The Shift from PLG to PLS: A Smarter Path to Enterprise-Scale Growth

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news. In each edition, we delve into:

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join nearly 10,000 readers for a summary of our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

The Shift from PLG to PLS: A Smarter Path to Enterprise-Scale Growth

Over the past decade, product-led growth (PLG) has become the default go-to-market motion for SaaS: users sign up, explore, and expand - all without ever talking to sales. Think freemium models, seamless onboarding, and viral team adoption. It’s fast, efficient, and loved by users.

But here’s the catch: PLG alone rarely gets you enterprise-scale revenue.

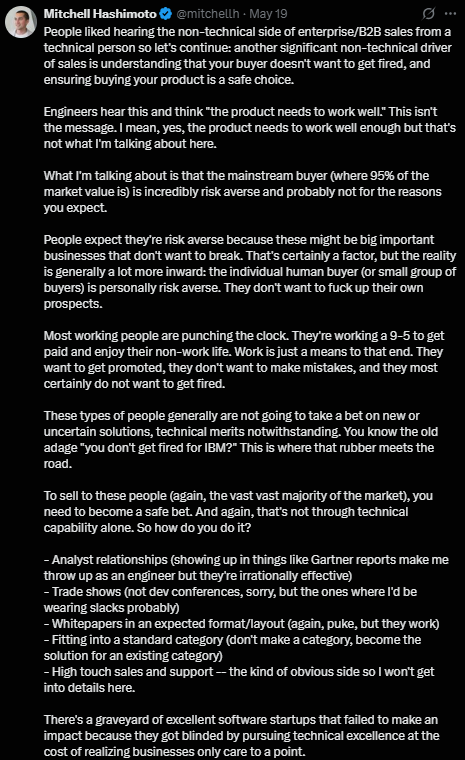

As SaaS companies grow, many are finding they need more than just a great product to originate and close complex deals. That’s where Product-Led Sales (PLS) comes in - using product usage data to guide smarter, more targeted sales efforts.

A recent McKinsey report, “From product-led growth to product-led sales: Beyond the PLG hype”, spotlights this shift: leading SaaS businesses are layering sales onto product-led foundations to accelerate revenue, reduce CAC, and win in competitive markets.

Why the shift is happening:

PLG can jumpstart growth, but PLS drives revenue expansion.

While PLG excels at adoption, self-serve alone often stalls when it’s time to upsell teams, land multi-year contracts, or expand across departments. That’s why over 60% of PLG companies add sales teams within two years.

Companies like Atlassian and Miro scaled rapidly with PLG, but both introduced sales-assisted motions as enterprise demand increased.

Take Atlassian, now valued at $46 billion. The company built its foundation on product-led growth, spending just 19% of revenue on sales and marketing at IPO, far below industry averages. But as President Jay Simons explained, pure PLG eventually hit natural limits:

“If we add 5,000 new customers a quarter and add that to the base of 120,000 existing customers, it would be very, very difficult to do that if we had to touch all of those customers along the way.”

Atlassian’s solution? A hybrid approach where the product drives most customer acquisition autonomously, but sales engages for high-value opportunities:

“If you're a large enterprise customer that has more complexity, or potentially more value to us, we have a team that can help steer you in the right direction... Most customers, if they wanted to go all the way through signup and straight into the product, they could. If they don't need us, that's great. We'll leave you alone. If you do need us, then we'll absolutely bend over backwards to help.”

This approach, letting the product do the heavy lifting while sales focuses on complex, high-value deals, exemplifies how PLS creates efficiency at scale.

Product usage data is the foundation of modern sales strategy.

Traditional marketing funnels rely on soft signals (like email opens or content downloads). PLS replaces these with Product Qualified Leads (PQLs) - users who activate key features, invite teammates, or hit usage thresholds.

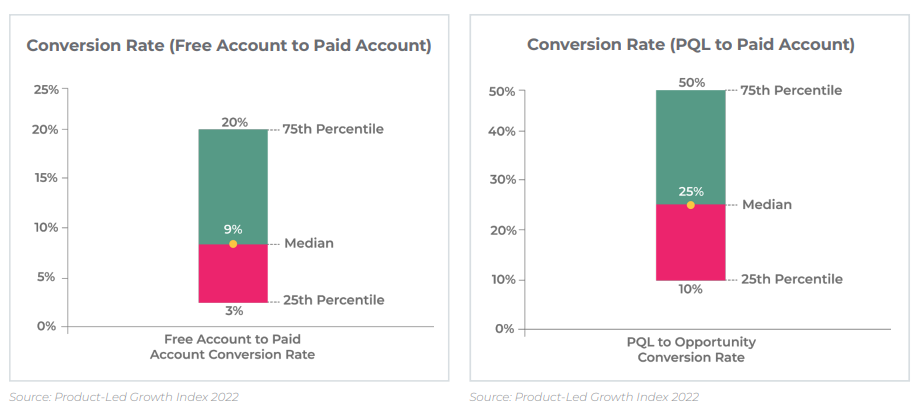

PQLs convert at a much higher rate than traditional leads. Gainsight reported that findings from The Product-Led Growth Index 2022 indicate that free trials using PQLs result in a 2.8x higher conversion rate than those who don't use PQLs.

Platforms like Pocus and Endgame are helping teams identify which accounts are ready for outreach based on in-product behavior, not guesswork.

Take DigitalOcean's approach: instead of chasing cold leads, their sales team used Pocus to identify accounts where usage spiked significantly in recent months or users hit specific engagement thresholds. The platform automatically surfaces these high-intent accounts and sends alerts to sales reps when certain behavioral triggers are met, enabling the team to focus outreach on users already showing buying signals. The result? They scaled from zero to over 10 product-qualified leads actioned daily by the sales team, with significantly higher conversion rates than traditional lead sources. These operational improvements translate directly to metrics investors care about.

PLS makes growth more efficient—and investors are taking note

The efficiency gains are significant. Companies implementing product-led sales strategies report meaningful improvements across key metrics - from shorter sales cycles to lower customer acquisition costs and higher lifetime value ratios in their best-performing segments.

In today's funding environment, efficiency metrics matter more than ever. It's not just about top-of-funnel traction, investors are looking for signs of a scalable, insight-driven GTM engine.

Our Take: It’s not a pivot. It’s an evolution

The product is still your strongest seller, but it can’t close every deal on its own. As usage signals become more trackable and buyers increasingly expect both self-serve and sales-assisted paths, companies that embrace PLS are gaining a clear edge.

PLS doesn’t replace PLG, it builds on it. The product remains the entry point, but sales teams guide high-intent users across the finish line. The most effective companies treat usage data as a strategic asset, surface insights in real time, and foster tight collaboration between product and sales.

At Bloom, we’re seeing this hybrid model become the new standard in modern SaaS. As companies mature, Product-Led Sales isn’t just a tactical adjustment, it’s the next stage of go-to-market maturity.

References:

McKinsey: From product-led growth to product-led sales: Beyond the PLG hype

Gainsight: Benchmark: Product qualified lead (PQL) conversion rates

Ortto: “Low touch does not mean no touch”: How to adopt a product-led sales model

Portfolio Spotlight

RightCrowd, a Bloom portfolio company, was recently highlighted by GrowthPoint Technology Partners for its strong position in the field service and physical security software landscape. As strategic acquisition activity heats up across vertical SaaS, we’re proud to back companies like RightCrowd that are leading in critical, high-growth categories.

Read more →

Join Our Portfolio Company: We're Hiring Account Executives

Bloom Equity Partners is rapidly scaling the Go to Market team for one of our portfolio investments in the Enterprise Data Management vertical. We're seeking our next two Account Executives to join this exciting company that sells into the Fortune 5000 with an incredible team, solution, and established customer list already in place. Remote positions available across the US. If you're a motivated sales professional looking to make an impact in a dynamic, high-growth environment, we want to hear from you.

See full job posting and apply here.

About Bloom Equity Partners

We’re big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: B2B Software and Technology-Enabled Companies

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M

Growth: No requirement

Profitability: Negative - $10M EBITDA

Investment Type: Operational control required

Business Development Team:

Abe Borden – Principal – abe@bloomequitypartners.com

Adam Kaseff – Senior Associate – adam.kaseff@bloomequitypartners.com

If you or someone you know is considering selling or investing in their business, we would love to learn more! Check out our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

Math to Evaluate Sales Reps & GTM

A CEO’s High-Level Guide to GTM Troubleshooting

Favorites from the Ecosystem

Investors…

Operators…

Founders…

If you’re enjoying The Bi-Weekly Bloom, we’d appreciate it if you shared it with your network.