Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news.

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join over 8,500 readers for a summary our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

Bloom Equity Completes Buyout of RightCrowd

Bloom Equity Partners has completed the buyout of RightCrowd’s Workforce Access Software business and Presence Control business via a carveout of RightCrowd Software Pty Ltd. and RightCrowd NV from Australian Stock Exchange listed RightCrowd Limited (ASX:RCW).

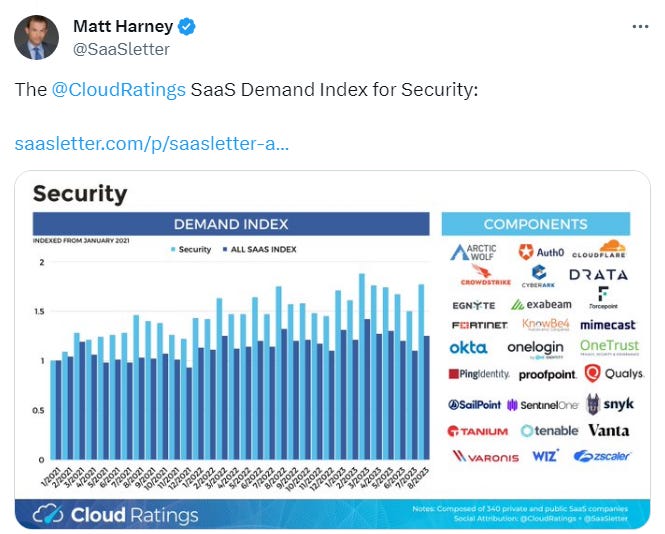

Founded in 2004, RightCrowd is a global provider of safety, security and compliance software solutions managing access and presence of people. Combined with its long-standing relationships with major security and business systems vendors, RightCrowd is able to deliver world-class solutions to meet clients’ most difficult security and compliance challenges. RightCrowd serves major global organizations, including Fortune 50 companies across most industry verticals. With offices in the USA, Canada, Belgium, Philippines, and Australia, RightCrowd has over 130 employees.

To learn more, please visit the Bloom Equity Partners press release.

The Current State of Tech M&A

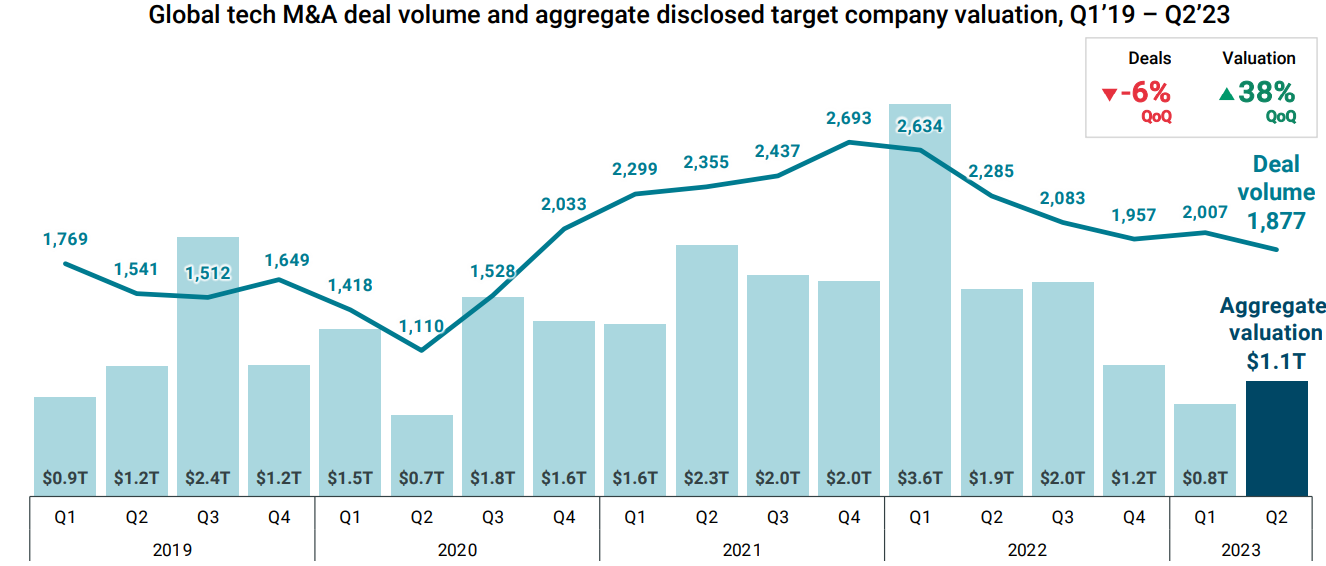

In Q2 2023, tech M&A transaction volumes fell to their lowest levels since 2020, according to CBI Insight’s Tech M&A Q2 2023 report. What happened? We reviewed the report to find important insights into the data behind the slowdown and how technology buyers respond to the current economic climate.

Deal Volume Hits Covid Lows

Tech M&A deal volume has dropped to the lowest level since 2020, with risk-off strategic acquirers being the primary drivers of a slowdown. Financial sponsors with large amounts of dry powder remain active, but are moving cautiously due to a lack of high-quality assets, more expensive debt and macro uncertainty.

Smaller companies see more action

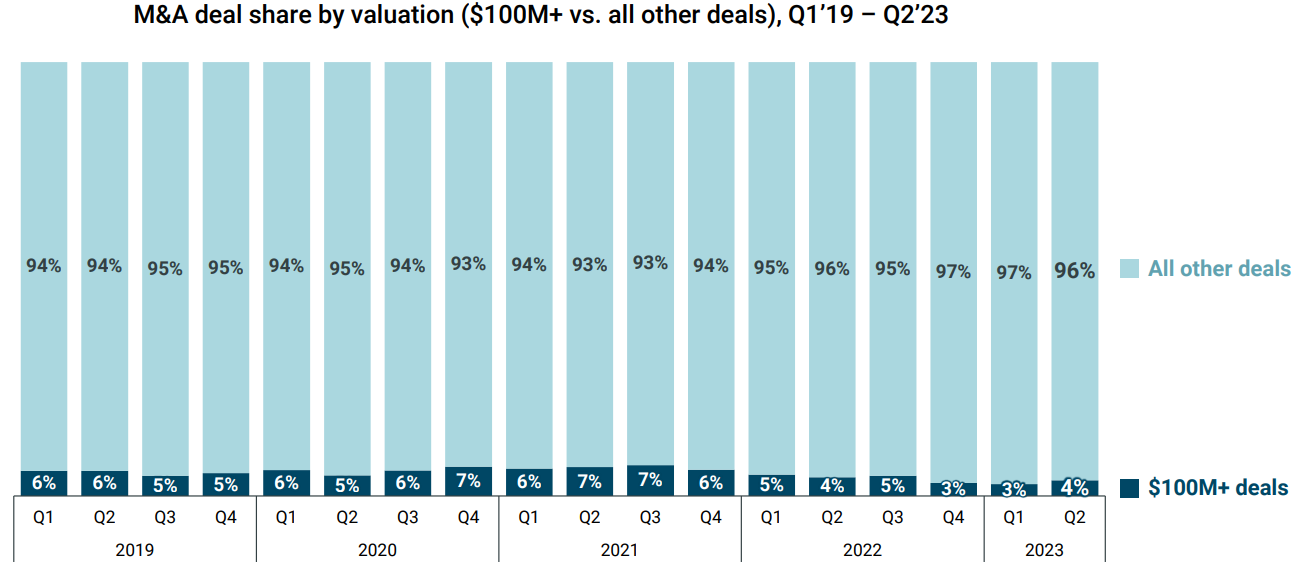

Two-thirds of Q2 2023 tech acquisitions featured smaller companies employing fewer than 50 people.

M&A targets worth $100M+ remain a smaller portion (4%) of total M&A activity compared to pre-2022 levels.

Valuations rebound slightly

The median M&A valuation in Q2’23 rebounds to $45M, in line with historical levels

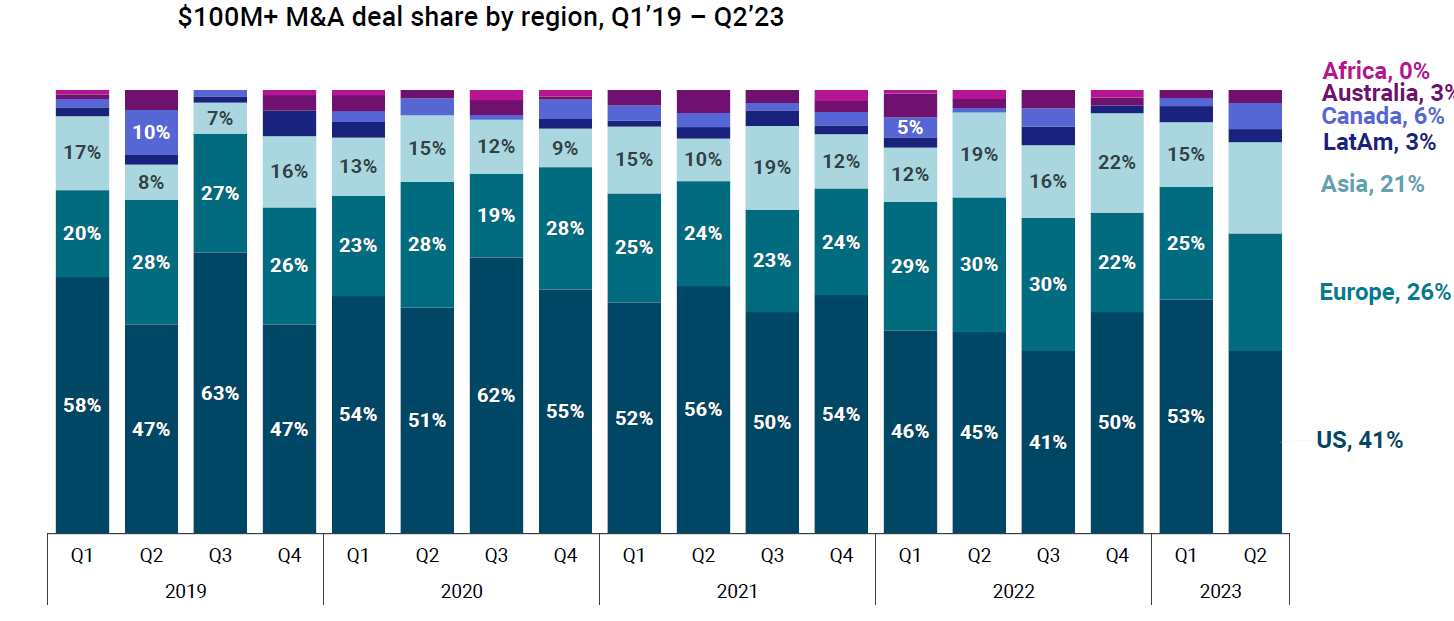

Europe leads in tech M&A volume

For the sixth quarter in a row, European M&A activity outpaced the US on a deal volume basis. However, the US deals are larger, comprising 41% of $100M+ M&A deals in Q2. Even with the largest M&A deals, the US share of $100M+ deals declines as Europe & Asia see growth

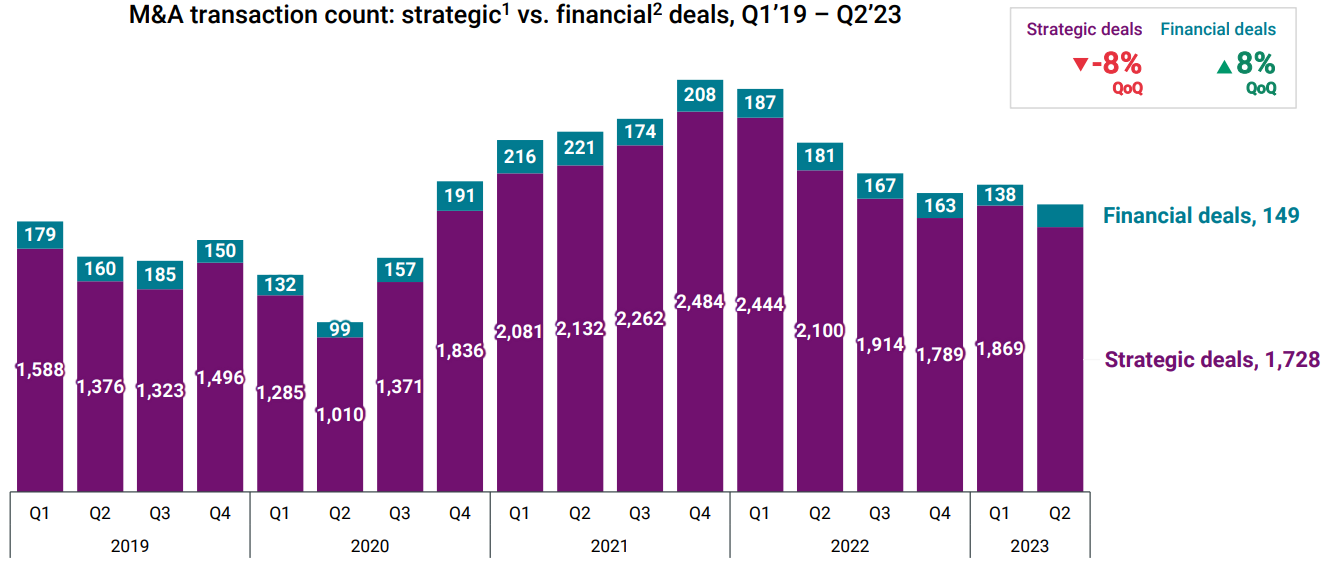

Strategic and Financial Buyers Slow Deal Activity

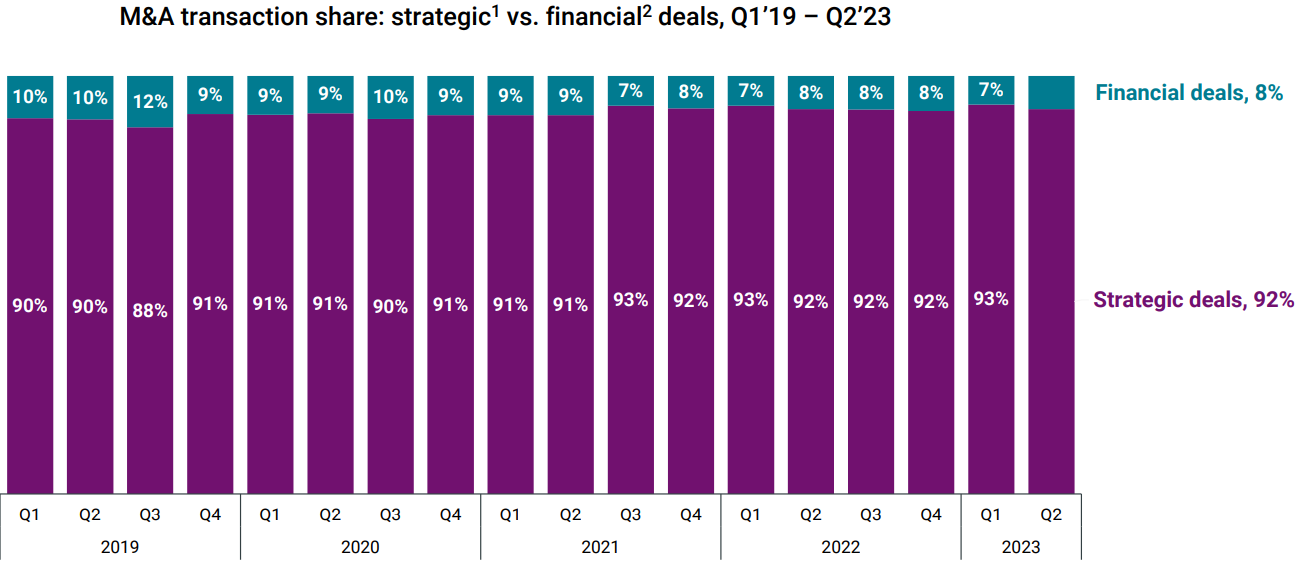

Financial buyers' share of tech M&A deals has decreased year-over-year since 2019. Strategic buyers are risk-off — doing the fewest deals since 2020.

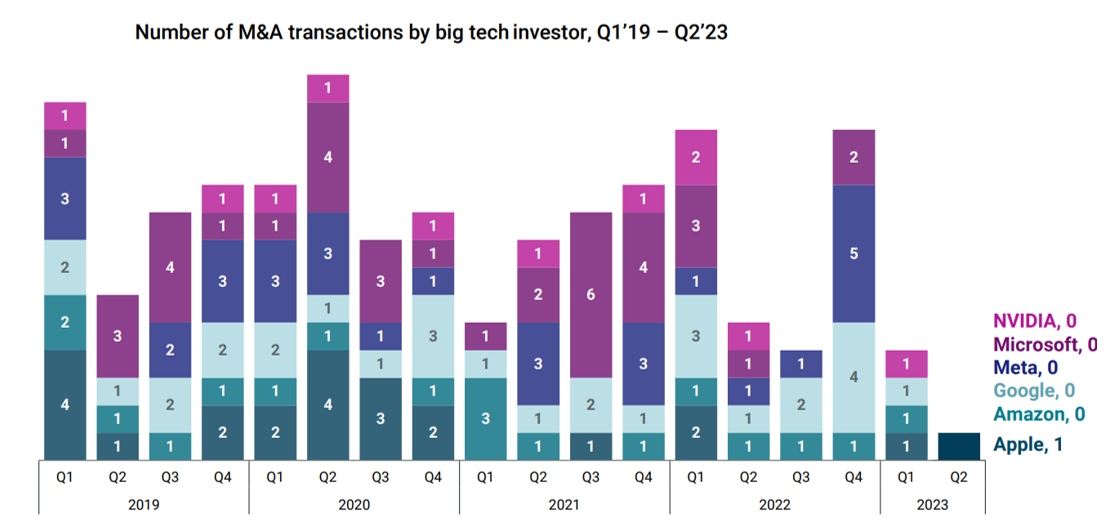

Big Tech M&A hits new low

In Q2, big tech M&A activity hit an 18-quarter low, and Apple was the only big tech firm to acquire a company. Beyond the prevailing risk-off mentality of strategic acquirers, big tech players are facing a more challenging regulatory (antitrust) climate — especially in the US and Europe.

You can view the full report here.

About Bloom Equity Partners

We're big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment in their business, we would love to learn more! We just launched our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

The Power of Content to Fuel Growth for B2B Software Companies

The Enterprise SaaS Unicorns Most Likely to Go Public

The Worst of Times for M&A and The Best of Times

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you're enjoying The Bi-Weekly Bloom, we'd appreciate it if you shared it with your network.