Happy Friday Founders and Friends,

This week we wanted to share some insights on the current state of the software market.

Below are some key takeaways from a presentation that a fellow SaaS investor, Logan Bartlett, put together. This gives a good breakdown on the current state of both the SaaS public and private markets.

Let’s start off with some good news:

The tailwinds driving the valuations in the private tech markets

Technological shifts

Companies staying private for longer than the historical average

Tech industries persistence during COVID

Low interest rates

Non-traditional investors participation in tech private markets continued to rise in 2021

Source: Redpoint: State of Current Market

Valuations paid by acquirers continues to rise

Source: Redpoint: State of Current Market

A few insights of what might lie ahead for both the private and public markets:

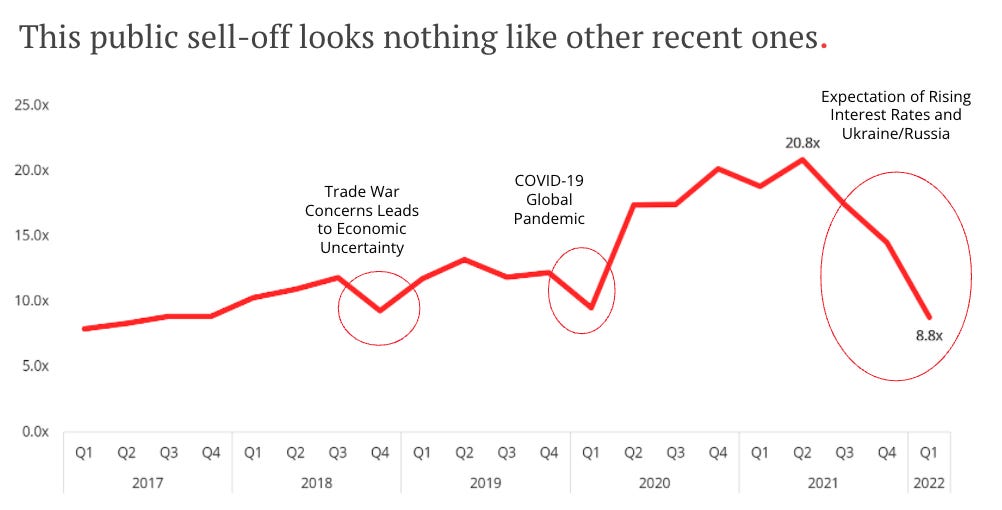

The public markets sell of is a lot different than recent years pull backs

Source: Redpoint: State of Current Market

Software multiples seem to mirror interest rates for the most part

Source: Redpoint: State of Current Market

Summary:

Business fundamentals remain healthy for public software companies

Private markets have not yet meaningfully corrected

There is a lot of uncertainty around the future of both the private & public markets (Ukraine, rising rates etc.)

If you enjoyed this breakdown make sure to check out the full Report👇

Redpoint: State of Current Market

P.S. If you are enjoying our bit-sized insights make sure to subscribe

Favorites from the Ecosystem

Investors👇…..

Founders👇……

Operators👇…..

What We’re Reading and Listening To…

📚 Were the “Covid Multiples” in SaaS Just an Anomaly?

📚 The Private Equity Market in 2021: The Allure of Growth

News from the Industry: deals, deals, and more deals 💰

Veracode secures significant growth investment from TA Associates

Vista Equity eyes April for first close of $24B fund

End Note 🔚

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.