Happy Friday, folks.

We are back with another week of SaaS insights and updates from the team at Bloom Equity Partners.

This week we’re sharing some key themes from Battery Ventures ‘state of the cloud report’ as well as some weekly content from across the industry. (p.s. Patrick Campbell’s recession thread is a must-read!)

If you are a new reader, welcome 👋 to The Weekly Bloom. Every Friday, we share our favorite SaaS articles, podcasts, tweets, and news headlines from across the industry to now ~4,500 readers. We also share some insights from our team and other successful professionals in the industry.

Battery Ventures OpenCloud 2022 Breakdown

Earlier last week, Battery Ventures released its highly anticipated 4th annual OpenCloud presentation which was 45 slides of top-notch insights.

And what did they make sure to note:

They’re still long cloud infrastructure and open-source software 🔥

If you want to read the full 45-page report, you can check it out: here!

But if you’re like us and have a jam-packed Friday, here are the condensed ‘cliff notes’:

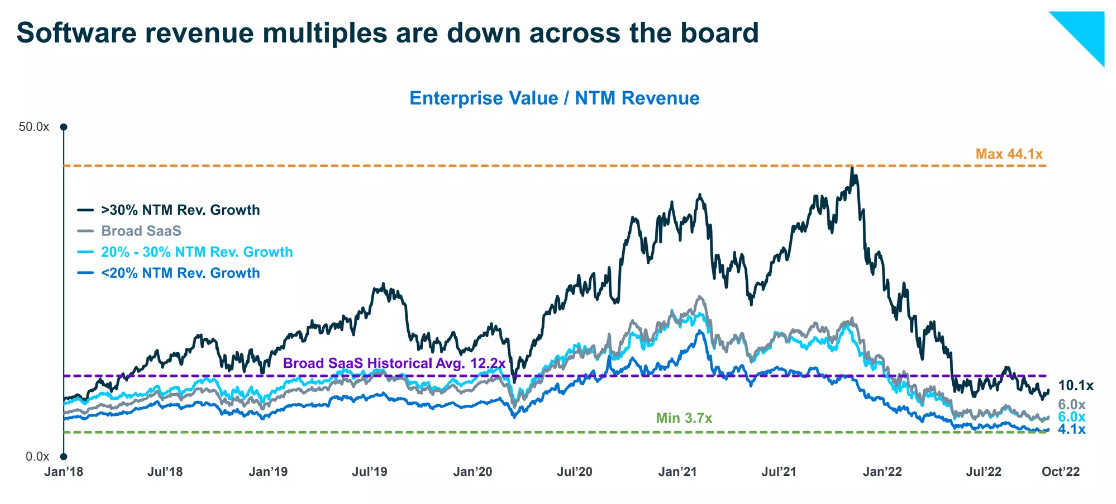

Public software multiples are below 2018 averages

This is mainly due to interest rate hikes and macro sentiment despite company growth forecasts reaming healthy.

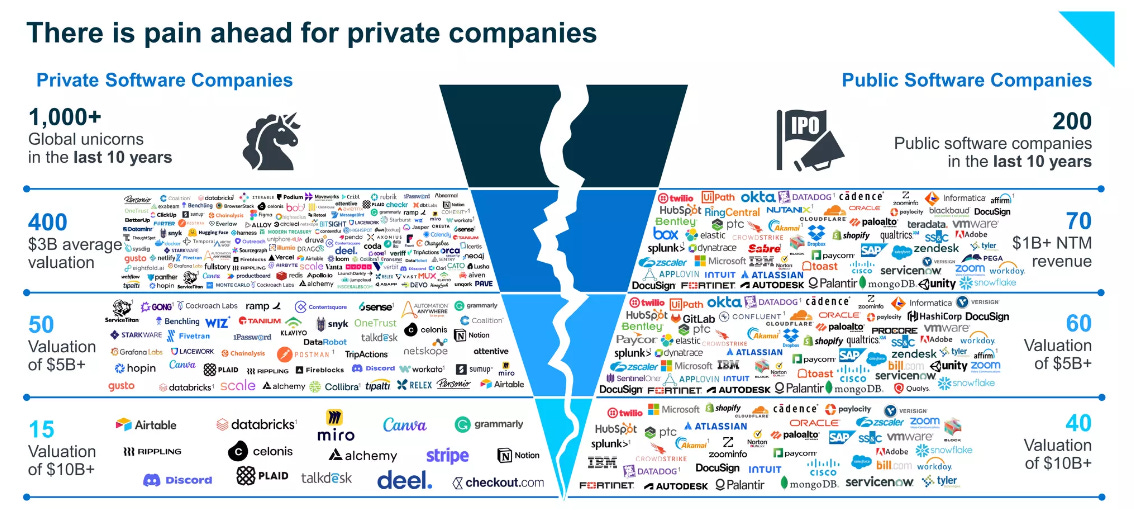

There is more than likely pain ahead for private companies.

There is a high bar for software unicorns to transition into public companies “often requiring a 10x+ revenue ramp and being mindful about margins”

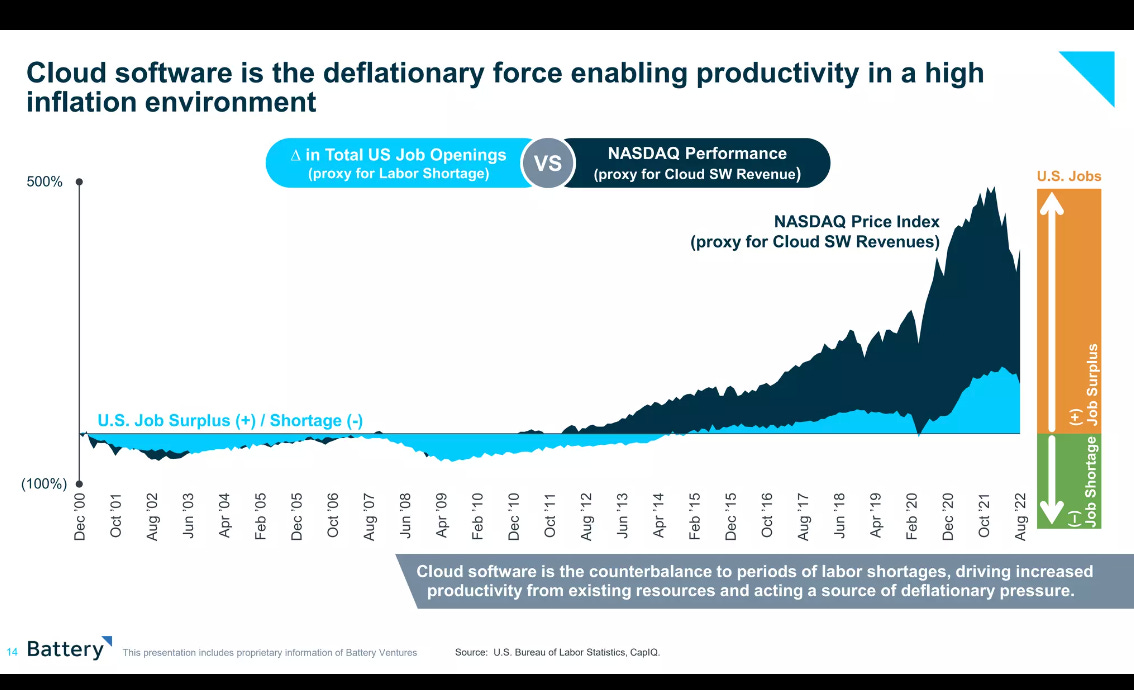

Cloud Software is actually a deflationary source as it enables higher productivity

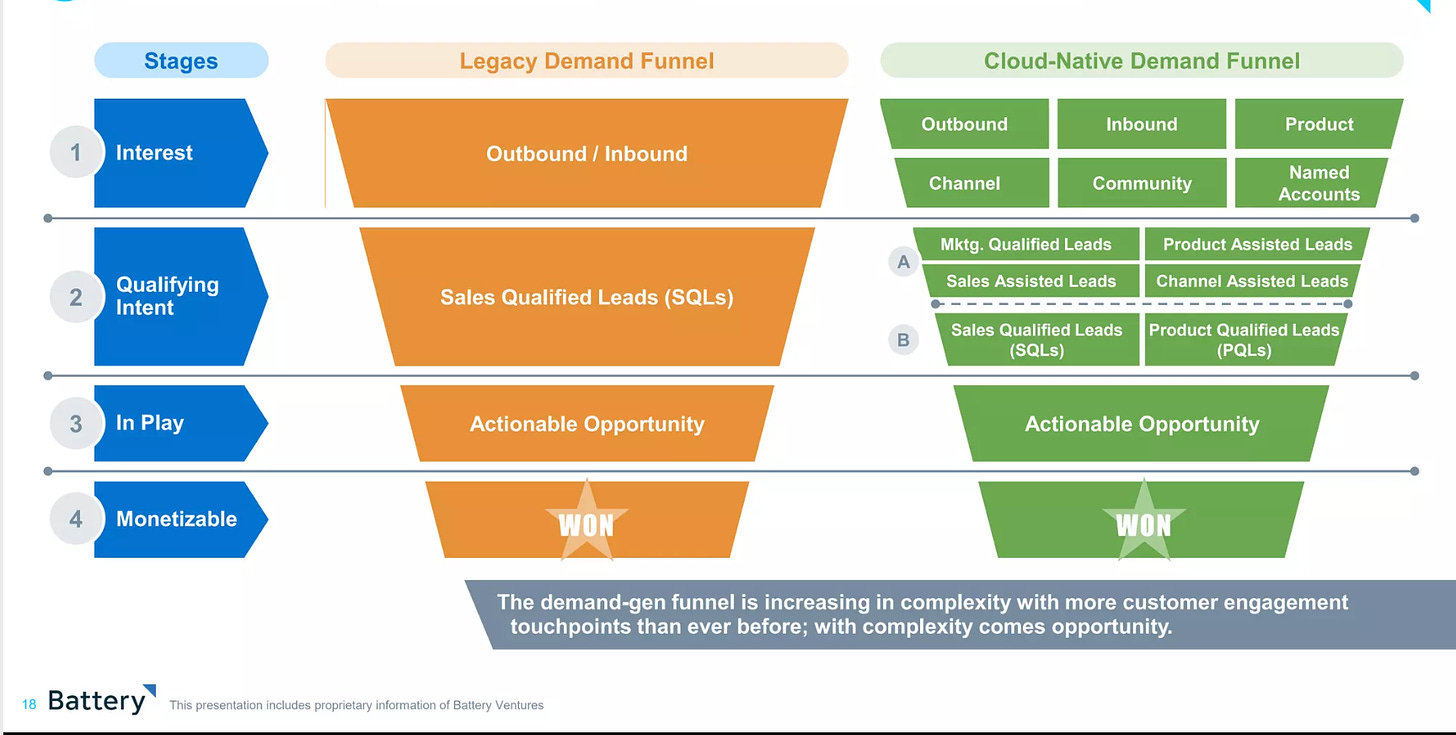

The demand-gen funnel for SaaS has become overly complex with an emphasis on customer engagement.

This has in turn led to the rise of GTM strategies based on buyer personas.

In today’s market, it’s becoming even harder to convert prospects into paying customers.

It’s not enough to just have one GTM approach. Sales playbooks will need to be optimized to buyers’ new preferences and personas.

We’ve reached our newsletter length limit so that’s all we have for the cliff notes!

TLDR for all SaaS founders and operators:

“The firm’s recommendation to founders navigating the market is to focus on demand generation optimization and optimize for sales, marketing, and expansion efforts. this will in turn lead to an increase in profitability.”

What We’re Reading and Listening To…

📚 The recipe for building a growth strategy to find traction early

Sustainable revenue growth through marketing and sales takes more than just a few inbound and outbound campaigns. You've got to think about your marketing and sales programs as a whole—the full funnel. The team at Bloom Growth Studio just unlocked their exact system for scaling growth and sales.

📚 Some Thoughts On What's Next for the VC Industry

Favorites from the Ecosystem

Investors👇…..

Founders👇…..

Operators👇….

News from the Industry: deals, deals, and more deals 💰

Vista's latest flagship fund halfway to $20bn target

Thomson Reuters to acquire tax automation company SurePrep for $500M

Thoma Bravo, Sunstone Partners to acquire UserTesting for $1.3B and combine it with UserZoom

End Note 🔚

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.

About Bloom Equity Partners

Bloom Equity Partners is a lower mid-market software-focused private equity firm, leveraging deep operational and commercial experience to create enduring market value for the benefit of our investors, founders, and their companies.

If you or someone you know is considering selling or taking investment, we might be able to help out. Just reply to this thread and we can get acquainted!