The Limitations and Insights of Valuation Multiples in Software Investing

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition, we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

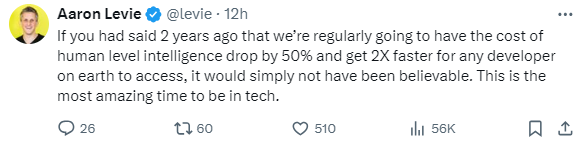

Insightful tweets from fellow investors and operators

Join nearly 10,000 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

Counterpoint Global Insights - Valuation Multiples

As an investor in modern technology companies, Bloom is challenged daily on when and how to use valuation multiples in concert within an expansive toolbox of pricing techniques to measure our opportunities to invest with our partner companies. Our takeaways below provide insight and understanding to some of the most recognizable valuation multiples, their usage and potential shortcomings.

Multiples are the tip of the iceberg. In most cases, there is more than meets the eye.

Widely used valuation multiples like P/E (Price to Earnings), EV/EBITDA (Enterprise Value to Earnings Before Interest, Taxes, Depreciation, Amortization), P/FCF (Price to Free Cash Flow), EV / ARR (Enterprise Value to Annual Recurring Revenue) are complex financial realities compressed into single figures. Although they are important calculations that are foundational to any investment analysis, they can provide oversimplifications, excluding a number of important operational considerations. These operational considerations provide a more comprehensive view of a company’s intrinsic value.

What Multiples Miss

Changes in accounting practices and the rise of intangible investments erode the informative value of earnings, leading to discrepancies between reported and adjusted figures. Multiples often fail to account for the return on investments and the impact of the time, capital intensity, considerations on intangible assets, and variations in profitability, capital structure, or tax rates.

Adjusting for Non-GAAP Measures

Companies regularly provide non-GAAP earnings alongside GAAP results, offering insights that require additional scrutiny. As businesses have unique characteristics, it is important to delve deeply into these alternative views. Stock-based compensation, restructuring charges, capital investments, EBITDA, FCF and M&A related costs should serve as breadcrumbs to formulate a view on a company’s exclusive operational position. Conclusion

While valuation multiples are indispensable tools in investing, they have inherent limitations. Investors should employ multiples as part of a broader valuation strategy, incorporating deep analysis of fundamental drivers and adjustments for intangible investments and non-recurring items.

We’re Hiring: Operating Advisor, Talent

Bloom Equity is hiring for a seasoned Talent focused Operating Advisor with extensive experience working with PE-backed software companies to lead the transformation and optimization of the talent function across multiple companies. To learn more, click here.

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or investing in their business, we would love to learn more! Check out our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

Private Equity is Helping Banks Shed Some of Their Risk

The Importance of Relationship Banks and How They can Benefit Alternative Investment Funds

Favorites from the Ecosystem

Investors…

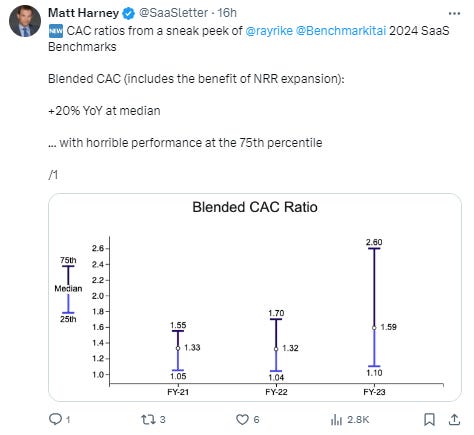

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.