The Agentic AI Advantage: Why Gen AI Isn’t Showing Up on the Bottom Line

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition, we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join nearly 10,000 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

The Agentic AI Advantage: Why Gen AI Isn’t Showing Up on the Bottom Line

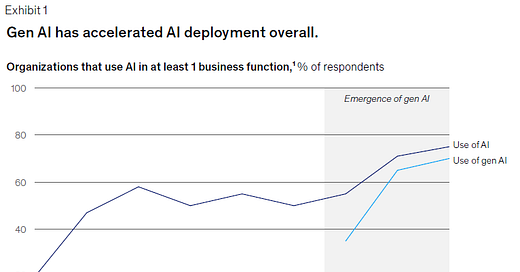

Generative AI adoption has scaled rapidly, but the results haven’t kept up. Nearly 80% of companies report using gen AI across their organizations, and Microsoft 365 Copilot is already deployed at nearly 70% of Fortune 500 companies. Yet more than 80% of these same companies say they’ve seen no material contribution to earnings.

According to McKinsey, this disconnect—what it calls the “gen AI paradox”—stems from three factors: an overemphasis on horizontal tools like copilots, a failure to scale high-value vertical use cases, and the absence of the infrastructure and leadership needed to move from pilots to enterprise-level execution.

This is where agentic AI enters the conversation. These autonomous systems can execute multi-step workflows, integrate with enterprise systems, and unlock the kind of transformation that earlier tools haven’t delivered. For investors and operators, this signals a clear shift in where value will be created and how to capture it.

The Horizontal vs. Vertical Divide: Where the Real Opportunity Lies

At the center of this paradox is a structural imbalance that matters deeply to investors. The enterprise AI market has largely bifurcated into two categories:

Horizontal use cases (e.g., enterprise-wide copilots and chatbots) have scaled quickly. Tools like Microsoft Copilot help employees with tasks like summarizing meetings or drafting emails—valuable in isolation, but often diffuse and hard to tie directly to financial outcomes.

Vertical use cases (e.g., AI embedded in underwriting, operations, or compliance workflows) offer much higher potential for ROI, but fewer than 10% of these use cases have made it past the pilot stage.

This divide creates a unique dynamic. Horizontal tools scale easily but struggle to show impact. Vertical solutions promise real value but are often blocked by organizational and technical complexity.

Enter AI Agents: A Path to Scale What Matters

McKinsey’s research points to a path forward: agentic AI. These are autonomous systems that understand goals, break them into tasks, and execute actions across business systems with minimal human input.

Unlike first-generation AI tools that assist with isolated tasks, agents are designed to operate across full workflows. They integrate reasoning, planning, memory, orchestration, and business system integration. This moves AI from reactive support to proactive execution.

One Case Study: Rethinking Legacy Modernization

Among the most compelling case studies in the McKinsey report is a major bank’s approach to modernizing its legacy infrastructure.

The Challenge:

The bank needed to update over 400 legacy applications; an effort projected to cost more than $600 million and take multiple years. Despite first-gen AI tools, the work remained labor-intensive and difficult to coordinate across development teams.

The Agentic Solution:

Rather than adding more tools to the existing workflow, the bank reimagined the process around autonomous “digital factories.” In this new model, developers acted as supervisors, overseeing teams of agents that collaborated on documentation, code generation, review, and testing.

The Result:

Early adopter teams saw over a 50% reduction in time and effort required. Beyond efficiency, the shift allowed the organization to scale modernization efforts more predictably and with greater consistency across teams.

This illustrates that agentic AI is most powerful in rethinking how high-complexity work gets done, not in marginal productivity gains.

Why Agents Unlock Vertical Use Case Value

Agents address the key limitation that’s held back vertical AI use cases: the ability to automate full, multi-step workflows.

They enable:

Process reinvention: Rather than optimizing legacy processes, agents allow organizations to redesign workflows with human-agent collaboration in mind.

Autonomous orchestration: Agents coordinate across systems, adapt in real time, and collapse cycle times by handling tasks in parallel.

Elastic operations: Agent teams can scale instantly, enabling companies to flex operational capacity without additional headcount.

What This Means for Investors and Operators

For private equity firms and operators, the implications are significant.

The risk:

Companies that stay in horizontal-only deployment or remain stuck in pilot mode may miss a critical wave of enterprise transformation.

The opportunity:

Portfolio companies that successfully implement agent-driven vertical use cases stand to benefit from:

Reduced operational costs

Accelerated time to market

New AI-enabled revenue streams

Improved customer experiences and retention

Just as importantly, agentic AI adoption opens up new dimensions for value creation, particularly in tech-enabled service and vertical SaaS businesses with complex internal workflows.

The CEO Commitment Required

McKinsey’s research finds that fewer than 30% of companies have CEOs directly sponsoring their AI agenda. But agent deployment isn’t a tools initiative—it’s an organizational shift. Companies that succeed in scaling agents invest at the leadership level and build cross-functional teams focused on transformation.

This shift includes:

Moving from isolated use cases to workflow reimagination

Building shared AI infrastructure to scale agents securely

Transitioning from experimentation to scalable delivery

Final Thought

The experimentation phase of generative AI is winding down. The next phase focuses on scaling AI through agents embedded in business-critical workflows.

We believe agentic AI represents a clear opportunity to rewire how enterprise work gets done. For software-enabled businesses, the potential to reduce complexity, scale productivity, and unlock new value is substantial.

The question is no longer whether AI agents will become part of the enterprise fabric. It’s whether your portfolio will act early enough to lead.

Sources:

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: B2B Software and Technology-Enabled Companies

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M

Growth: No requirement

Profitability: Negative - $10M EBITDA

Investment Type: Operational control required

Business Development Team:

Abe Borden – Principal – abe@bloomequitypartners.com

Adam Kaseff – Senior Associate – adam.kaseff@bloomequitypartners.com

If you or someone you know is considering selling or investing in their business, we would love to learn more! Check out our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

The Modern Playbook for Value Creation in PE

Distribution - The Only Moat Left?

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.