The Latest SaaS Pricing Trends

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news.

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join over 6,000 readers for a summary our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

The Latest SaaS Pricing Trends

Vendr recently released its “SaaS Trends Report” for Q2 2023, offering a detailed breakdown of the most critical trends in the software market to help SaaS buyers and sellers navigate the year ahead.

The report is based on over 3,000 transactions processed on the Vendr platform for Q2, totaling over $240 million in SaaS spend. We reviewed the report and uncovered some valuable insights for you.

Over the past 18 months, the software market has undergone a significant transformation with tighter budgets, slower growth and more challenging capital markets. This new reality is reflected in both purchasing behaviors and sales strategies.

Buyers are consolidating tech stacks, prioritizing existing suppliers and reducing spending on new products.

Sellers focus on price transparency, as noted by a gradual decline in average discounts.

Annualized Contract Value (ACV) Hits Lowest Point in Three Years

Average ACV dropped by 45% between Q1 and Q2.

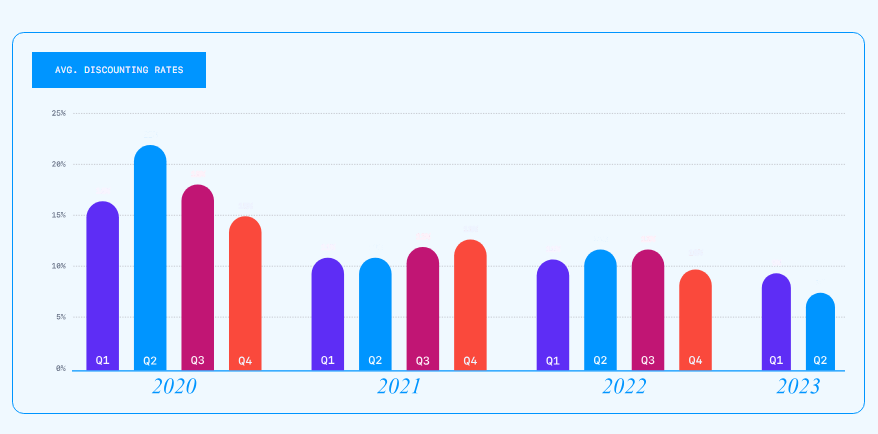

The discount rate decreased from 11% in Q2 2022, to 9% in Q1 2023 to 7% in Q2 2023

Buyers opt for fewer seats, choosing the most affordable tier and reducing expenses.

CRM, Accounting & Finance, and IT Service Management product categories experienced the most significant declines in average ACV.

Despite the ACV decrease, major suppliers in CRM, project management and marketing automation plan to raise prices to combat lower contract values.

The charts below illustrate the average ACV for all SaaS transactions through Vendr, quarter by quarter, for 2022 and 2023.

Discount Rates Declining

The discount rate is tracked as the delta between the price offered at the beginning and end of the negotiation. Tracking discounts shows the extent to which suppliers deviate from the listed price.

Despite other industry surveys showing sellers’ willingness to offer discounts, this report demonstrates the opposite, with sellers reluctant to offer deep discounts.

Less discounting and lower ACV indicate suppliers are moving toward standardizing list price with the negotiated price.

Top Product Categories

Password Management, B2B Sales Prospecting, and App Integration & Automation products sold the most from Q1 2023 to Q2 2023.

Sales Intelligence is the most popular SaaS category, rising five spots since Q1, with the ACV for Sales Intelligence tools increasing by over 20% in Q2. With layoffs rising, companies are doing more with less — including go-to-market. Sales Intelligence products help companies prospect at a high velocity and add to the pipeline with fewer resources.

The top three categories, Sales Intelligence, Cybersecurity, and Cloud Data Integration, reflect companies’ mission-critical priorities.

Top Net-New Purchased Products in Q2 2023

Buyers are shifting budgets to proven products and avoiding taking a chance on newer companies.

New product purchases emphasize 2023’s mission-critical priorities: growth, sustainability, and security.

AI Not Strongly Influencing SaaS Purchasing

Big tech companies like Google, Microsoft, Salesforce, and Adobe lead the way in B2B SaaS with native AI solutions deeply embedded in available products. Zendesk and Atlassian have developed impressive AI engines, though generally offering less day-to-day value to customers.

Smaller SaaS companies are leveraging the industry-leading technology of top companies to enable products with AI tools.

Compared to the broader SaaS ecosystem, AI is being embraced more by go-to-market tools like CRM, sales intelligence, and marketing/sales automation.

Predictions for Q3 2023

Expect clearer pricing information and fewer discounts as more companies streamline sales teams, and suppliers are less likely to play games or drag out sales processes.

In AI, distribution will be the differentiator. The explosion of AI startups will produce leaders, but incumbent players who can quickly and meaningfully put AI functionality in front of large numbers of users will be the biggest winners.

Stack consolidation will lead buyers to purchase fewer new products and focus on getting more value from existing suppliers instead of adding new ones. Suppliers will offer more features, tools and comprehensive product suites to meet buyers' needs and avoid being dropped.

The year of the price hike continues. Prices will increase as SaaS suppliers manage challenges like declining ACV, reduced seat counts, and the need to hit growth targets.

You can view the full report here.

About Bloom Equity Partners

We're big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment in their business, we would love to learn more! We just launched our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

Tech M&A Adjusts to a New Normal

SaaS Relevance in Recessionary Times

Favorites from the Ecosystem

Investors…

Operators….

If you're enjoying The Bi-Weekly Bloom, we'd appreciate it if you shared it with your network.