Software M&A Outlook in 2 Charts

News, insights and updates from the team at Bloom Equity Partners

Welcome back to another edition of The Weekly Bloom - one of the best weekly resources for Private Equity, Enterprise Software, and Technology news. We hope that you enjoyed last week’s Insights from BlackRock's Latest PE Outlook Report.

This week’s edition features:

Software M&A Outlook in 2 Charts

Earlier this week Axial released its 2023 Software M&A Market Outlook, breaking down some notable trends and sub-sectors of focus for investors. As middle-market software investors, our team wanted to share a few key insights from the report.

Cybersecurity, HealthTech, FinTech, Artificial Intelligence, and GovTech are becoming the most appealing sub-sectors for M&A interest in Q1

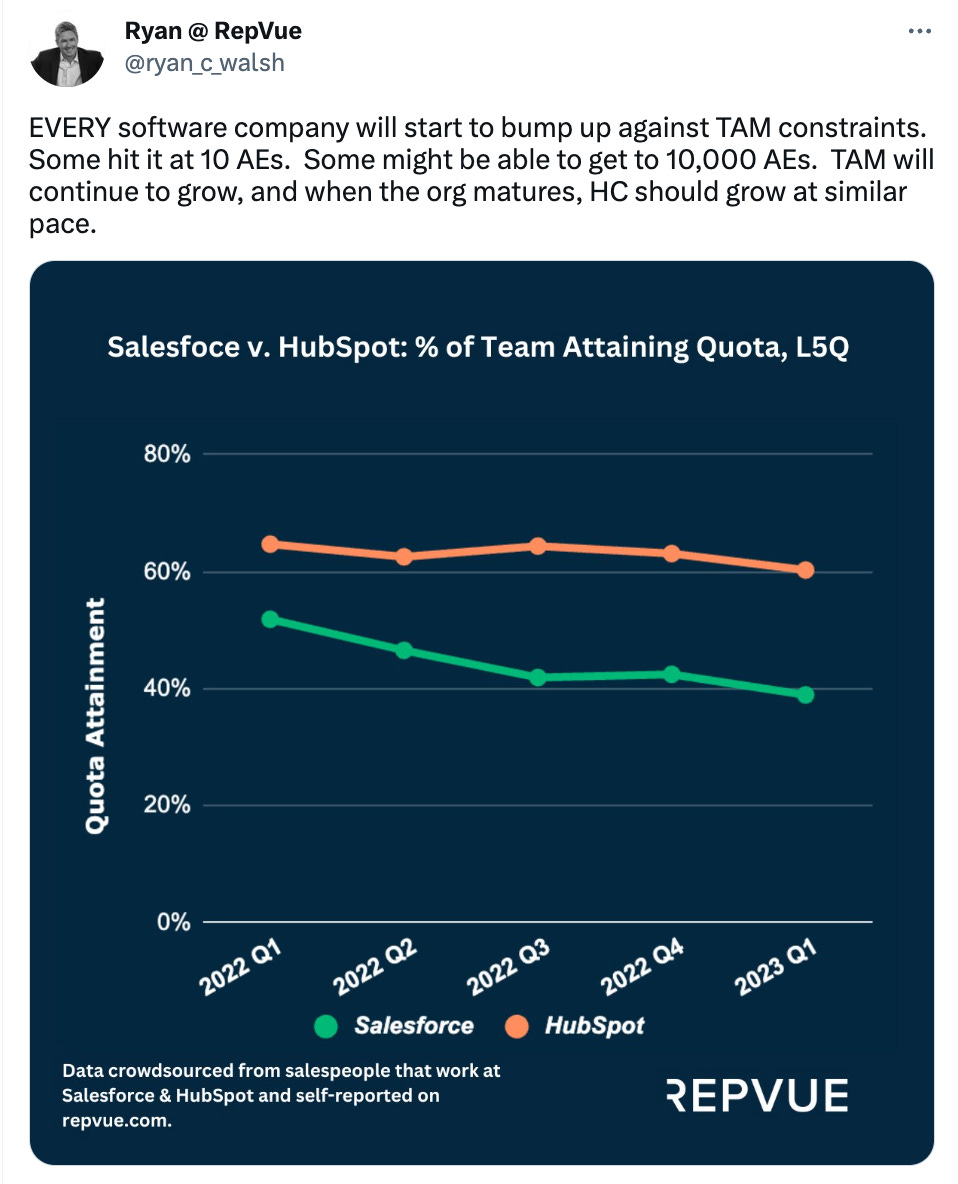

The discretionary and cyclical nature of marketing and sales software is the primary trait that has softened the demand from investors.

A buyer’s market is in store for 2023

According to the survey of SaaS acquirers, diminishing access to capital may provide buyers with more attractive opportunities as compared to recent years.

Buyer selectivity has become a running trend as valuations continue to downtrend. Axial noted that the “pursuit rate,” on their deal platform decreased by 40-50% in the final three quarters of 2022.

It is evident as we approach a buyer’s market in 2023, acquirers with ‘dry powder’ to deploy will benefit, and even more so as many buyers continue to wait for valuations to bottom out.

You can check out the full report👇

2023 Software M&A Market Outlook

Partner with Bloom Equity Partners

We're big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $40M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within six months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment in their business, we would love to learn more! We just launched our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

SaaSletter - Cost Discipline Post SVB

S&P 2023 Private Equity Outlook

Bloom Equity Partners Career Opportunity

Investing from our debut Fund, we’re actively hiring for our investment team, linked below. Reach out to careers@bloomequitypartners.com or on the specific job ad if you'd like to learn more / recommend someone for a role.

Favorites from the Ecosystem

Investors….

Operators….

If you're enjoying The Weekly Bloom, we'd appreciate it if you shared it with your network.