State of the Public SaaS Industry

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news.

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join over 8,500 readers for a summary our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

State of Public SaaS Industry

While The Bi-Weekly Bloom typically focuses on the Private Equity space, we thought this report on the public SaaS market would be of particular interest to our readers as public market data provides context not easily available in the private markets.

A recent brief on the current two trillion dollar public SaaS Market from Meritech Software, an investor in later-stage – and predominantly software companies - explores the state of valuations, operating metrics and KPIs, profitability and scale, and what it means to be a best-in-class public SaaS company.

Trended Valuation Multiples

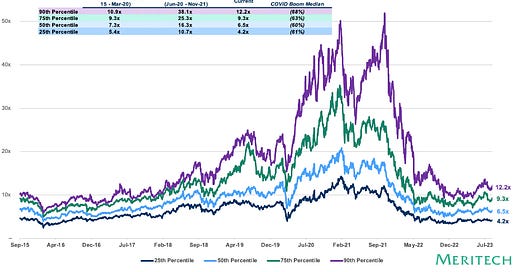

Enterprise Value / NTM Revenue Multiples | All SaaS, Quartiles

This chart shows the 25th, 50th, 75th and 90th percentile NTM revenue multiples. 90th percentile companies have seen the most multiple compression, down 77% from a 2021 high of 51.9x to 12.2x today. The current median multiple is 6.5x, still below the pre-COVID median of 7.3x but down 69% from the 2021 high of 20.8x.

Enterprise Value / NTM Revenue Multiples | Top 10

The following chart shows the same view but only for the ten companies with the highest multiple daily. The current top 10 company median is 13.8x, 23% above the pre-COVID median of 11.2x but down 80% from the 2021 high of 69.0x.

Enterprise Value / Implied ARR | All SaaS

The following chart looks at Implied ARR multiples for the SaaS market for the last eight years. The current median multiple is 7.3x, below the pre-COVID median of 8.8x but down 69% from the 2021 high of 23.4x.

Operating Metrics and KPIs

Median NTM Revenue Growth and Free Cash Flow Margins | All SaaS

Public SaaS companies rapidly shifted towards efficiency. Forward growth rates decreased dramatically, and free cash flow margins increased. Companies are trading growth for profitability in today’s market.

Median Net Dollar Retention | All SaaS

Net dollar retention rates across public SaaS have continued to decline and are at their lowest point in years at a median of 115%. Upsells decreased while churn and contraction increased.

Median Implied ARR per FTE | All SaaS

While companies are raising free cash flow margins, they are forced to do more with less, given layoffs and slower hiring.

Median Payback Period in Months | All SaaS

Payback periods increase as new business is slower, expansion is harder, and churn and contraction increase.

Growth and Profitability Analysis and Regressions

Growth Rate & Profitability Buckets | All SaaS

The below analysis shows median revenue multiples segmented by estimated NTM revenue growth rate and profitability over time, with 2017 being a proxy for pre-COVID times and 2021 being a proxy for the post-COVID boom period. As the other charts show, multiples have come down across the board, even more so for higher-growth companies burning cash. Today, the Street does not expect any public SaaS companies to grow faster than 40% over the next 12 months.

Rule of 40 Buckets | All SaaS

The chart below is similar to the prior chart but is segmented instead based on Rule 40. CrowdStrike is the only company currently in the Rule of 60 bucket.

Rule of 40 Composition | All SaaS

This chart is a more nuanced view, breaking down the composition of the Rule of 40 between growth and cash flow margins and showing both the median multiple and the median Rule of 40 of each bucket. Simple regressions comparing multiples against growth or the Rule of 40 are valuable, but this analysis shows that the composition of your Rule of 40 can meaningfully impact your valuation. This is highlighted in the red boxes in the tables, showing that companies with a similar Rule of 40 growing faster can trade at a significant premium (9.0x) to companies with lower growth and higher free cash flow margins (5.4x).

The bar chart plots those red boxes and visualizes the inverse correlation between Rule of 40 and multiple for this very reason, a dynamic you could not pick up from looking at a simple regression. Investors pay the highest prices for companies that are growing quickly and have some free cash flow. This implies the company has a great market structure, and if growth was slowed, theoretically, free cash flow margins would rise even further. Blank cell(s) indicate no companies are currently in that bucket.

Company Rankings

Top 10 Implied ARR Multiple Companies

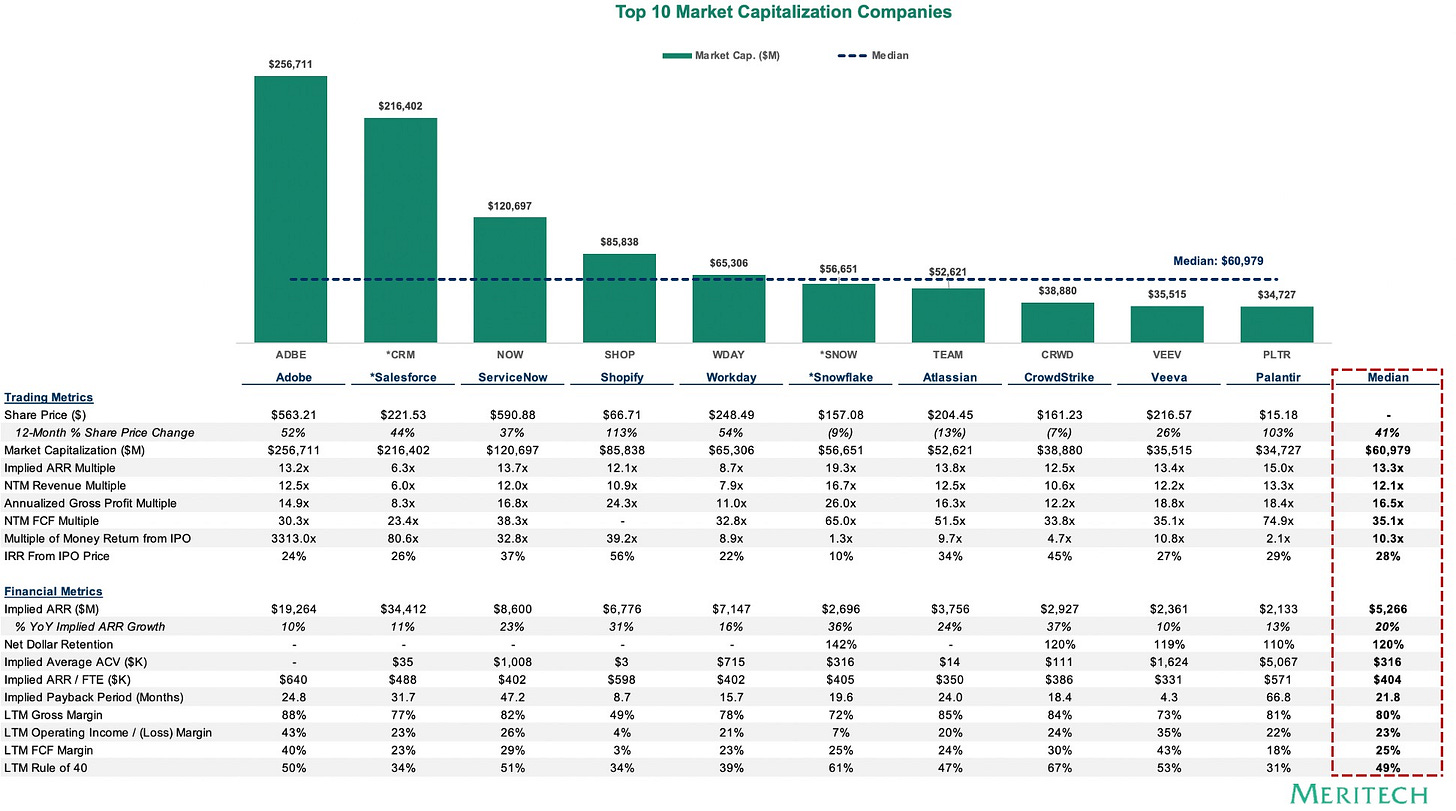

Top 10 Market Capitalization Companies

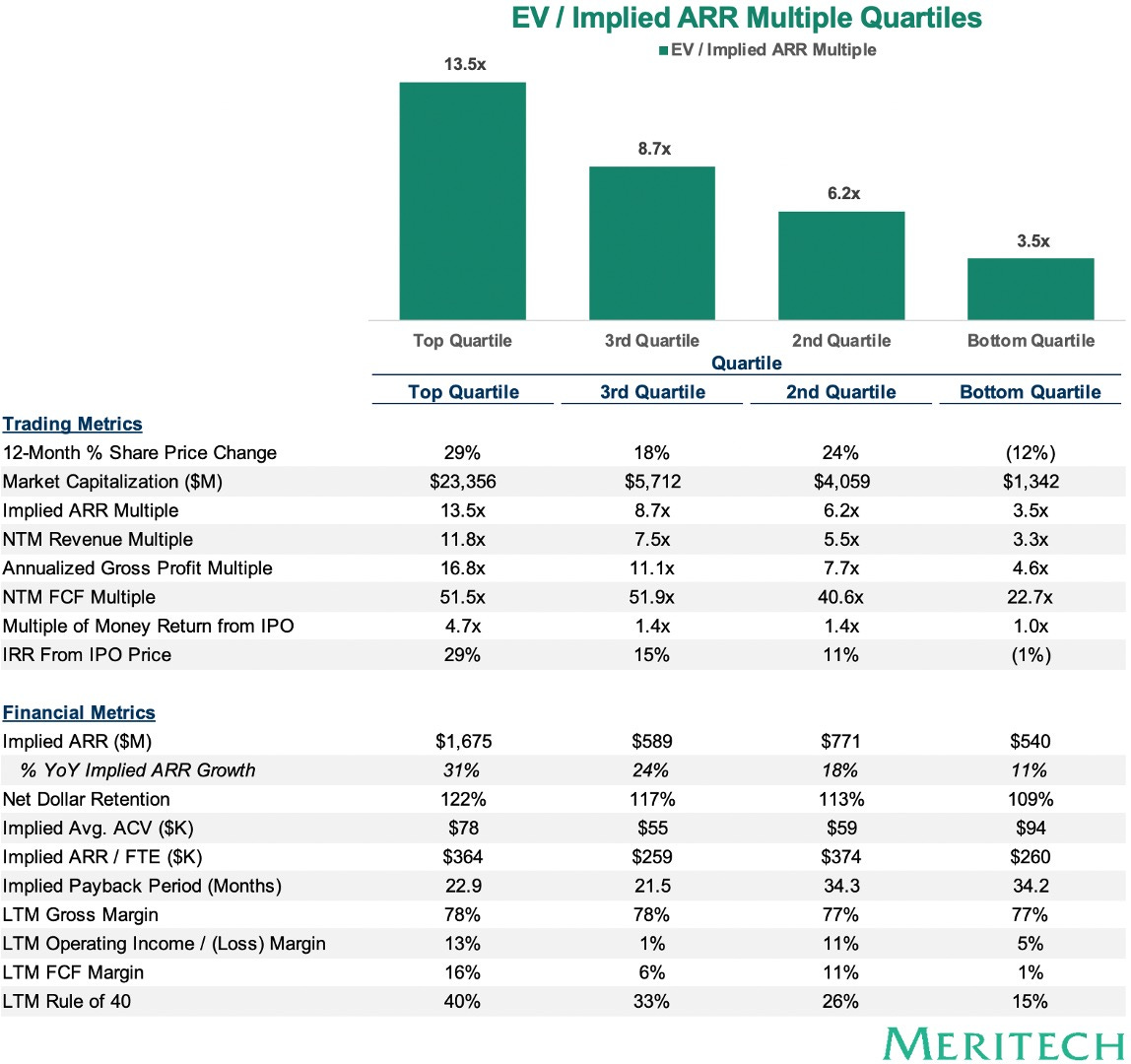

Enterprise Value / Implied ARR Multiple by Quartiles | All SaaS

You can view the full update here.

About Bloom Equity Partners

We're big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment in their business, we would love to learn more! Bloom has a referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

Embracing Product-Led Growth: The Shift Toward User-Centric SaaS Solutions

The Fast Evolution of SaaS Security from 2020 to 2024

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you're enjoying The Bi-Weekly Bloom, we'd appreciate it if you shared it with your network.