The State of Middle Market PE in 3 Charts

News, insights and updates from the team at Bloom Equity Partners

Happy Friday fellow technology investors and operators,

Welcome back to another edition of The Weekly Bloom - one of the best weekly resources for Private Equity, Enterprise Software, and Technology news. We hope that you enjoyed last week’s 2022 SaaS M&A Review.

This week’s edition features:

The State of Middle Market PE

What We’re Reading and Listening To…

Graham Weaver’s tips for improving customer retention

Bain’s PE podcast on operational due diligence

Insights from Orlando Bravo and other software investors and operators

2022 Middle Market PE Review

Earlier this month Pitchbook released its US PE Middle Market Report, breaking down some notable trends that happened across the space. As middle-market investors, our team wanted to share a few key insights from the report.

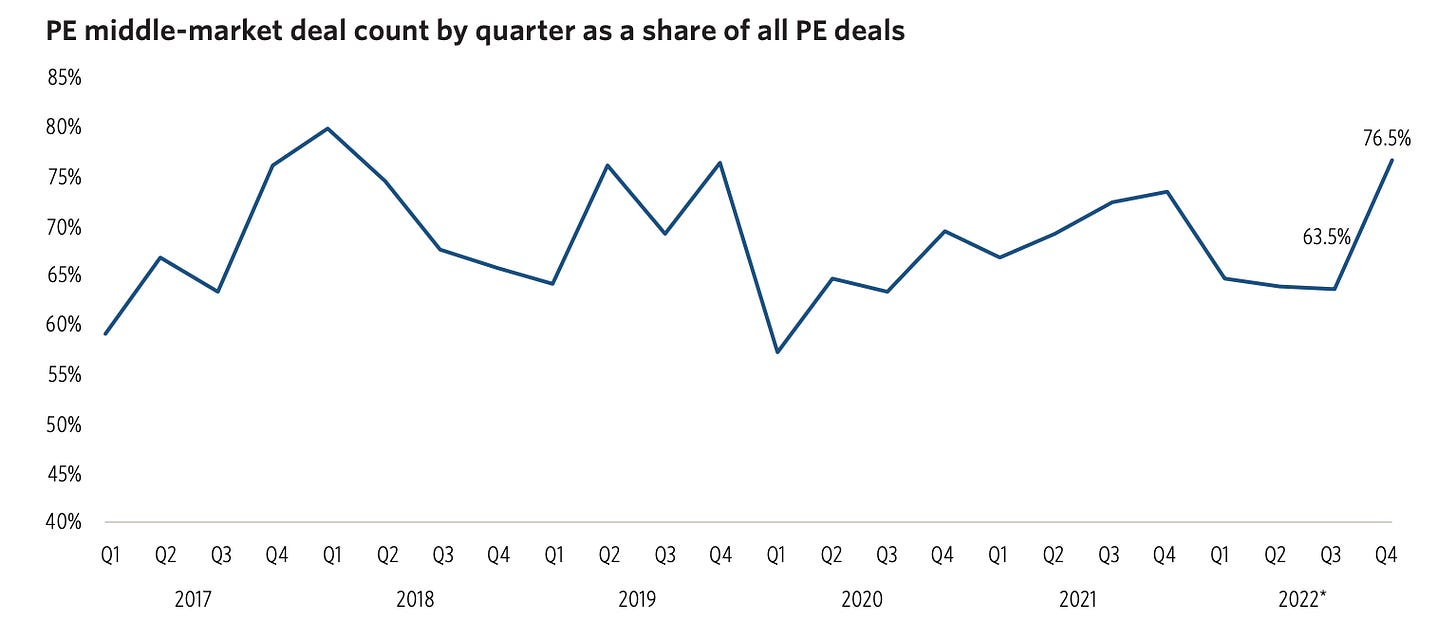

Middle-market deal count as a share of PE deals reached near-record highs:

In Q4 2022, middle-market deal count accounted for 76.5% of all private equity deals, marking the highest quarterly level in the past five years. This increase may be indicative of deal fatigue affecting larger transactions. As financing for mega buyout deals becomes more difficult, sponsors are seeking out add-on investments.

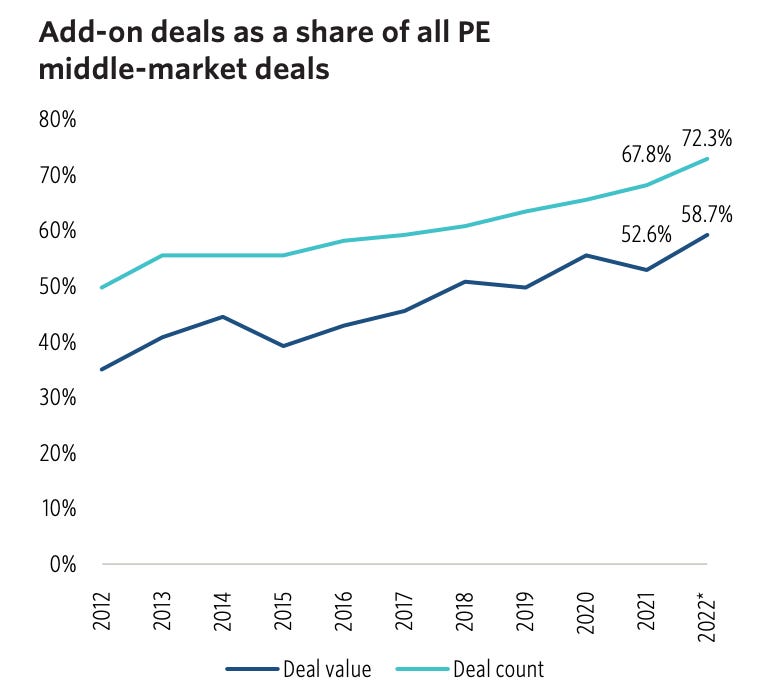

Add-on deals fueled middle market M&A:

The middle market's smaller, fragmented nature often presents more opportunities for scaling. Middle-market companies are typically more nimbler than their larger counterparts, enabling smoother integration processes. As public markets struggle due to macroeconomic headwinds and private market valuations adapt accordingly, add-ons become an increasingly appealing option for general partners (GPs) seeking to expand existing portfolio companies.

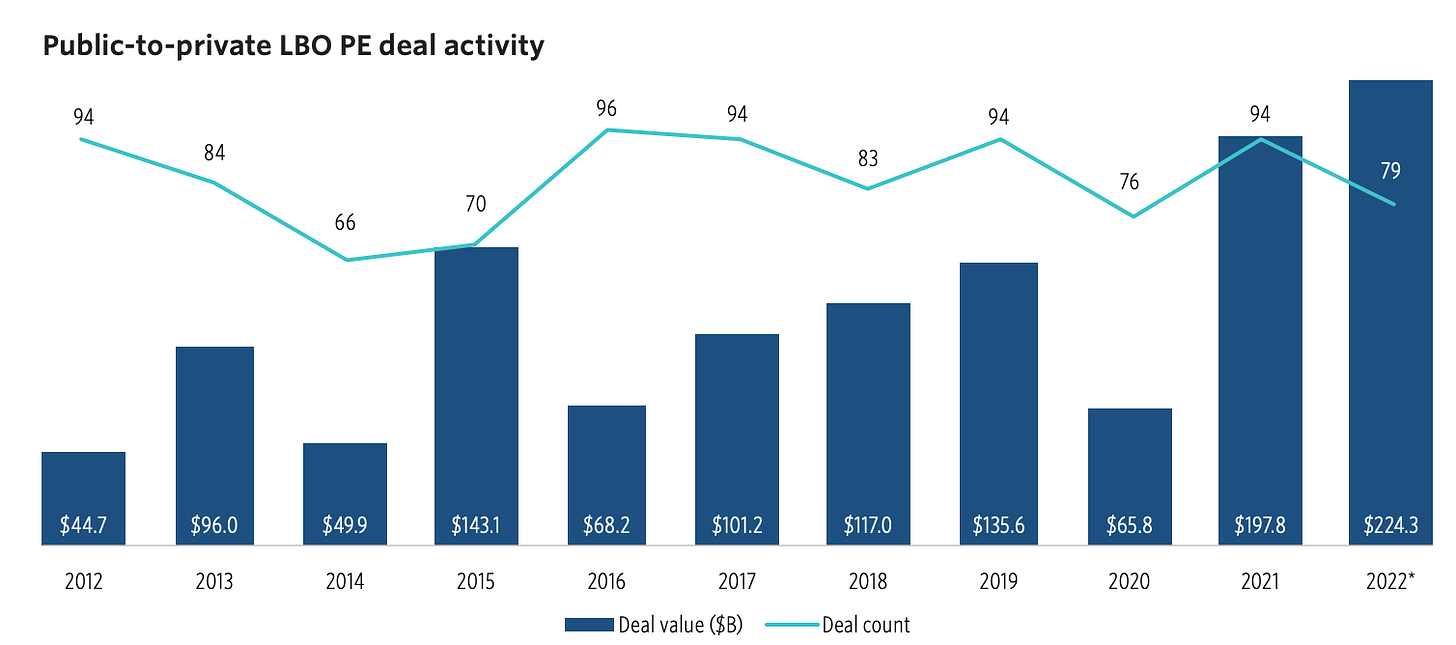

Take-privates dominated as public company valuations continued to drop:

Middle-market take privates reached record levels of deal value in 2022 showing that as market caps dropped into the middle-market territory, sponsors took advantage of the opportunity to take these firms private. Additionally, the median deal size of take privates in 2022 shrank from $1.7B in the first half of 2022 to $316.0 million in the second half of the year.

Here is the full report👇

Partner with Bloom Equity Partners

We're big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $40M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within six months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment in their business, we would love to learn more! We just launched our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

Alpine Software: Tips for improving customer retention

Bloom Equity Partners Career Opportunity

Investing from our debut Fund, we’re actively hiring for our investment team, linked below. Reach out to careers@bloomequitypartners.com or on the specific job ad if you'd like to learn more / recommend someone for a role.

Favorites from the Ecosystem

Investors….

Operators….

if you're enjoying The Weekly Bloom, we'd appreciate if you shared it with your network.