Software Sector Sees High Valuation Levels and Growing Confidence

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition, we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join over 8,500 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

Software Sector Sees High Valuation Levels and Growing Confidence

The software landscape is starting 2024 on a high note, with confidence and valuation levels starting to climb, according to a new report from Carlsquare. The report highlights current developments and M&A trends in the software industry.

High-Level Takeaways

Valuation levels are climbing, and there are clear signs of growing confidence across the software market.

Profitability continues to be a core focus for investors, but growth software companies have regained their valuation premium.

We reviewed the report and identified some additional highlights.

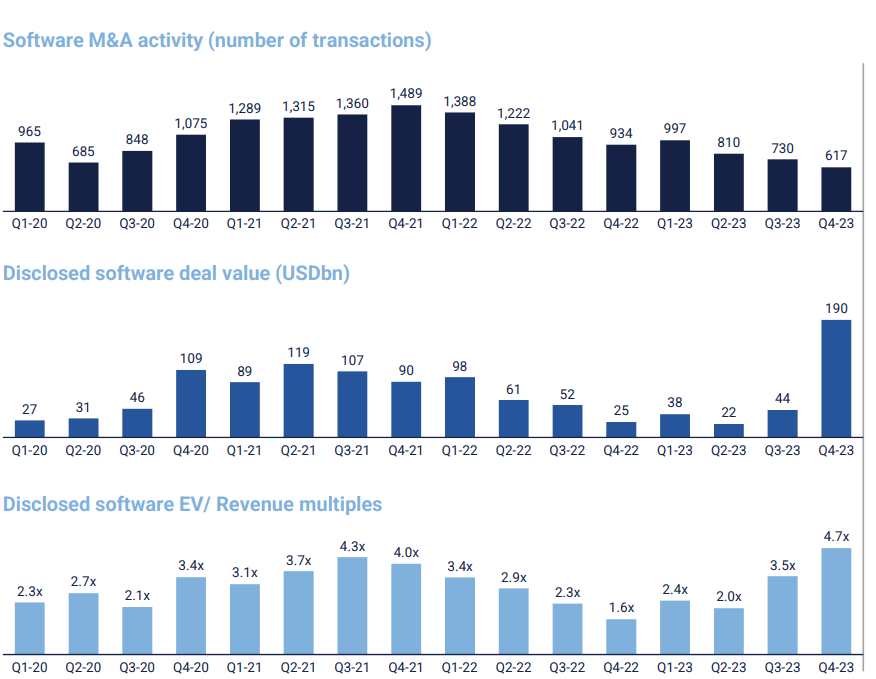

Deal values are rising, but transaction volume remains low

Disclosed software EV/ Revenue multiples climbed for the second consecutive quarter to the highest levels of the last four years, exceeding Q3 2021, while the overall number of deals still hovers around early pandemic levels.

Deal activity in Q4 2023 was 42% less than the rolling four-year average, indicating wide spreads between private equity bids and founder asking prices.

Venture capital has remained cautious

Funding valuations, typically higher for smaller growth stage companies than for scaled M&A targets, decreased below its four-year average to 12.1x across all disclosed fundraises

Disclosed funding value in Q4 2023 was 49% less than the rolling four-year average. On the other hand, dry powder levels grew to an estimated $374Bn from global tech-focused private equity funds.

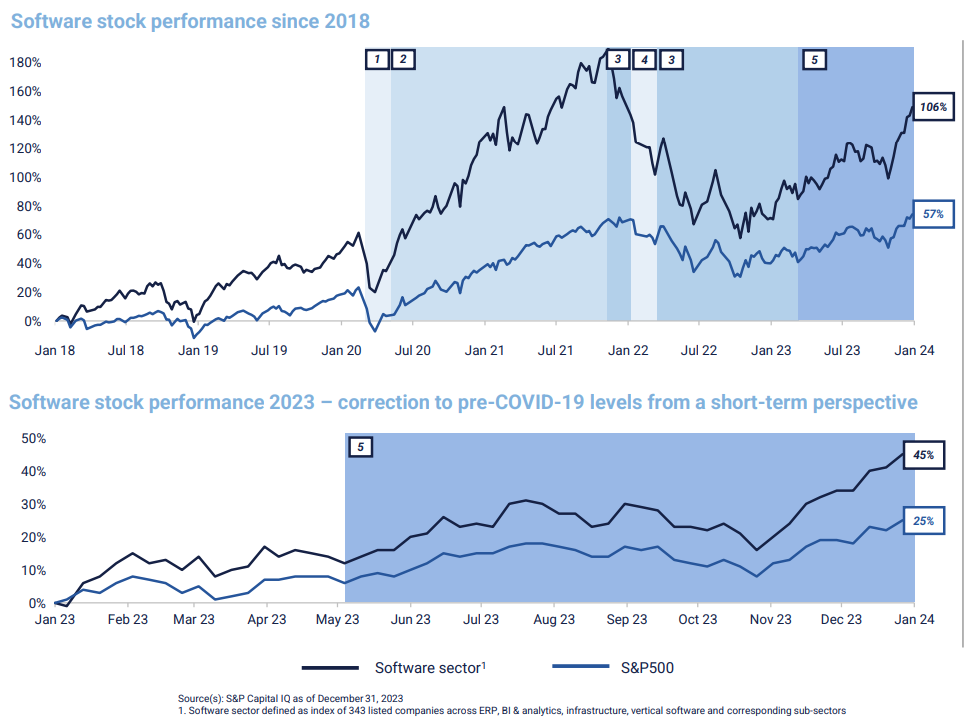

Stock prices are recovering steadily — a potential leading indicator of higher M&A volumes

The chart below maps software stock performance since 2018. The corresponding numbers below are shown in the chart to illustrate stock performance at specific points in time.

Initial cautious investor sentiment after the global spread of COVID-19

Software rallied due to digitalization and government stimulus in response to the pandemic.

Ongoing supply chain issues, geopolitical tension and contractionary monetary policy are causing a decline in valuations.

2022 Russian invasion of Ukraine.

Easing inflationary pressures and anticipated Fed loosening are bullish signals for growth investors.

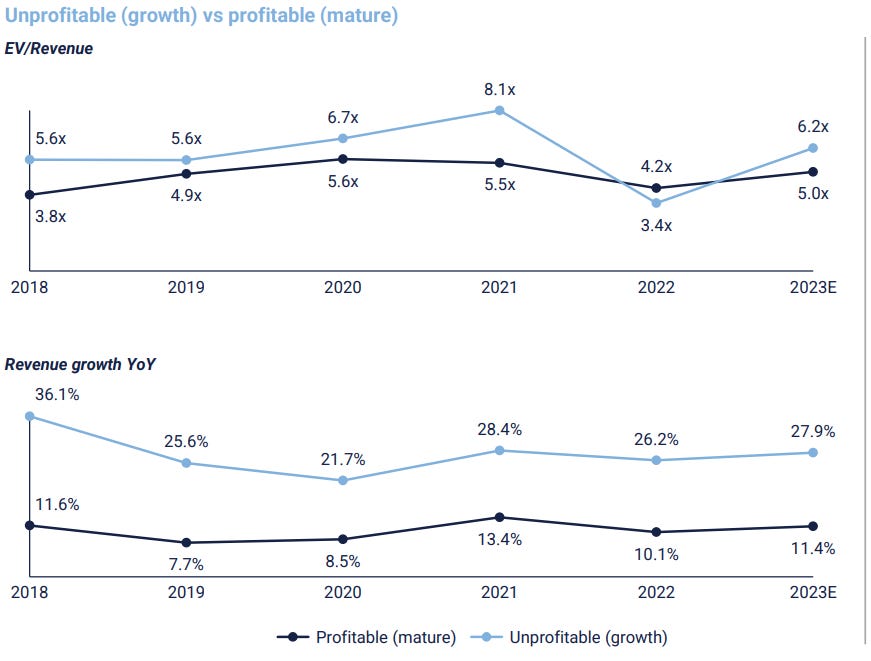

Growth companies overtake profitable companies

Unprofitable software companies show higher top-line growth than their profitable peers, indicating a sacrifice of profitability in favor of growth.

Historically, growth companies are valued higher than mature companies; however, the trend reversed through 2022 as investors flocked to safer, profitable companies.

Growth companies regained their premium over mature companies at the end of 2023, indicating a returning preference for growth companies.

While unprofitable software businesses consistently grow at rates of 10- 15% more than profitable peers, investors typically reward this growth with higher multiples. The gap between these two cohorts diverged, crossed, and returned to historical levels.

A returning preference for growth companies signals growing confidence in the software sector outlook and a return to the norm of a valuation gap between growth and mature software businesses.

Growth and profitability continue as the strongest predictors of high multiples

The Rule of 40(%) is a performance rule-of-thumb metric indicating an attractive SaaS company‘s growth rate plus EBITDA margin exceeds 40% and represents the trade-off between profitability and growth.

Despite the trend of listed companies remaining unprofitable for longer, acquirers are increasingly intolerant of high-growth companies with heavy losses, making raising and transacting at attractive multiples challenging (for example, reaching the Rule of 40 with 60% growth and 20% losses). In addition, 0% EBITDA margins are increasingly a floor for an attractive exit, particularly to a private equity investor.

North American software companies achieved higher growth and outperformed their European peers in valuation

North American software companies historically outperformed their European peers in revenue growth and EV/ Revenue valuations but lagged on profitability.

Both groups have delivered the highest EBITDA margins since 2018, and the profitability gap between the two regions has narrowed to the smallest level on record.

North American software companies remain ahead of their European counterparts in valuation, achieving an EV/ Revenue premium of 2.0x and an EV/ EBITDA premium of 3.6x in 2023

Given the difference, American PE investors continue to seek value in European platforms.

You can view the full report here.

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or investing in their business, we would love to learn more! We just launched our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

Optimizing SaaS: 20 Tips to Ensure Your Company Achieves Maximum Value

11 SaaS Software Trends for 2024: New Forecasts You Should Know

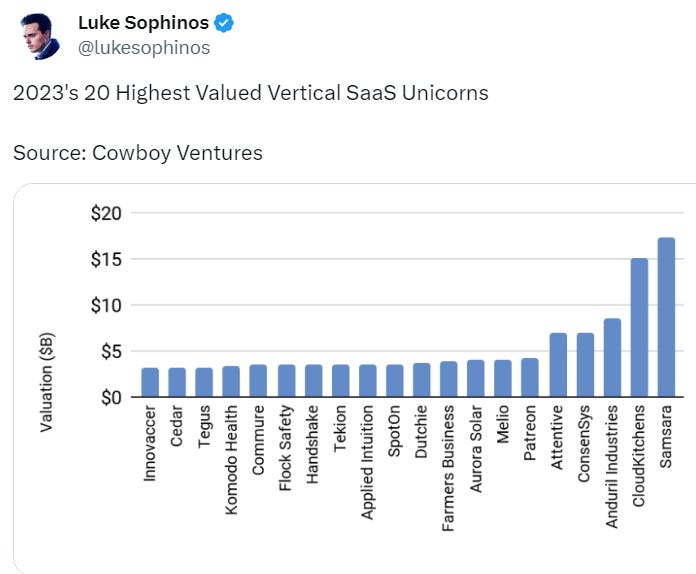

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.

Thanks for including our Scott Brinker podcast