Scaling SaaS from $1 to $20M and Overcoming the Growth Plateau: Insights from ICONIQ Growth’s 2024 Report

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition, we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join nearly 10,000 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

Scaling SaaS from $1 to $20M and Overcoming the Growth Plateau: Insights from ICONIQ Growth’s 2024 Report

Scaling a SaaS business to $20M ARR is a complex and critical phase that many early-stage companies struggle to navigate. The 2024 ICONIQ Growth Report summarizes quarterly operating data from 107 B2B SaaS companies and 12 public companies selected based on their IPO performance criteria to offer valuable data and insights to guide early-stage companies through this journey. By analyzing financial and operational data, the report highlights key benchmarks that successful SaaS companies use to drive growth, increase efficiency, and maintain scalability.

The Growth Plateau and the Four Key Questions

Many SaaS companies face a significant challenge as they approach $20M ARR. During this period, year-over-year growth slows or even stalls, what the report calls the Growth Plateau, which creates a major hurdle for companies looking to scale further.

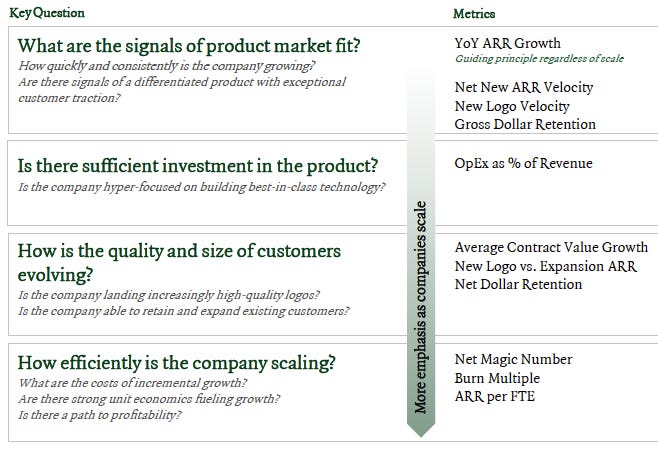

Top-performing SaaS companies can break through this plateau by focusing on four key questions that guide their strategies for growth and efficiency:

What are the signals of product-market fit?

Is there sufficient investment in the product?

How is the quality and size of customers evolving?

How efficiently is the company scaling?

These questions, combined with the right metrics, help companies navigate this pivotal stage in their growth trajectory.

1. What Are the Signals of Product-Market Fit?

Achieving product-market fit is one of the most important milestones for early-stage SaaS companies.

Year-Over-Year (YoY) ARR Growth:

High-performing SaaS companies maintain 2-4x YoY ARR growth, even through the notorious Growth Plateau. This metric serves as a guiding principle for assessing a company’s momentum and market traction. The ability to sustain this growth is strongly correlated with achieving product-market fit.

Net New ARR Velocity:

Consistency in increasing net new Annual Recurring Revenue (ARR) quarter over quarter is a hallmark of top SaaS companies. This consistency reflects strong customer traction and signals readiness for scaling go-to-market (GTM) strategies. Companies that can maintain momentum in new ARR are better equipped to resist the slowdown seen at $20M+ ARR.

New Logo Velocity:

Maintaining a high new logo acquisition (10-20% growth per quarter) during the $1-$10M phase is a key driver of success as SaaS companies look for revenue expansion opportunities within existing customers. This rapid acquisition of quality logos sets the stage for upsell and cross-sell opportunities, which become more significant as the company scales beyond $10M ARR as the source of new ARR shifts towards the existing company base.

Gross Dollar Retention:

Companies that achieve 95-100% gross dollar retention in the early stages demonstrate strong product-market fit and a loyal customer base. This retention level, paired with new logo velocity, can provide predictability to revenue attainment as the company evaluates other opportunities to accelerate revenue acquisition (M&A, commercial partnerships) to set-up for long-term growth.

2. Is There Sufficient Investment in the Product?

Investing in product development is crucial for long-term success. In the early stages, much of a company’s resources should be directed toward building and refining the product. Operating Expense (OpEx) as a Percentage of Revenue is a key metric to watch.

OpEx as a Percentage of Revenue

$1-$5M ARR companies are typically in the development stage and dedicate a substantial portion of their OpEx to research and development focused on laying a solid product foundation. Only once companies scale to $5-$10M does the OpEx strategy shift towards expanding the sales and marketing (S&M) functions. Sufficient early-stage investment in product maturity is critical for long-term scalability.

3. How Is the Quality and Size of Customers Evolving?

As companies grow, it’s important to monitor the evolution of their customer base.

Average Contract Value (ACV) Growth

As SaaS companies scale, they increasingly land higher-value contracts, especially those targeting enterprise customers. However, maintaining high new logo velocity while expanding ACVs is key to avoiding customer concentration risks.

New Logo vs. Expansion ARR

Initially, growth is driven by acquiring new customers, but as companies scale, customer expansion becomes increasingly important. A healthy mix of new logo acquisition and customer expansion signals scalable growth. By $15M ARR, 35% of new ARR typically comes from customer expansion. This shift shows that top companies not only retain their customers but also grow their revenue from existing accounts.

Net Dollar Retention

Net Dollar Retention (NDR) reflects how well a company retains and expands revenue from its existing customers, factoring in both churn and upsell. This metric becomes critical as SaaS companies scale past $10M ARR. Top performers achieve 120-130% NDR, showing they not only retain customers but also grow their accounts through upselling, driving sustainable revenue growth.

4. How Efficiently Is the Company Scaling?

Efficiency becomes more critical as SaaS companies scale, and key metrics like the Net Magic Number, Burn Multiple, and ARR per Full-Time Employee (FTE) provide insight into how effectively companies are growing.

Net Magic Number

The Net Magic Number measures how efficiently companies convert their sales and marketing spend into revenue. It is a key metric for assessing the productivity of go-to-market efforts. Top-quartile companies achieve a 1-2x Net Magic Number, demonstrating effective use of their sales and marketing resources while continuing to grow. Once companies reach ~$10M, high growth velocity, solid retention, and low costs for sales and maerketing contribute to 1-2x top quartile net magic number.

Burn Multiple

Burn Multiple measures capital efficiency by comparing net burn to ARR growth, indicating how well a company is managing its cash relative to revenue generation. SaaS companies that pursue top-quartile growth maintain burn multiples of 1.5-2x, balancing high growth rates with disciplined spending to ensure long-term financial sustainability.

ARR per Full-Time Employee (FTE)

ARR per Full-Time Employee (FTE) measures the productivity of a company’s workforce by tracking the amount of revenue generated per employee. As companies scale toward $20M ARR, top performers achieve $140-$150K ARR per FTE, demonstrating efficient headcount management and the ability to maximize employee output while growing the business.

The 2024 ICONIQ Growth Report provides a data-driven framework for scaling a SaaS business from $1M to $20M ARR. By focusing on the key questions around product-market fit, product investment, customer quality, and operational efficiency, companies can navigate the challenges of the Growth Plateau and set themselves up for sustained success.

For more detailed insights and benchmarks, the full report offers valuable guidance for early-stage SaaS businesses.

Bloom Equity Completes Take-Private of GRC International

Bloom Equity Partners is pleased to announce the successful take-private of GRC International (“GRCI”) from the London Stock Exchange’s AIM.

Founded in 2002, GRCI is a leading provider of governance, risk, and compliance (“GRC”) solutions. GRCI offers consulting services, training, tools, and software solutions to address a wide range of compliance needs, including both established frameworks, such as ISO27001 and GDPR, and emerging regulations such as DORA. GRCI is headquartered in the UK and serves customers in the UK, EU, and US.

To learn more, please visit the Bloom Equity Partners press release.

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: B2B Software and Technology-Enabled Companies

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M

Growth: No requirement

Profitability: Negative - $10M EBITDA

Investment Type: Operational control required

If you or someone you know is considering selling or investing in their business, we would love to learn more! Check out our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

Five Ideas That Every CEO Should Know

The Pipeline Metrics That Matter

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.