Happy Friday!

This week we’re sharing an outlook on SaaS valuations in the public markets. Fair warning- it’s not too pretty.

With the Weekly Bloom, we’re giving you a curated experience of everything that’s going on in the world of SaaS.

If you've been enjoying these newsletters, would you mind sharing with a fellow enterprise software entrepreneur, investor, or capital allocator that you feel would enjoy them too?

Public Saas Valuations Update

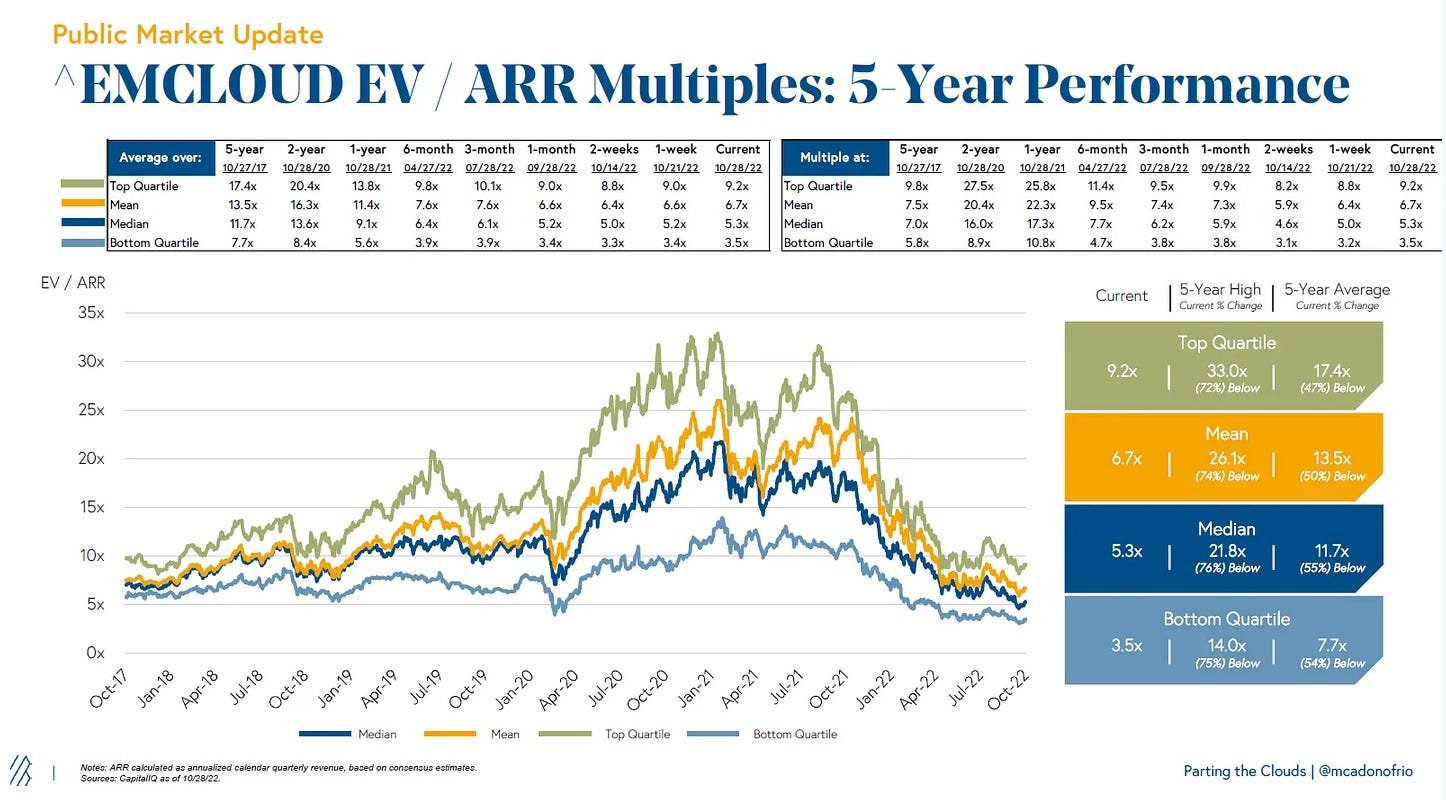

Earlier this week Bessemer Venture Partners shared across their weekly newsletter ‘Parting the clouds’. It’s a great metric-dense newsletter for any software investor or operator looking to stay up-to-date on the industry.

In this week’s edition, the team highlighted a few noteworthy SaaS valuation metrics:

53% of the BVP Cloud Index, EMCLOUD (an index designed to track the performance of emerging public cloud companies) are trading under 6x ARR.

The mean EMCLOUD ARR multiple is 6.7x which is down 70% from 2021.

The EMCLOUD market cap is down 50% YOY.

It’s clear that the public markets are demanding a lot from SaaS companies right now. They want both strong growth and strong cash flow. In order to be trading anywhere close to 10x ARR you need roughly 50% ARR growth and ~15% FCF margin.

TLDR: Public markets are demanding that SaaS companies show not just growth, but also profitability in the form of free cash flow. This is a high bar that is difficult to meet.

What We’re Reading and Listening To…

📚 How to set SaaS marketing budgets

📚 The Perfect Formula for a Recession Resistant Software Company Today

Favorites from the Ecosystem

Investors👇…..

Founders👇…..

Operators👇….

News from the Industry: deals, deals, and more deals 💰

Private equity firms hear clock ticking to invest funds in challenging market

Potentia offers $1.80 bid for Nitro Software, other parties circle

K1 Investment Management to buy ELMO Software in $319m deal

End Note 🔚

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.

About Bloom Equity Partners

Bloom Equity Partners is a lower mid-market software-focused private equity firm, leveraging deep operational and commercial experience to create enduring market value for the benefit of our investors, founders, and their companies.

If you or someone you know is considering selling or taking investment, we might be able to help out. Just reply to this thread and we can get acquainted!