends: 2023 Year-in-Review & 2024 Predictions

Vendr’s recently released “The SaaS Trends Report: 2023 Year-in-Review” offers a breakdown of the most significant trends in the software market to help SaaS buyers and sellers determine where to invest their resources in the new year. It also includes SaaS market predictions for 2024.

We reviewed the report and uncovered valuable insights for you, including top categories, ACV trends, and buying cycles.

You can view the full report here:

2023 Pricing Trends

Average Contract Value

During Q2 2023, ACV dipped as buyers exercised caution, but the trend reversed in Q3, with both net new purchases and renewals reaching year-highs in Q4.

ACV for net new purchases increased 32% YoY, while the YoY for renewal ACV dropped 11%.

Blended ACV for net new purchases and renewals averaged $87k in 2023, a 4% decrease from 2022

The highest ACVs occurred in the IT Infrastructure, Data Analytics, and Customer Support categories, while Design and Content Tools, Human Resources, and Collaboration and Communication sported the lowest.

2023 New Sales ACV

2023 Renewal ACV

Buying Cycles

Buyers purchased SaaS 5% faster in 2023 than in 2022, with most suppliers’ buying cycles ranging from 41 to 55 days.

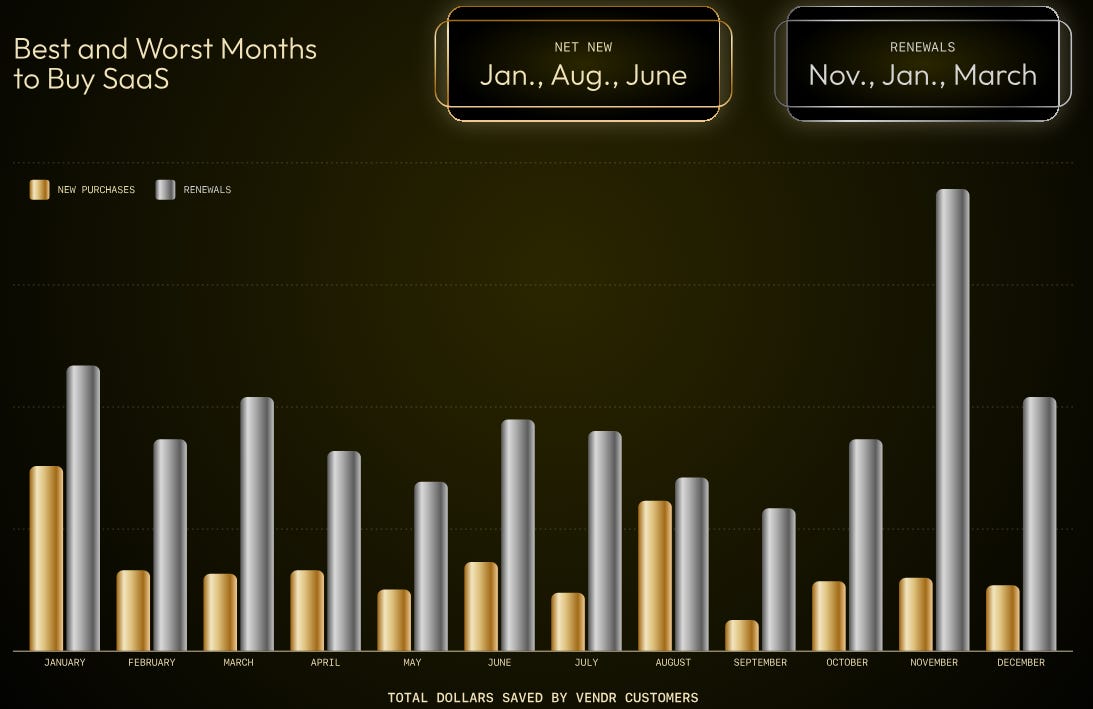

Seasonality

Winter months are the best time to buy, sell and save on SaaS. Purchases take longer in the Summer.

In 2023, January had the most renewals, but renewals took the longest. The advice is to renew early if your renewal date is in January.

December was the most popular month for net new purchases, a frequent YoY trend because companies learn if they have any leftover budget.

June, July, and August tied for the most prolonged buying cycles in 2023.

SaaS Market Snapshot

Top Purchased Categories

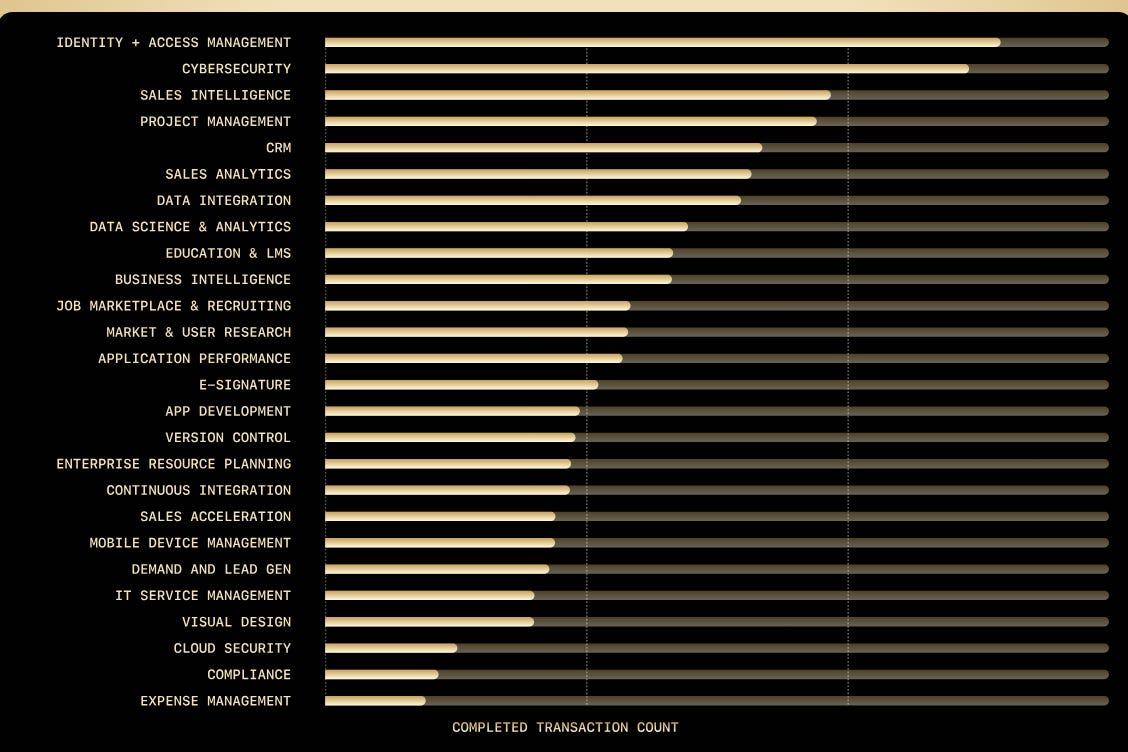

The top two categories in 2023 — Identity and Access Management and Cybersecurity — remained the same from 2022.

In 2022, Application Performance Monitoring made the Top 10 but fell out in 2023, replaced by data and analytics.

Version Control, IT Service Management, Cloud Security and Visual Design were new to the category listing in 2023.

The chart below shows the top categories based on the number of purchases made during 2023 on the Vendr platform.

Top Software Categories For 2023

Mapping Software Budgets by Category

Across all company sizes on the Vendr platform, most software budgets are allocated to IT Infrastructure, Sales, Data Analytics & Management, and Security & Compliance.

Productivity, Vertical Industries, Dev Ops, and Human Resources have a consistent percentage of spend, regardless of company size.

The percentage of companies spending on design and content tools, marketing and advertising, finance and accounting, and commerce and retail declines as company size increases.

Spend by Category

Machine Learning and Artificial Intelligence

Throughout 2023, there was a noticeable, though expected, increase in AI-specific companies, allowing buyers to improve customer experiences and streamline internal operations. However, AI’s impact on spending is challenging to measure as the tools are often embedded into products from non-AI categories.

The report uses Vendr’s Machine Learning and Artificial Intelligence subcategory to track the ACV. In 2023, the subcategory saw a 54% increase YoY.

AI and Machine Learning Subcategory ACV and Buying Cycle

CFO Predictions for 2024

Tighter software budgets are the new normal

Despite predictions of decreasing inflation and interest rates, organizations will keep budgets tight, with CFOs closely involved in deals.

Multi-year deals come due

In 2022, many companies prioritized growth at all costs. In 2024, multi-year deals signed in 2022 will be renewed, with many of these deals contracting as part of the renewal process.

Sales apps shine as a return to growth emerges

This year, companies explore how to return to growth profitably. However, most companies will rely on efficiency and SaaS-driven ROI rather than increased hiring.

2024 Vintage Apps

Companies founded in 2024 will introduce products designed and developed as AI-first.

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or investing in their business, we would love to learn more! We just launched our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

Operating Advisor Wanted: Strategic Cost Optimization

Bloom Equity is looking for a part-time, contract, Operating Advisor to focus on strategic cost optimization. To learn more, please visit the LinkedIn posting to learn more and follow directions to apply.

What We’re Reading and Listening To…

The Ultimate SOC 2 Checklist for SaaS Companies

The Convenience and Security Risks of Relying on SaaS Platforms

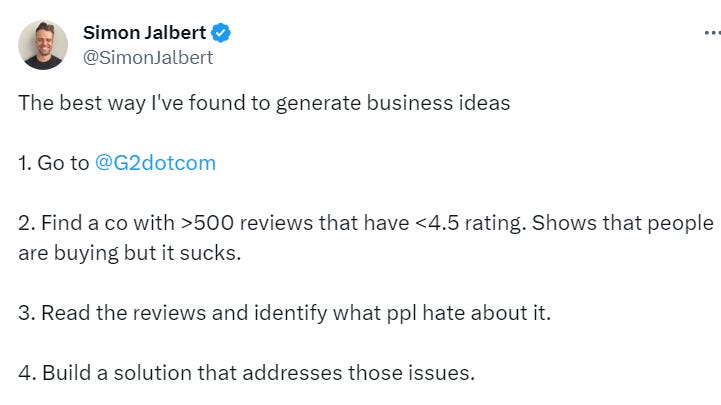

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.