Q1 2023 PE Middle Market Report

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news.

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join over 6,000 readers for a summary our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

2023 Q1 PE Middle Market Seizing the Spotlight

The Q1 PE Middle Market Report by Pitchbook was recently released, and it's packed with valuable insights and trends on private equity fund performance, specifically focusing on the middle market. We dove deep into the report and found some interesting data points and findings we'd love to share with you.

Performance & Market Share:

Smaller sized funds (ranging from $100 million to $5 billion) have outperformed megafunds for three consecutive quarters, with a remarkable 917 basis points higher median one-year horizon returns.

The performance gap in favor of the middle market is the widest since 2016.

The middle market's share of all PE buyouts has reached over 75% for two consecutive quarters, marking the highest level in the past five years.

Shifting Deal Dynamics:

Middle-market dealmaking experienced a slight decline in Q1 2023 compared to its peak in late 2021.

Access to debt packages for large leveraged buyouts has become more challenging.

PE firms are shifting their focus towards pursuing smaller deals with more manageable multiples.

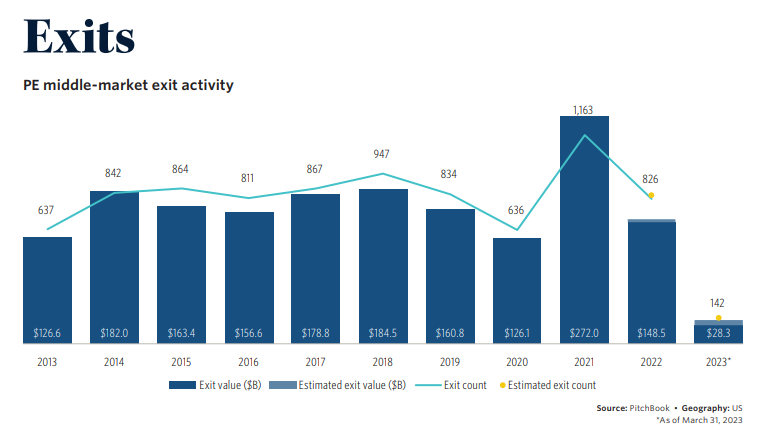

Market Exits:

There is a notable shift occurring in the realm of public-to-private deals.

Fund managers are holding out for better prices before selling to other sponsors or corporate buyers, leading to a decrease in middle-market exit activity during this period

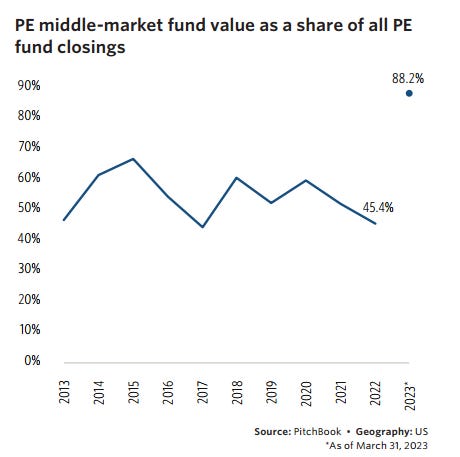

Strong Fundraising:

A total of 38 funds closed during Q1 2023 with $49.9 billion in total

capital raised, up 70.3% YoY when compared with Q1 2022

LPs are favoring smaller buyout funds targeting smaller companies.

Overall, the middle-market PE segment is experiencing strong fundraising momentum.

The US PE middle market is experiencing positive momentum, setting the stage for a promising year of fundraising and success. Despite potential market fluctuations, the middle market's inherent strength and favorable dynamics are attracting attention and creating opportunities.

You can check out the full report here.

About Bloom Equity Partners

We're big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment in their business, we would love to learn more! We just launched our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

Viostream has been immersed in the digital video ecosystem for over 15 years, and they know what turns a good video into a great video. Viostream’s video production services enable the creation of compelling video assets for your organization.

What We’re Reading and Listening To…

Private Equity Businesses Confront Hiring Hurdles for Key Roles

Private Equity Giants Settle for Bite Size Deals

Favorites from the Ecosystem

Investors…

Operators….

If you're enjoying The Bi-Weekly Bloom, we'd appreciate it if you shared it with your network.